by James Picerno, Capital Spectator

Suddenly business as usual for small-cap investing is in need of a makeover, thanks to a new research paper (a landmark study for asset pricing) that revisits, reinterprets and ultimately revives the case for owning these shares — after controlling for quality, i.e., “junk”. Cliff Asness of AQR Capital Management and several co-authors have dissected the small-cap effect anew and discovered that there is a statistically robust small-cap premium across time after all, but only for companies that aren’t wallowing in financial trouble of one kind or another. The paper’s title says it all: “Size Matters, If You Control Your Junk.”

At the very least the study will reframe the way the investment community thinks about small-cap investing, perhaps leading to a new generation of ETFs in this space with freshly devised benchmarks. Does that mean that the enigma of the small-cap premium been solved? Let’s put it this way: suddenly the topic looks a lot less cryptic.

For those who haven’t been keeping up to date on the strange case of the on-again, off-again small-cap premium, a growing pool of research has raised doubts about this risk factor. Although there was much rejoicing in the years following the influential 1981 paper by Rolf Banz (“The Relationship between Return and Market Value of Common Stocks”) — the study that effectively launched the industry of small-cap investing — the pricing anomaly has fallen on hard times in recent years. As Asness et al. advise:

Considering a long sample of U.S. stocks and a broad sample of global stocks, we confirm the common criticisms of the standard size factor: a weak historical record in the U.S. and even weaker record internationally makes the size effect marginally significant at best, long periods of poor performance, concentration in extreme, difficult to invest in microcap stocks, concentration of returns in January, absent for measures of size that do not rely on market prices, and subsumed by proxies for illiquidity.

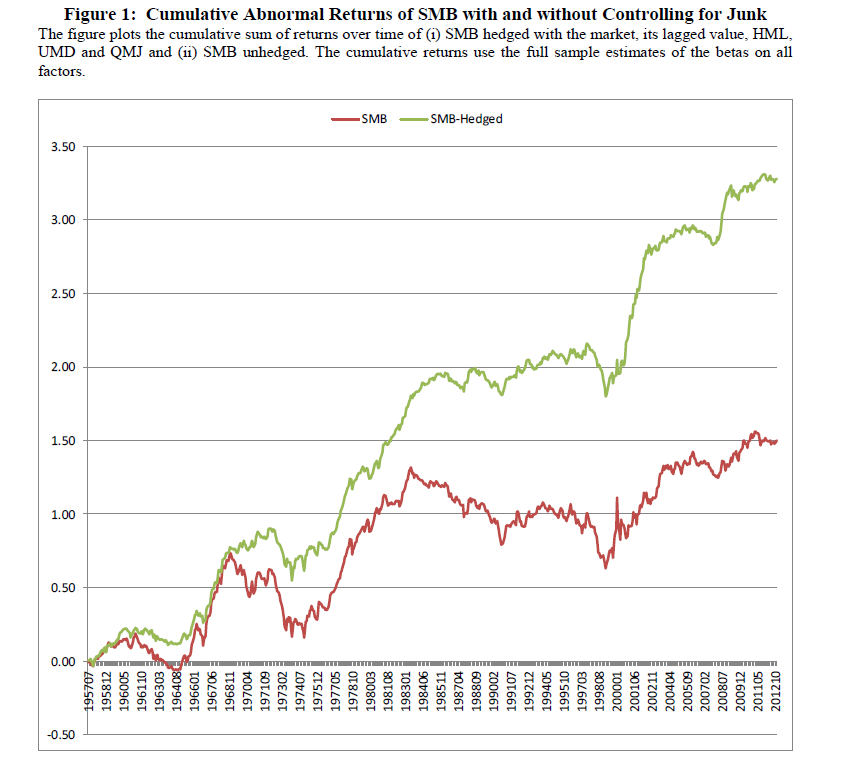

This is old news, of course. What’s new is the finding that “controlling for quality/junk reconciles many of the empirical irregularities associated with the size premium that have been documented in the literature and resurrects a larger and more robust size effect in the data.” In other words, the small-cap factor is alive and kicking, but it requires some tweaking in how we think of this slice of equities, namely, by focusing on comparatively “high-quality” firms.

In summary, controlling for junk produces a robust size premium that is present in all time periods, with no reliably detectable differences across time from July 1957 to December 2012, in all months of the year, across all industries, across nearly two dozen international equity markets, and across five different measures of size not based on market prices.

The critical issue is that small caps generally are populated with a relatively high share of “junky” firms. Whereas large firms tend to be of higher quality — defined by, say, profits or earnings stability — there’s a wider spectrum of dodgy operations among smaller firms. That’s not surprising, but it does have major implications for how we think about expected return in this corner of the equity market.

It’s puzzling that no one’s documented this previously, at least not as thoroughly and convincingly as Asness and company have. In any case, the results speak loud and clear: if you’re intent on carving out a dedicated allocation to the small-cap factor, you’re well advised to do so by focusing on relatively high-quality firms in this realm of the capitalization spectrum.

Keep in mind too that the findings don’t conflict with the value factor, although here too there may be a bit more clarity in the wake of the paper. In fact, the authors “find that accounting for junk explains why small growth stocks underperform and small value stocks outperform the Fama and French (1993, 2014) models.”

Ultimately, the numbers speak volumes. The new paper slices and dices the data from several perspectives and it’s worth the time to read through the details to understand how this study revises our understanding of small-cap investing. “Overall, there is a weak size effect, whose variation over time and across seasons is substantial, as documented in the literature,” the researchers write. The smoking gun is that the case for small caps looks much stronger when sidestepping the junkiest firms.

A graph from the paper summarizes the point. Indeed, the difference between the cumulative investment return for the conventional definition of small-cap (SMB, or small minus big) vs. the proxy defined by Asness et al. (SMB-Hedged) is quite stark over the past half century.

The paper’s discovery amounts to an important revelation for asset pricing, and arguably something more substantial for investors who toil in the small-cap waters. In short, it seems that small-cap strategies as currently designed are in need of revising, perhaps dramatically so, depending on the portfolio, ETF or mutual fund.

Yes, Virginia, there is a small-cap premium, but to harvest it in a meaningful way we’ll have to rethink how we invest in these companies.

Copyright © Capital Spectator