by Don Vialoux, EquityClock.com

(Editor’s Note: Mr. Vialoux is appearing on BNN’s Market Call today at 1:00 PM EST)

Pre-opening Comments for Monday January 19th

Canadian equity markets are expected to be quiet today in response to the Martin Luther King holiday in the U.S.

Canadian equity prices are expected to be influenced by international equity market trends as well as overnight U.S. index futures. The Shanghai Composite Index plunged 7.7% after the Chinese central bank clamped down on loans issued by banks for equity margin. European equity markets were up approximately 0.5% in anticipation of news on monetary stimulus to be announced this Thursday. U.S. equity index futures were down approximately 0.3%.

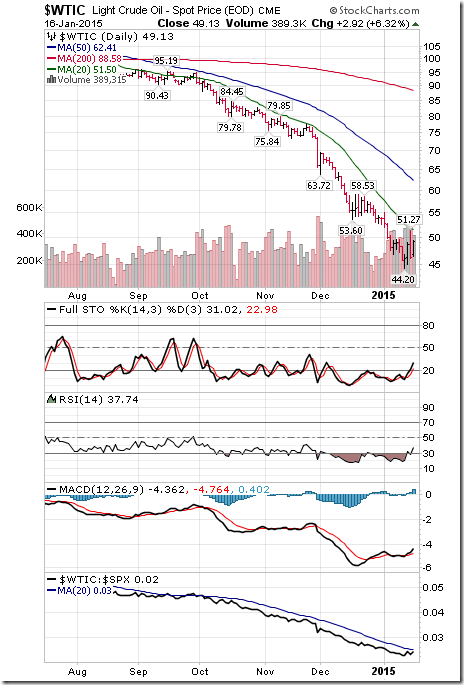

Crude oil dropped $0.46 per barrel after JP Morgan dropped its estimate for an average price of Brent Crude Oil in 2015 to $49 from $82 per barrel.

Economic News This Week

December Housing Starts to be released at 8:30 AM EST on Wednesday are expected to increase to 1,055,000 from 1,028,000 in November.

Bank of Canada’s Interest Rate Policy to be released at 10:00 AM EST on Wednesday is expected to maintain the overnight lending rate at 1.00%.

Weekly Initial Jobless Claims to be released at 8:30 AM EST on Thursday are expected to dip to 300,000 from 316,000 last week.

December Existing Home Sales to be released at 10:00 AM EST on Friday are expected to increase to 5,050,000 units from 4,930,000 units in November

December Leading Economic Indicators to be released at 10:00 AM EST on Friday are expected to increase 0.4% versus 0.6% in November

Canada’s December Consumer Price Index to be released at 8:30 AM EST on Friday is expected to fall 0.5% month-over-month (1.7% gain year-over-year) versus a decline of 0.4% month-over-month in November (2.0% gain year-over-year)

Canada’s November Retail Sales to be released at 8:30 AM EST on Friday are expected to be unchanged from November.

Earnings News This Week

The Bottom Line

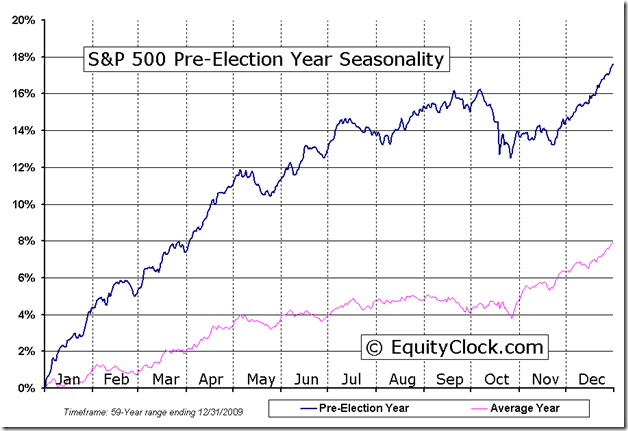

North American equity markets entered into a short term corrective phase on December 29th. The corrective phase is expected to continue until end of the fourth quarter earnings report period (i.e. late January/early February). Thereafter, North American equity markets are expected to resume an intermediate uptrend as they normally do during a U.S. Presidential Pre-election year. Equity markets around the world are expected to be exceptionally volatile this week due to a series of economic/political news events. Precious metals and precious metal equities/ETFs are expected to maintain their current positive momentum. Also, new opportunities have surfaced. International market ETFs including EEM, EFA and IEV are showing early signs of bottoming/outperformance relative to the S&P 500 Index.

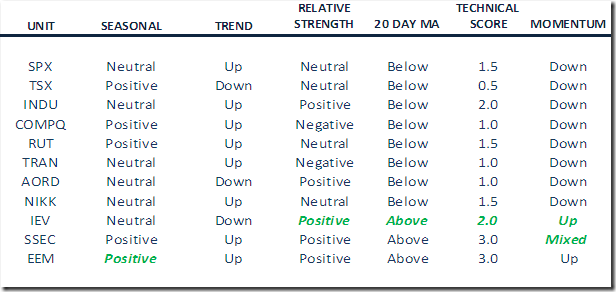

Daily Seasonal/Technical Equity Trends For January 16th

Green: Increase from the previous day

Red: Decrease from the previous day

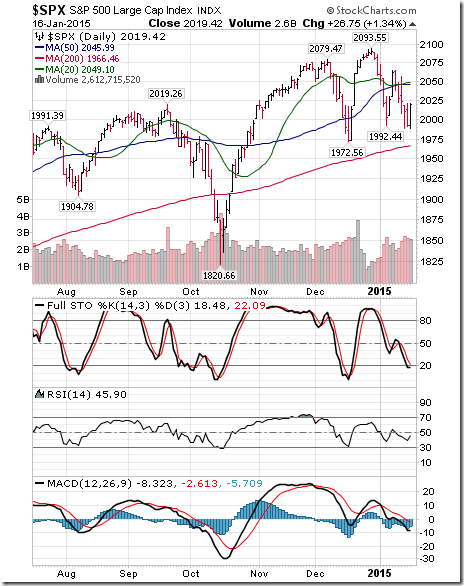

S&P 500 Index fell 25.39 points (1.24%) last week. Intermediate trend remains up. The Index remains below its 20 day moving average. Short term momentum indicators are trending down.

Percent of S&P 500 stocks trading above their 50 day moving average dropped last week to 43.80% from 55.20%. Percent remains in an intermediate downtrend.

Percent of S&P 500 stocks trading above their 200 day moving average dropped last week to 65.00% from 71.60%. Percent is intermediate overbought and remain in a downtrend.

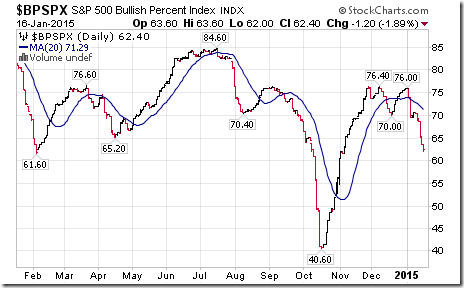

Bullish Percent Index for S&P 500 stocks fell last week to 62.40% from 70.40% and remains below its 20 day moving average. Percent remains intermediate overbought and is trending down.

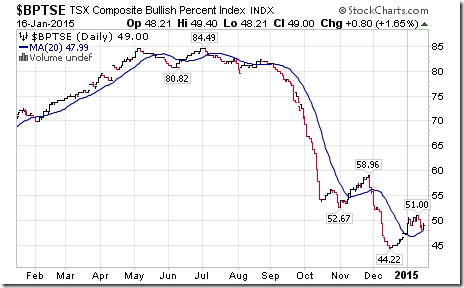

Bullish Percent Index for TSX Composite stocks slipped to 49.0% from 49.80% and remained above its 20 day moving average. The Index continues to recover from an oversold level.

The TSX Composite Index dipped 75.71 points (0.52%) last week. Intermediate trend remains down (Score: 0.0). The Index fell below its 20 day moving average (Score: 0.0). Strength relative to the S&P 500 Index remains Neutral (Score: 0.5). Technical score fell to 0.5 from 1.5 out of 3.0. Short term momentum indicators are trending down.

Percent of TSX stocks trading above their 50 day moving average fell last week to 43.20% from 47.20%.

Percent of TSX stocks trading above their 200 day moving average slipped to 39.60% from 42.40%.

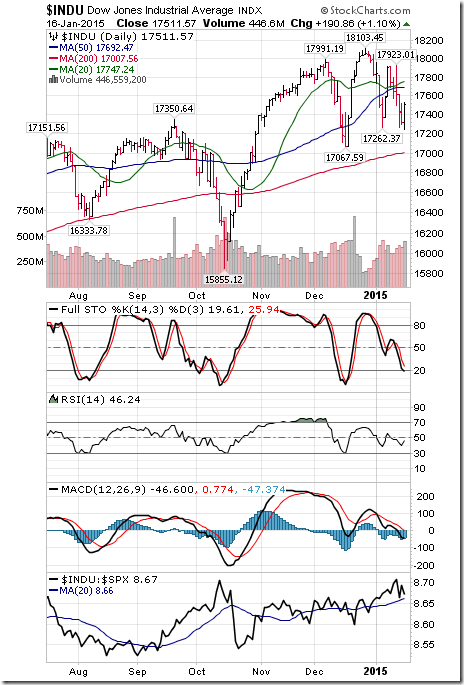

The Dow Jones Industrial Average dropped 225.80 points (1.27%) last week. Intermediate trend remains up. The Average fell below its 20 day moving average. Strength relative to the S&P 500 Index remains positive. Technical score dipped to 2.0 from 3.0 out of 3.0. Short term momentum indicators are trending down.

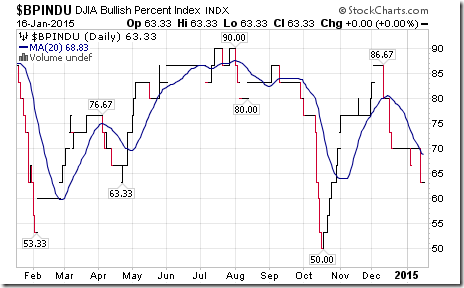

Bullish Percent Index for Dow Jones Industrial Average stocks dropped last week to 63.33% from 70.00% and remained below its 20 day moving average. The Index remains intermediate overbought and is trending down.

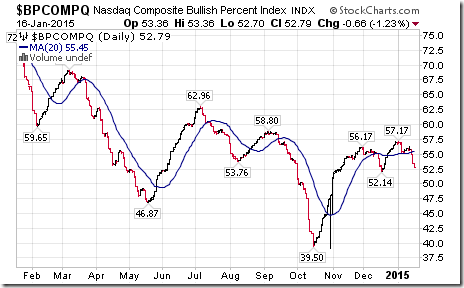

Bullish Percent Index for NASDAQ Composite stocks fell last week to 52.79% from 55.71% and dropped below its 20 day moving average. Intermediate trend has changed to down.

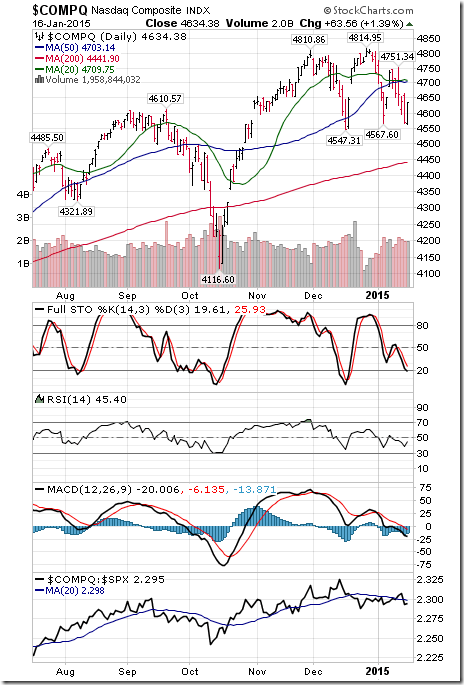

The NASDAQ Composite Index dropped 69.69 points (1.48%) last week. Intermediate trend remains up (Note: the S&P 100 Index briefly broke support on Friday and established an intermediate downtrend). The Index remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 1.0. Short term momentum indicators are trending down.

The Russell 2000 Index fell 9.03 points (0.76%) last week. Intermediate trend remains up. The Index fell below its 20 day moving average. Strength relative to the S&P 500 Index remains Neutral. Technical score dipped to 1.5 from 2.5 out of 3.0. Short term momentum indicators are trending down.

The Dow Jones Transportation Average lost 94.03 points (1.06%) last week. Intermediate trend remains up. The Average remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 1.0 out of 3.0. Short term momentum indicators are trending down.

The Australia All Ordinaries Composite Index fell 161.30 points (2.97%) last week. Intermediate trend remains down. The Index fell below its 20 day moving average. Strength relative to the S&P 500 Index remains positive. Technical score dipped to 1.0 from 2.0 out of 3.0. Short term momentum indicators are trending down.

The Nikkei Average dropped 333.57 points (1.94%) last week. Intermediate trend remains up (almost changed on Friday). The Average remains below its 20 day moving average. Strength relative to the S&P 500 Index remains neutral. Technical score remains at 1.5 out of 3.0. Short term momentum indicators are trending down.

iShares Europe 350 units added $.94 (2.27%) last week. Intermediate trend remains down. Units moved above their 20 day moving average on Friday. Strength relative to the S&P 500 Index changed to positive from negative. Technical score improved to 2.0 from 0.0. Short term momentum indicators are trending up.

The Shanghai Composite Index gained 81.09 points (2.46%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index remains positive. Technical score remains at 3.0 out of 3.0. Short term momentum indicators are mixed.

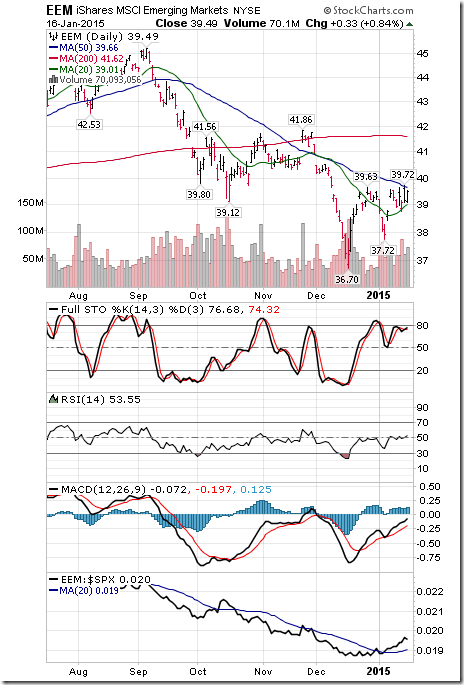

iShares Emerging Markets added $0.22 (0.56%) last week. Intermediate trend changed to up from down on a move above $39.63. Units remain above their 20 day moving average. Strength relative to the S&P 500 Index remains positive. Technical score improved to 3.0 from 2.0 out of 3.0. Short term momentum indicators are trending up.

Currencies

The U.S. Dollar Index gained another 0.83 (0.90%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average. Short term momentum indicators are trending up, but are overbought.

The Euro fell another 2.76 (2.33%) last week following the Swiss Franc adjustment. Intermediate trend remains down. The Euro remains below its 20 day moving average. Short term momentum indicators are trending down, but are oversold.

The Canadian Dollar fell another US 0.67 cents (0.80%) last week. Intermediate trend remains down. The Canuck Buck remains below its 20 day moving average. Short term momentum indicators are trending down, but are oversold.

The Japanese Yen added 0.67 (0.79%) last week. Intermediate trend remains down. The Yen remains above its 20 day moving average. Short term momentum indicators are trending up.

Daily Seasonal/Technical Commodities Trends for January 16th

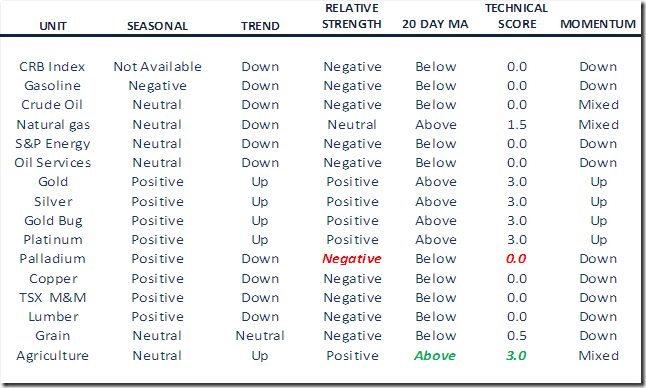

The CRB Index dropped another 5.20 points (2.16%) last week. Intermediate trend remains down. The Index remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0. Short term momentum indicators have just started to trend up.

