After a long period of calm, global markets now face tumbling oil prices, geopolitical risks and monetary policy changes. Investors looking for new ways to diversify in this uncertain environment should take a long look at investments that don’t take their cues from stock or bond market movements.

by Christine Johnson, AllianceBernstein

The Key: Un-Stock-Like Return Patterns

Alternative investments have that name for a reason: they don’t act like traditional investments. Adding alternatives thoughtfully to a portfolio may lower its sensitivity to the stock market and interest-rate fluctuations. Alternatives also have the potential to enhance long-term returns and reduce risk.

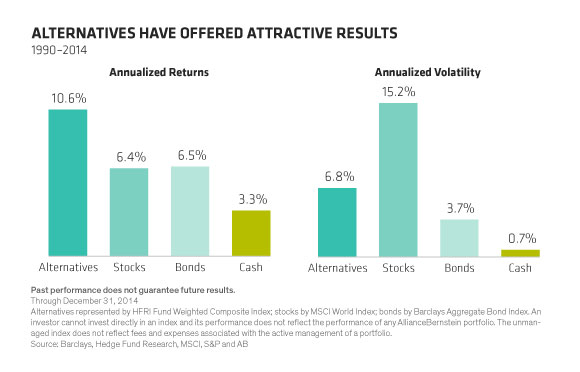

Investors may be surprised to learn that over the last 25 years, alternatives have produced higher returns than stocks, bonds or cash—with less than half the volatility of stocks (Display). A big part of the equation? Managers’ use of flexible investment approaches, and their ability to act opportunistically to exploit mispricings within and across asset classes.

How Do Alternatives Handle Stress?

On average, alternative investments haven’t been up as much as stocks in bull markets, but they also haven’t been down as much as stocks in bear markets. By losing less than traditional equity strategies during times of market stress, alternative strategies have historically preserved investors’ capital. In 2001 and 2002, as markets struggled to recover from the dot-com bust, alternatives provided more downside protection than stocks. In 2008, alternatives also lost less than stocks.

Alternatives in the Portfolio Context

Investors want more diversification in their portfolios; we think investments that don’t track stock and bond markets as closely as traditional investments offer that potential. Many alternative strategies provide returns driven more by a manager’s skill in decision making than by broad market movements.

And there’s a lot of variety among alternatives. Investors can choose narrowly focused alternative strategies—nontraditional bond or long/short equity, for example. Or they can opt for a more diversified strategy like multi-manager. This offers exposure to diverse approaches—and even diverse managers. A manager’s investing skill is integral to alternative investing, and the returns of individual strategies can vary greatly. A diversified strategy may prove valuable.

Challenging market periods turn up unexpectedly, and a diversified investing approach that incorporates alternatives may help portfolios’ performance across diverse market conditions. Not all strategies will be in or out of favor at a given time. This point is particularly relevant in terms of US stocks. The lofty returns of the last couple of years won’t last indefinitely—so it makes sense to look for strategies whose return patterns offer something different from those of the broad market.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

Christine Johnson is Managing Director of Alternative Investments at AB (NYSE:AB).