Europe’s Turn

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

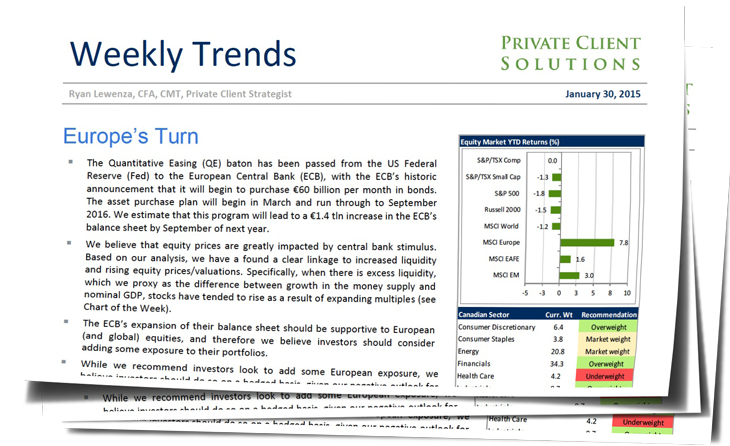

• The Quantitative Easing (QE) baton has been passed from the US Federal Reserve (Fed) to the European Central Bank (ECB), with the ECB’s historic announcement that it will begin to purchase €60 billion per month in bonds. The asset purchase plan will begin in March and run through to September 2016. We estimate that this program will lead to a €1.4 tln increase in the ECB’s balance sheet by September of next year.

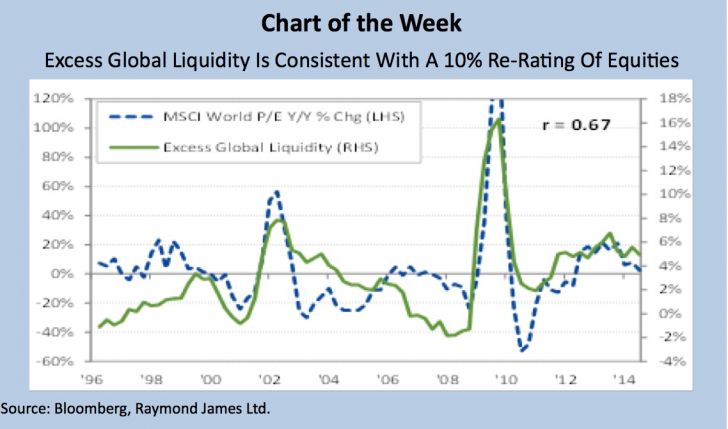

• We believe that equity prices are greatly impacted by central bank stimulus. Based on our analysis, we have a found a clear linkage to increased liquidity and rising equity prices/valuations. Specifically, when there is excess liquidity, which we proxy as the difference between growth in the money supply and nominal GDP, stocks have tended to rise as a result of expanding multiples (see Chart of the Week).

• The ECB’s expansion of their balance sheet should be supportive to European (and global) equities, and therefore we believe investors should consider adding some exposure to their portfolios.

• While we recommend investors look to add some European exposure, we believe investors should do so on a hedged basis, given our negative outlook for the Euro. We would recommend investors play this theme through the WisdomTree Europe Hedged ETF (HEDJ-N), which is hedged to the US dollar.

Read/Download Ryan Lewenza's complete report below: