Median NYSE Price/Earnings Multiple at Post-War RECORD

by James Paulsen, Chief Investment Strategist, Wells Capital Management

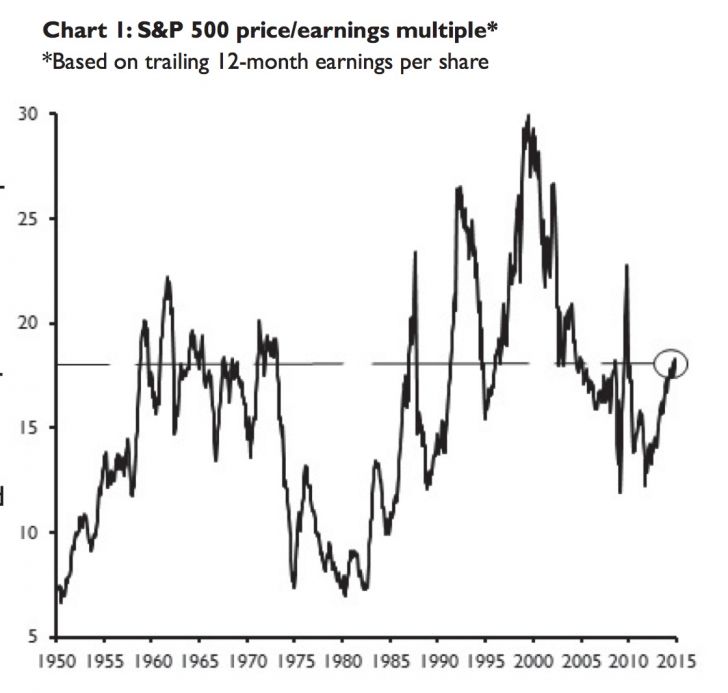

The S&P 500 begins the new year with a price/earnings (P/E) multiple of about 18 times trailing 12-month earn- ings per share. This represents a valuation higher than about 74% of the time since 1945. While a relatively high valuation, it remains far below its post-war record of more than 30 times earnings in early 2000, and as recent- ly as the 1990s, the stock market delivered nice returns from valuation levels at or above today’s P/E multiple.

Most U.S. stocks, however, are much more expensive than suggested by the S&P 500 Index. The median New York Stock Exchange (NYSE) stock is currently at a post- war record high P/E multiple, a record high relative to cash flow, and near a record high relative to book value! In the late 1990s, surging technology stock prices caused the overall S&P 500 P/E multiple to reach record highs even though the median stock’s P/E multiple never became excessive. Conversely, today, although the S&P 500 P/E multiple remains far below record highs, median valuations are at a pinnacle. Whereas most recognized the headline S&P 500 P/E multiple was at a record high in 2000, far fewer are aware of just how expensive the median stock is today.

Stocks more expensive than suggested by headline S&P 500 Index

Chart 1 illustrates the P/E multiple for the market-cap weighted S&P 500 Index. At 18 times trailing earnings, the value of the U.S. stock market is widely perceived as slightly above average but not excessive.

However, as Charts 2, 3, and 4 show, the median U.S. stock is indeed much more aggressively priced than is widely perceived. These charts were derived from an extensive online database compiled by professor Kenneth R. French recording annual calculations (for June of each year since 1951) for the median NYSE stock’s P/E multiple, price to cash flow multiple, and price to book value ratio. As of June 2014, the median U.S. stock was priced at a post-war high at slightly more than 20 times earnings! Similarly, at about 15 times, the median stock is also currently priced at a record high relative to cash flow. Finally, the median price to book value ratio has only been higher than it is currently in two years since 1951 (in 1969 and in 1998 which were both followed by significant declines)!

Read/Download James Paulsen's complete report below:

Copyright © Wells Capital Management