The Bright Side of Cheap Oil

by Burt White, Chief Investment Officer, LPL Financial

Earnings season is here and, as we wrote in our earnings preview last week (“A Tale of Two Earnings Seasons”), low oil prices and the energy sector will be the market’s main focus. Energy companies begin to report earnings this week, as energy services provider Schlumberger releases results on Thursday, January 15, 2015, although most of the sector’s results will come the last week of January and first week of February. While we try to gauge the energy sector outlook, we will also pay close attention to sectors and industries that potentially benefit the most from cheap oil, particularly in the consumer discretionary sector and the transportation industry, or the transports. (This week’s Weekly Economic Commentary, “Drilling into the Labor Market,” discusses energy’s impact on U.S. and state economies and labor markets.)

It Starts with the Consumer

The obvious place to start when analyzing beneficiaries of cheap oil is the consumer discretionary sector. The “tax cut” from lower prices at the pump is significant. U.S. consumers purchase about 140 billion gallons of gas annually, so a $1.00 drop in gasoline is a net savings of $140 billion (or about 1% of gross domestic product [GDP]). Each household that has been spending about $2,500 per year on gasoline (roughly the national average) will see a drop of perhaps $600 annually, based on U.S. Energy Information Administration (EIA) forecasts. For someone making the median income in the United States (about $52,000), that’s almost an extra week’s paycheck. And the total does not include home heating costs, where additional savings are captured, as the decline came just ahead of the coldest winter months (the sharp drop in natural gas prices is also helping). Depending on your assumptions, savings for the average American from lower energy prices could reasonably be estimated at over $1,000 per year, which for many, is like getting a raise. Keep in mind the consumer represents two-thirds of the U.S. economy.

The additional disposable income in consumers’ pockets has positive implications for several consumer industries:

· Traditional retailers. These companies could possibly get an extra boost from consumers’ additional disposable income, against an already favorable economic backdrop with steady job growth and solid consumer confidence (despite modest wage growth).

· Discount retailers. Retailers that cater to consumers in the lower- and middle-income categories may benefit disproportionately because their customers spend a higher portion of their discretionary income on gasoline. For retailers that sell gasoline, sharply lower oil prices tend to boost refining profit margins. (Note: Some discount retailers are classified by S&P as consumer staples.)

· Travel and leisure. Companies in the travel and leisure industries within the consumer discretionary sector are also poised to potentially reap benefits from lower oil prices. For example, cruise operators benefit from greater consumer purchasing power as well as lower fuel costs, which make up more than 15% of operating expenses for the two biggest U.S.-listed cruise ship operators, which combined are spending about $3 billion annualized on fuel.

· Restaurants. Both the increase in disposable income and any boost to driving that cheaper gasoline provides may benefit restaurants.

· U. S. auto companies and auto suppliers. More driving is good for U.S. auto sales, which were very strong during December 2014 with a more than 10% year-over-year increase and near post-Great Recession highs on an annualized basis. Cheaper gas is good for the sales of sport utility vehicles (SUV) that carry higher prices and typically higher profit margins than smaller vehicles. It is also cheaper to produce tires, because more than half of the raw materials to make tires are petroleum based.

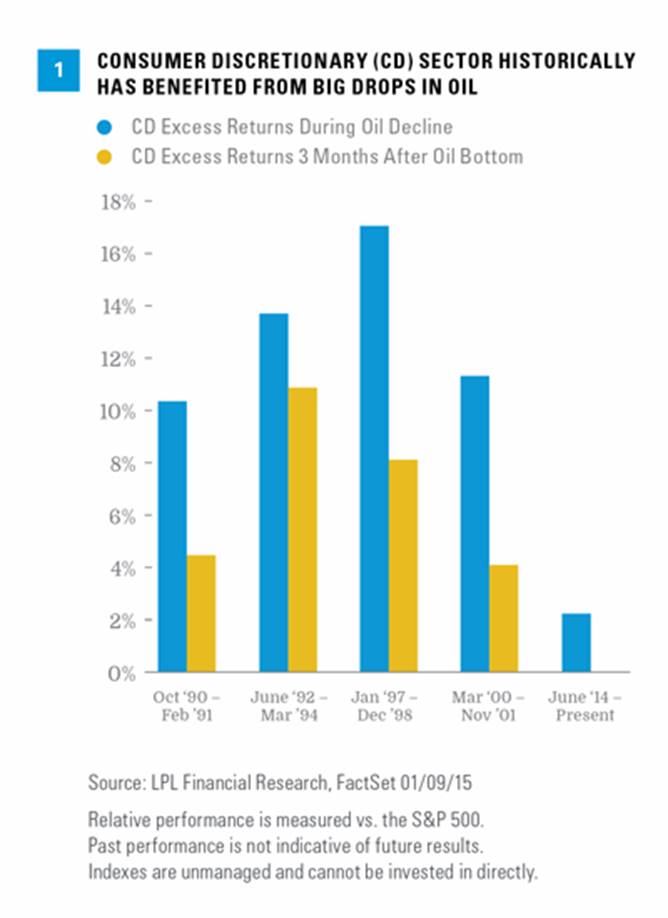

All of this good news for the consumer discretionary sector has translated into the strong performance one would expect [Figure 1], but it may not be over. Historically, consumer discretionary’s strong relative performance during the biggest oil declines of the past 25 years (outperformed the S&P 500 by 11% on average) and in the three months after the bottom in oil prices (an additional 7% on average) suggests that the sector could potentially be poised for further outperformance.

