by Don Vialoux, EquityClock.com

Pre-opening Comments for Tuesday January 13th

U.S. equity index futures were higher this morning. S&P 500 futures were up 10 points in pre-opening trade. Futures were fueled by strong overnight gainx in European and emerging equity markets.

The fourth quarter earnings report season is off to a good start. After the close yesterday, Alcoa reported higher than consensus fourth quarter revenues and earnings. Alcoa gained $0.23 to $16.40

Apple added $1.36 to $110.61 after Credit Suisse upgraded the stock to Outperform from Neutral. Target is $130.

Abbot Labs (ABT $45.50) is expected to open lower after Jefferies downgraded the stock from Buy and lowered its target to $50.

Amazon.com gained $4.74 to $296.15 after Citigroup upgraded the stock to Buy from Neutral.

Goldman Sachs adjusted its recommendation on selected U.S. retailers. Best Buy was upgraded to Buy from Neutral. Target is $45. Costco was downgraded to Neutral from Buy. Target is $147. Best Buy added $1.16 to $40.25. Costco slipped $0.71 to $141.81

Hewlett Packard was unchanged after Pacific Crest downgraded the stock from Outperform to Sector Perform.

Mosaic (MOS $46.36) is expected to open lower after CIBC downgraded the stock to Underperform from Sector Perform. Target is $47.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2015/01/12/stock-market-outlook-for-january-13-2015/

Note comments on Crude Oil, TSX Composite and Alcoa

Interesting Charts

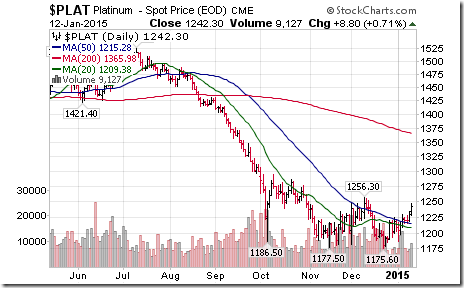

Precious metals were a highlight yesterday. Gold and silver recorded significant gains. Platinum and Palladium recorded stronger gains. Seasonal influences at this time of year favour Platinum, Palladium and Silver over Gold.

StockTwits Released Yesterday @equityclock

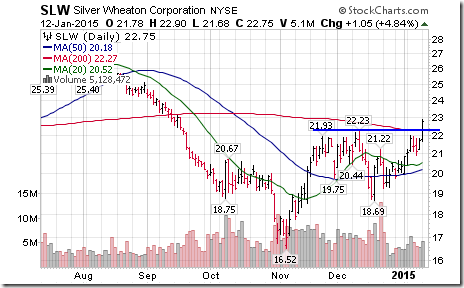

Silver showing signs of a base building pattern within seasonal strength: $SLV, $SIL, $SI_F, $Silver.

Technical action by S&P 500 stocks to 11:00 AM: Bearish. 4 stocks broke resistance: $MO, $ACT, $BMY $EW. 20 stocks broke support.

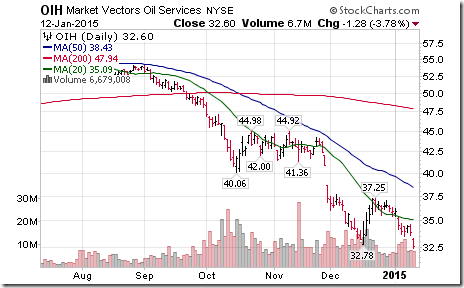

Prominent on the list of S&P stocks breaking support were oil services stocks: $CAM, $NOV, $RDC, $SLB. $OIH tells the story

Canadian banks are leading Cdn. stocks lower. Breakdowns this morning included $RY.CA, $BMO.CA, $XFN. CA, $ZEB.CA

More silver and gold stocks are breaking resistance. $GG and $SLW in U.S. Dollars broke this morning.

Completion of a nice double bottom pattern by the silver equity ETF this afternoon: $SIL

