by Darren Williams, AllianceBernstein

There are good reasons to be concerned about the medium-term outlook for euro-area growth. But that doesn’t mean the business cycle is dead. We think the conditions for a cyclical rebound in regional growth are currently better than they’ve been at any time since the global financial crisis.

Most investors are well aware of the huge challenges facing the euro area. In particular, there’s justifiable concern that, over the medium term, the region may be trapped in a period of very low nominal growth. Nonetheless, it’s important to realize that, this year at least, the economy is likely to benefit from powerful cyclical tailwinds.

Oil Price and Exchange Rate

The most obvious of these are the oil price and the exchange rate. In euro terms, the oil price is currently about 30% below its average level in the first half of last year, while the euro’s trade-weighted exchange-rate index has fallen by almost 10% over the same period. Using standard rules of thumb, these two changes should add roughly 1% to economic growth in the coming year

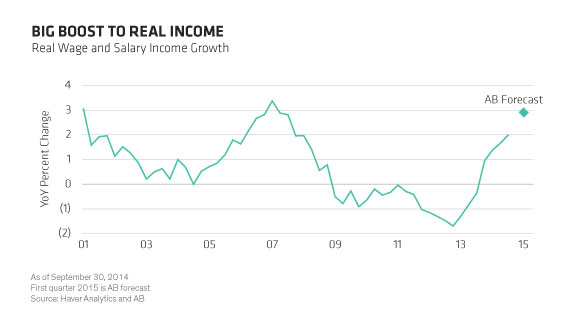

Real incomes will certainly receive a significant boost from cheaper oil. This, in essence, is similar to the fiscal impulse that would be provided by a reduction in value-added tax rates. According to our estimates, annual growth in real labor income is currently running at almost 3.0% (Display), close to the cyclical peaks seen in 2001 and 2006/07, when consumer-spending growth was considerably stronger than it is at present.

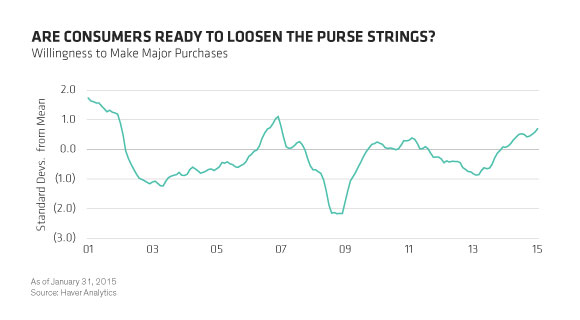

Much will depend on the extent to which consumers decide to spend or save the windfall gain from oil. It’s not certain which way they’ll swing. However, we’re encouraged by the recent pickup in consumer confidence, particularly indications that households may be more willing to make major purchases than they have been at any time since 2006 (Display). There’s little support here for the conventional view that consumers are likely to postpone spending when prices start to fall.

Supportive Backdrop

Importantly, the positive developments outlined above are occurring at a time when the policy mix in the euro area has become more supportive of growth. After a period of damaging austerity between 2010 and 2013, our estimates suggest that the overall fiscal stance for the region is likely to be neutral to mildly expansionary this year.

At the same time, money and credit dynamics have started to improve. Bank lending rates for Spanish and Italian companies have fallen sharply in recent months, while net new loans to euro-area households and firms rose by €19 billion in the final quarter of 2014—the best quarter since the start of the credit crunch in 2011. The loan mix was encouraging, too, with loans to nonfinancial companies finally starting to pick up.

Cyclical Outlook Brightens

Against this backdrop, consensus forecasts for euro-area growth are probably too low and look set to move higher. We expect 1.5% growth this year, compared with the current consensus estimate of 1.1%.

Of course, there are important caveats to consider. One relates to a possible breakdown in the bailout negotiations between Greece and its euro-area partners. But so long as this doesn’t result in a default and/or euro-area exit, there’s unlikely to be a material impact on growth elsewhere in the region. Another is that faster real growth is likely to come largely at the expense of lower prices. This means nominal growth—the key for debt sustainability—is likely to be little changed this year at 1.8% after 1.6% in 2014, in our view.

Still, this is likely to keep the European Central Bank (ECB) firmly in accommodative mode—even if, as we expect, growth surprises on the upside.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Darren Williams is Senior European Economist at AB (NYSE:AB).

Copyright © AllianceBernstein