Good News Is Not Limited to Consumers

The transports are also big beneficiaries of the big drop in oil prices. In addition to the increased economic growth experienced in the United States over the past year, these companies benefit from increased buying power of their commercial and consumer customers, and from reduced fuel and raw material costs that boost profit margins. Worth noting is that companies’ hedging activities do offset a portion of the gains.

· For airlines, fuel composes about one-third of total operating costs. The six largest publicly traded U.S. carriers spent a total of $45 billion annualized on fuel, based on the most recent quarterly data. Lower oil may either mean cheaper airline tickets or wider profit margins for airlines, or both.

· Railroads consume a lot of fuel, although they also transport it, providing an offset to the benefits of lower oil prices as production volume growth ebbs. The four largest U.S. railroads spent more than $11 billion annualized on fuel, based on their most recent quarterly data, amounting to approximately 20% of total operating expenses. Reduced fuel surcharges do shift some of the benefit to commercial and retail customers, however, reducing the rails’ cost savings.

· Shipping companies are also potential beneficiaries of cheaper oil. For the two biggest publicly traded U.S. package delivery and logistics companies, fuel makes up about 9% of operating expenses or nearly $10 billion annualized, based on the most recent quarterly data. Trucking companies see a similar benefit. As with the rails, reduced fuel surcharges shift some of the benefit to commercial and retail customers — a win either way.

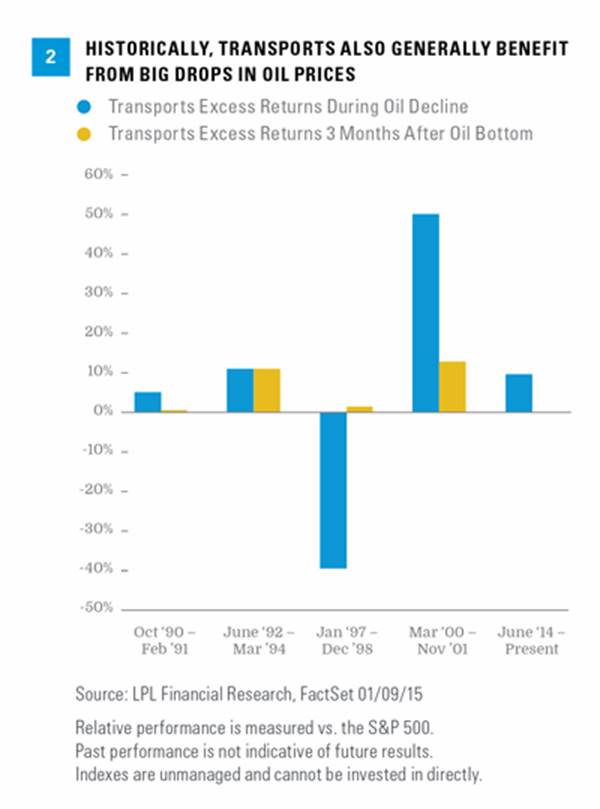

Like consumer discretionary, the performance record for transports has also been positive during prior big oil price declines, though it is not quite as consistent. The underperformance during the 1997–1998 oil price decline was driven by sharp declines in the railroad stocks, due in part to weak pricing power and a more challenging regulatory environment. Still, on average, the

transports sector outperformed by 7% during the oil price declines, and by an additional 6%, on average, during the next three months [Figure 2].

Conclusion

The consumer discretionary sector and the transports are both potentially big beneficiaries of the big drop in oil prices, supporting our positive views of both groups. The “tax cut” for consumers (or if you prefer, the “raise”) and cheaper fuel for the biggest industrial purchasers — such as airlines, railroads, and shipping companies — may benefit the bottom lines for the companies in both groups. Although we do not know when oil prices will bottom, when they do, it does not necessarily mean that the good performance for these areas of the stock market will come to an abrupt end. Along with the energy sector, companies in these groups will be the ones to watch this earnings season. n

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Because of its narrow focus, specialty sector investing, such as healthcare, financials, or energy, will be subject to greater volatility than investing more broadly across many sectors and companies.

Commodity-linked investments may be more volatile and less liquid than the underlying instruments or measures, and their value may be affected by the performance of the overall commodities baskets, as well as weather, geopolitical events, and regulatory developments.

Stock investing involves risk including loss of principal.

INDEX DESCRIPTIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Copyright © LPL Financial