by Ben Carlson, A Wealth of Common Sense

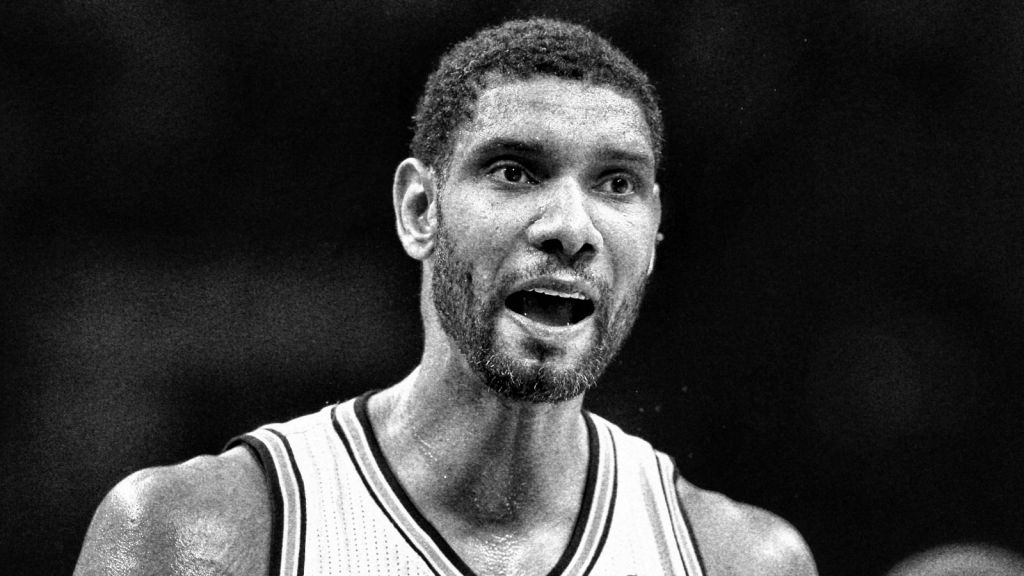

Tim Duncan of the San Antonio Spurs is arguably the greatest power forward in NBA history. Unfortunately, success puts a target on your back when it comes to financial advice. It was recently discovered that Duncan has joined the long list of rich people that have been taken advantage of through lousy investments or shady advisors. Bloomberg outlined how much money Duncan was taken for:

San Antonio Spurs 15-time All Star Tim Duncan lost more than $20 million to bad investments at the center of a lawsuit filed Friday against his ex-financial adviser, a person familiar with the matter said.

“Over the course of 17 years, I invested in a series of opportunities presented by Charles Banks, on his assurance that we were working together for my family’s long-term financial security,” Duncan said in a statement. “Banks exploited my good intentions and our relationship for his personal gain and my substantial loss. I’m saddened that my name will join the list of athletes to fall victim to this sort of misconduct.”

Duncan, 38, said he met Banks during his rookie year in 1998. At Banks’s urging, the athlete invested several million dollars in hotels, beauty products, sports merchandising and wineries that the adviser owned or in which he had financial stakes, according to the filing.

A similar fate happened to the NHL’s Jack Johnson of the Columbus Blue Jackets earlier this year:

On the morning of Oct. 7, two days before the Blue Jackets opened the 2014-15 season, Jack Johnson left his Ferrari parked in the garage of his Dublin apartment and drove his BMW to a federal courthouse Downtown to file for bankruptcy.

Johnson has earned more than $18 million during his nine-year NHL career, not including the $5 million he will be paid this season by the Blue Jackets.

Almost all of the money is gone, and some of his future earnings have already been promised — which is why Johnson, surrounded by a new team of financial advisers and an attorney, signed his financial surrender.

The scene was nearly four years in the making, after a string of risky loans at high interest rates; defaults on those loans, resulting in huge fees and even higher interest rates; and three lawsuits against Johnson, two of which have been settled and one that’s pending.

Why does this happen, not only to professional athletes but to many wealthy investors?

A few thoughts:

- Rich people are more at risk for fraud and deceit than anyone. The vultures are constantly circling to cash in.

- Unfortunately, a talented sales staff will nearly always trump a talented investor when motivating people to hand over their money. Hucksters are usually very good marketers, meaning they know which buttons to push to sell their services and which narratives to hit to sell a compelling “investment” idea.

- The ultra-rich have a much different risk profile than everyone else. They’ve already won the game. Even if they have an appetite for risk, they probably don’t need to invest in risky ventures to try and grow their capital. But because they’re so rich it actually makes it easier for them to take a few fliers in hopes of hitting a home run because they think they don’t have to worry about money. This strategy comes unraveled when leverage is involved with too many poor choices.

- There’s a very big difference between trying to get rich and trying to stay rich. It can be difficult for people to understand the difference between capital accumulation and capital preservation. It’s a completely different mindset.

- The peer pressure to invest in deals, restaurants, a friend’s business ideas, etc. grows exponentially when everyone around you sees the dollar signs. Everyone wants a piece of the action.

- Many rich people equate their wealth with briliance. People think the bigger their bank account gets the more intelligent they are in business. Arrogance has lost more money for people than poor investment ideas.

- Even the wealthy have to live within their means (as Larry Ellison learned from his financial advisor).

- Owning assets doesn’t make you wealthy. It’s your net worth, meaning assets minus liabilities ,that matter. Buying a bunch of stuff doesn’t mean you’re rich. It means you’re good at spending money. Consumption does not constitute saving.

It’s difficult to find legitimate sources of financial advice that have your interests in mind, especially when you have a large bank account. There are even more opportunities for mis-steps when you make millions of dollars because everyone thinks they have the perfect investment idea for you. Instead of hearing sound financial advice, the wealthy often have to deal with people trying to impress them to get between them and their money.

The biggest lesson here is that becoming wealthy doesn’t excuse you from paying attention to your finances.

Sources:

Spur’s Tim Duncan Sais to Lose $20 Million to Bad Investments (Bloomberg)

Blind-sided: Blue Jackets’ Jack Johnson is bankrupt; who led him there is biggest shocker (Columbus Dispatch)

Further Reading:

Professional Athletes and Their Money

Are the Wealthy Really Better Investors?

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © A Wealth of Common Sense