Gasoline added $0.04 per gallon (3.03%) last week. Intermediate trend remains down. Gas remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0. Short term momentum indicators have just started to trend up.

Crude Oil added $0.77 per barrel (1.59%) last week. Intermediate trend remains down. Crude remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0. Short term momentum indicators are trending up.

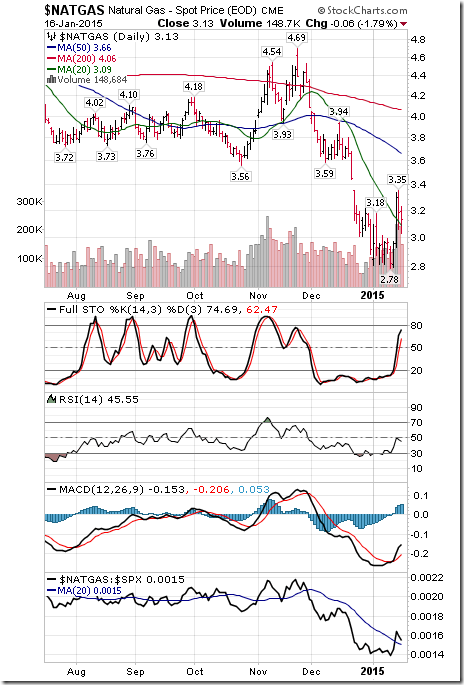

Natural Gas added $0.18 (6.10%) last week. Intermediate trend remains down. Gas moved above its 20 day moving average. Strength relative to the S&P 500 Index changed to Neutral from Negative. Technical score improved to1.5 from 0.0. Short term momentum indicators are trending up.

The S&P Energy Index fell 8.56 points (1.50%) last week. Intermediate trend remains down. The Index remains below its 20 day moving average. Strength relative to the S&P 500 Index turned negative from neutral. Technical score dropped to 0.0 from 0.5 out of 3.0. Short term momentum indicators are trending down.

The Philadelphia Oil Services Index dropped another 6.78 points (3.42%) last week. Intermediate trend is down. The Index remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0. Short term momentum indicators are trending down.

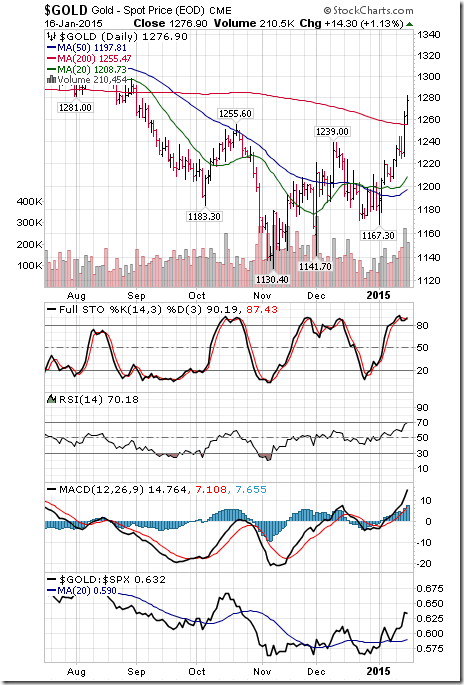

Gold gained $60.80 per ounce (5.00%) last week. Intermediate trend changed to up from down on a move above $1239.00. Gold remained above its 20 day moving average. Strength relative to the S&P 500 Index changed to positive from neutral. Technical score improved to 3.0 from 1.5 out of 3.0. Short term momentum indicators are trending up.

