A Global Growth Scare, Again

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

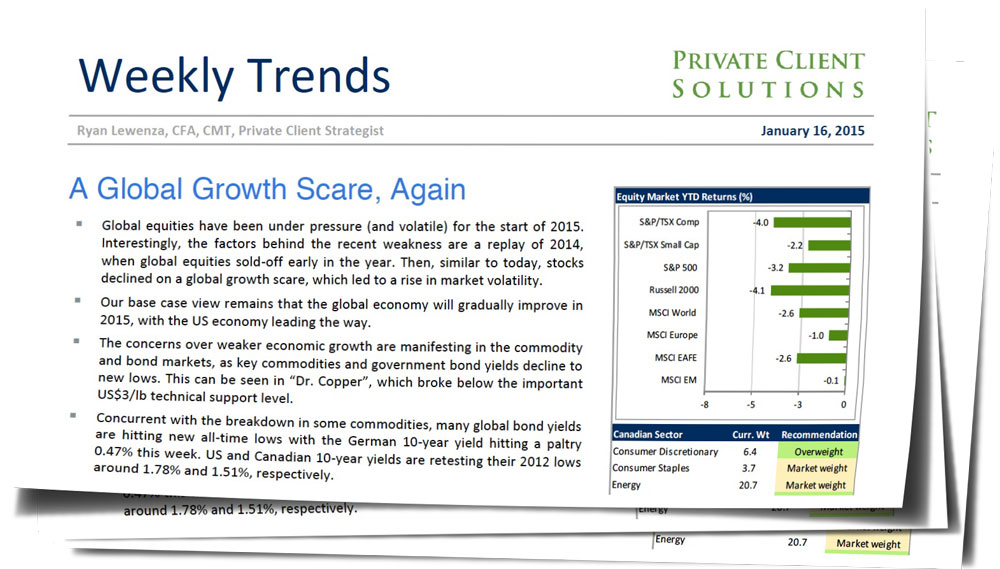

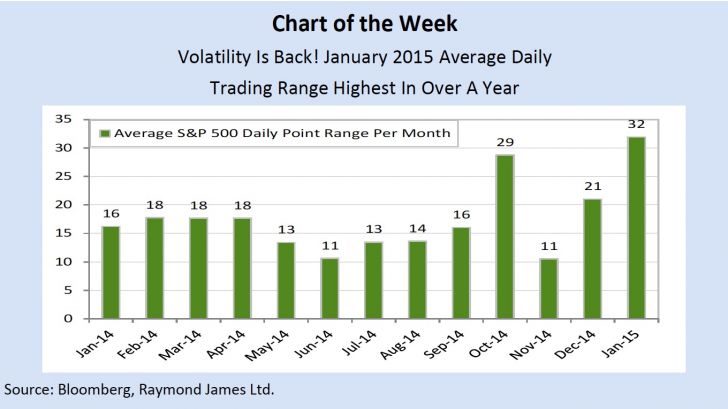

• Global equities have been under pressure (and volatile) for the start of 2015. Interestingly, the factors behind the recent weakness are a replay of 2014, when global equities sold-off early in the year. Then, similar to today, stocks declined on a global growth scare, which led to a rise in market volatility.

• Our base case view remains that the global economy will gradually improve in 2015, with the US economy leading the way.

• The concerns over weaker economic growth are manifesting in the commodity and bond markets, as key commodities and government bond yields decline to new lows. This can be seen in “Dr. Copper”, which broke below the important US$3/lb technical support level.

• Concurrent with the breakdown in some commodities, many global bond yields are hitting new all-time lows with the German 10-year yield hitting a paltry 0.47% this week. US and Canadian 10-year yields are retesting their 2012 lows around 1.78% and 1.51%, respectively.

• We see bond yields bottoming in the coming months as this growth scare fades. Similarly, commodity prices should benefit from stronger economic growth; however, commodities face numerous headwinds which supports our call to underweight the materials sector in portfolios.

• Within the materials sector we prefer the gold and fertilizer sub-industries.