Trader’s Corner

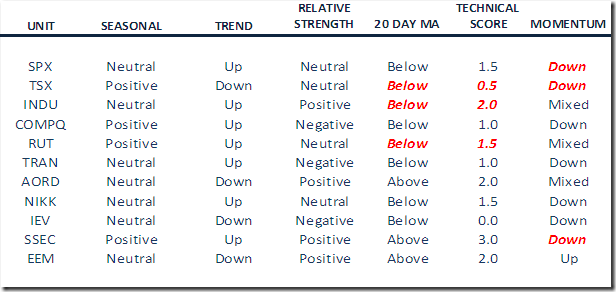

Daily Seasonal/Technical Equity Trends For January 12th

Green: Increase from the previous day

Red: Decrease from the previous day

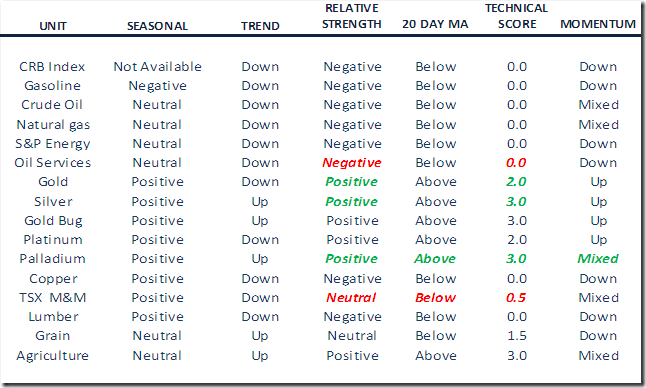

Daily Seasonal/Technical Commodities Trends for January 12th

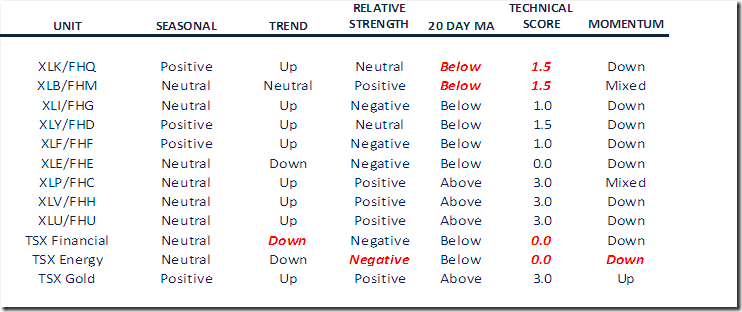

Daily Seasonal/Technical Sector Trends for January 12th

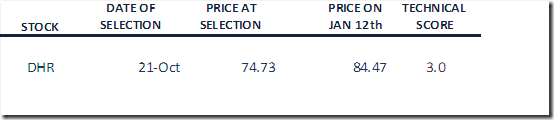

Monitored List of Technical/Seasonal Ideas

Technical score fell to 1.0 from 3.0. Accordingly, the stock has been deleted from the monitored list with a gain of 13.0%.

FP Trading Desk Headlines

FP Trading Desk headline reads, “What to watch for in Q4 S&P 500 earnings” Following is a link:

FP Trading Desk headline reads, “Contrarians due for a good year”. Following is a link:

http://business.financialpost.com/2015/01/12/contrarians-due-for-a-good-year/?__lsa=a8bf-9c5e

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

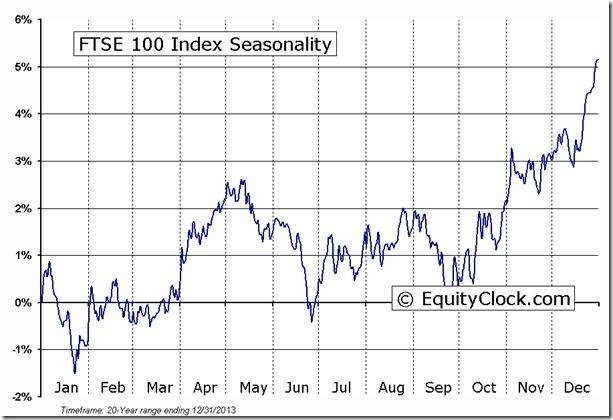

Below are examples:

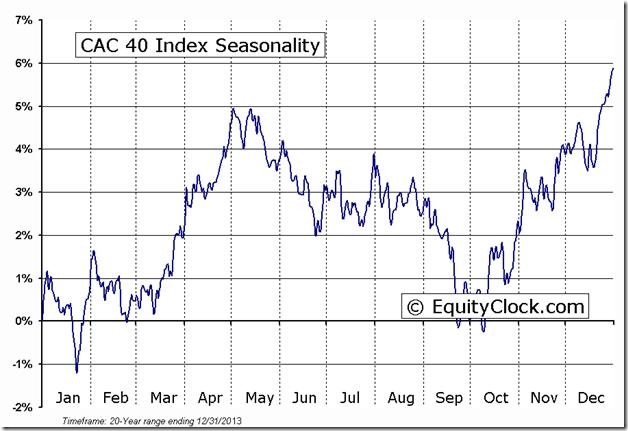

Editor’s Note: European equity markets have a history of bottoming in the last week in January. Most technical parameters currently are not positive. However, if Europe proceeds with a Quantitative Easing program later this month, European equities will quickly respond. Early signs of outperformance relative to the S&P 500 have appeared, but it is too early to make the call. Potential for the trade is particularly intriguing if the U.S. Dollar Index peaks.

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

Horizons Seasonal Rotation ETF HAC January 12th 2014

Copyright © EquityClock.com

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/HLIC/bd073cbac0d792b3723e0c192570ef7a.png)