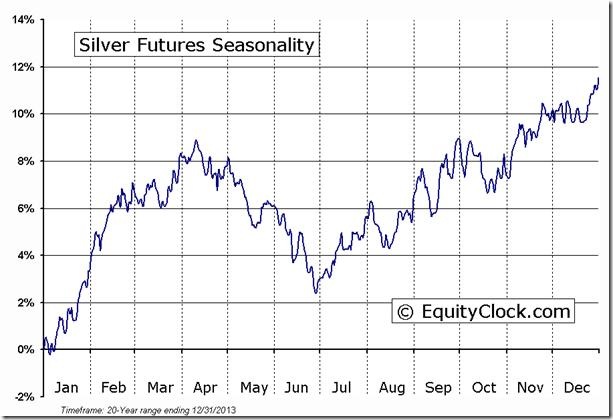

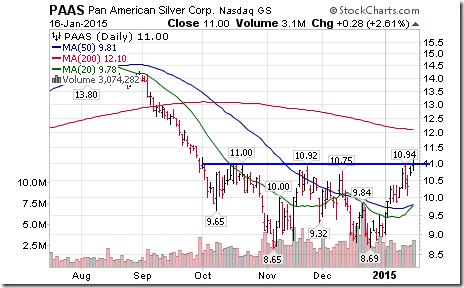

Silver gained $1.33 per ounce (8.10%) last week. Intermediate uptrend was confirmed on a move above $17.35. Silver remains above their 20 day moving average. Strength relative to the S&P 500 Index changed to positive from neutral. Technical score improved to 3.0 from 2.5 out of 3.0. Short term momentum indicators are trending up. Strength relative to Gold has turned positive.

The AMEX Gold Bug Index jumped 14.57 points (7.82%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index remains positive. Technical score remains at 3.0 out of 3.0. Short term momentum indicators are trending up. Strength relative to Gold remains positive.

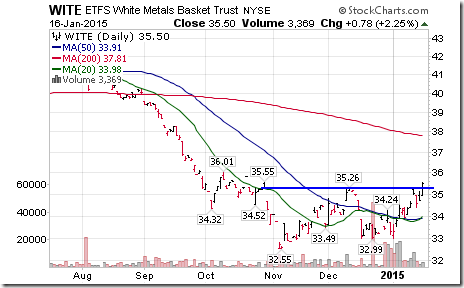

Platinum gained $39.30 per ounce (3.19%) last week. Intermediate trend changed to up from down. PLAT remains above its 20 day moving average. Strength relative to Gold: Neutral.

Palladium fell 45.85 points (5.73%) last week. Intermediate trend changed to down from up on a move below $775.00. PALL remained below its 20 day moving average. Strength relative to the S&P 500 Index changed to negative from neutral. Score fell to 0.0 from 1.5 out of 3.0.

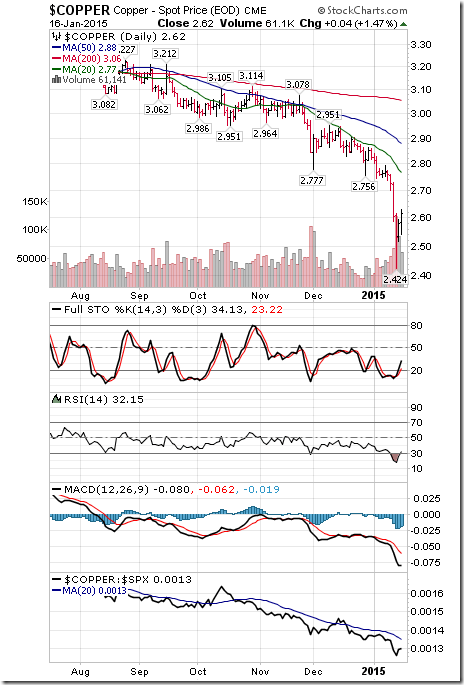

Copper fell another $0.13 per lb. (4.73%) last week. Intermediate trend remains down. Copper remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0. Short term momentum indicators are trending down, but are oversold and showing early signs of bottoming.

The TSX Metals & Mining Index fell 105.59 points (15.40%) last week. Intermediate trend remains down. The Index fell below its 20 day moving average. Strength relative to the S&P Index changed to negative from positive. Technical score dropped to 0.0 from 2.0 out of 3.0. Short term momentum indicators are trending down.

Lumber dropped $7.10 (2.23%) last week. Intermediate trend remains down. Lumber remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0. Short term momentum indicators are trending down.

The Grain ETN dropped $1.96 (5.08%) last week. Intermediate trend changed to Neutral from Up on a move below $36.67. Units remain below their 20 day MA. Relative strength:negative.

The Agriculture ETF added $0.19 (0.36%) last week. Intermediate trend remains up. Units remain above their 20 day moving average. Strength relative to the S&P 500 Index remains positive. Technical score remains at 3.0 out of 3.0. Short term momentum indicators are mixed.

Interest Rates

The yield on 10 year Treasuries fell another 21.2 basis points last week. Intermediate trend remains down. Yield remains below its 20 day moving average. Short term momentum indicators are trending down and are oversold.

Conversely, price of the long term Treasury ETF gained $2.12 (1.62%) last week. Intermediate trend remains up. Units remain above their 20 day moving average.

Other Issues

The VIX Index jumped 3.52 (20.06%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average.

Short term technical indicators (mainly momentum) are trending down and are oversold, but have yet to show signs of bottoming.

Intermediate technical indicators (e.g. Percent trading above 50 day moving average) continue to trend down, implying that the medium term correction starting on December 29th is not over yet.

Responses to fourth quarter results released to date generally have been negative unless results clearly exceeded consensus estimates. Most of the negative responses came after companies reduced guidance. The strong U.S. Dollar Index is having an impact on first and second quarter revenues and earnings.

Economic news this week is expected to confirm slow, but steady growth in the U.S. Focus is on Obama’s State of the Union address on Tuesday evening.

Beyond January, the outlook for world equity markets is positive. Historically, the best time during the four year Presidential cycle to own equities is from the beginning of November in a mid-term election year to July in a pre-election year.

International uncertainties are exceptionally high this week due to a series of international political and economic events including China GDP year-over-year report on Tuesday, World Economic Forum in Davos starting on Wednesday, ECB Press Conference on Thursday, Flash PMI reports from China and Europe on Friday and Greece’s election next Sunday.

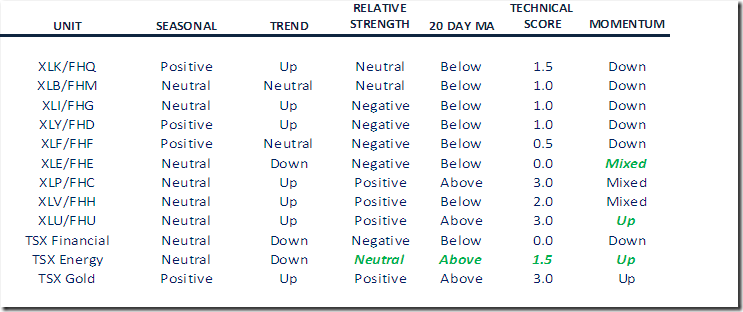

Daily Seasonal/Technical Sector Trends for January 16th

StockTwits released on Friday

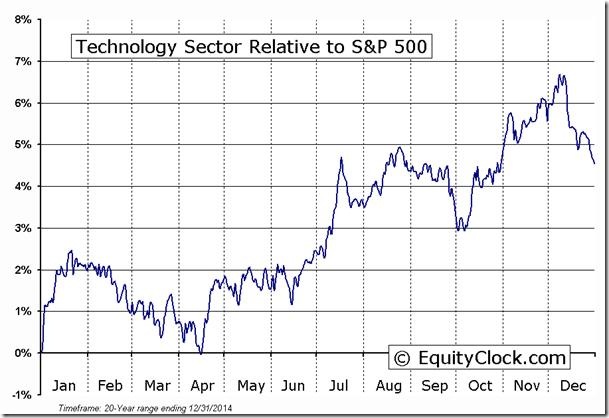

Period of seasonal strength for the technology sector ends today: $XLK, $AAPL, $SMH, $SOX, $SOXX

Quiet bearish technical action by S&P 500 stocks to 10:45 AM: Breakouts: $ED, $PNW. Breakdowns: $KSS, $LEN, $ETFC, $MCO, $SNA, $V

Beautiful double bottom breakout by $SLV this morning.

‘Tis the season for silver to move higher!

Another silver stock breaking above a base building pattern: $PAAS

$WITE, a former top pick on BNN broke above a double bottom pattern. Units are 50% silver, 33% platinum, 16% palladium

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Below is an example:

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

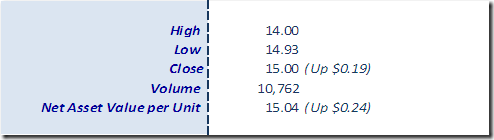

Horizons Seasonal Rotation ETF HAC January 16th 2014

Copyright © EquityClock.com