by Lance Roberts, STA Wealth Management

Submitted by Lance Roberts of STA Wealth Management,

Earnings Expectations Are Grossly Optimistic

As we enter into the end of the year, the vast majority of analysts have already come out with bullish forecasts for the S&P 500 going into 2015. The primary driver behind these optimistic forecasts is simply stronger economic growth will lead to higher corporate earnings which will justify higher asset prices. Fair enough.

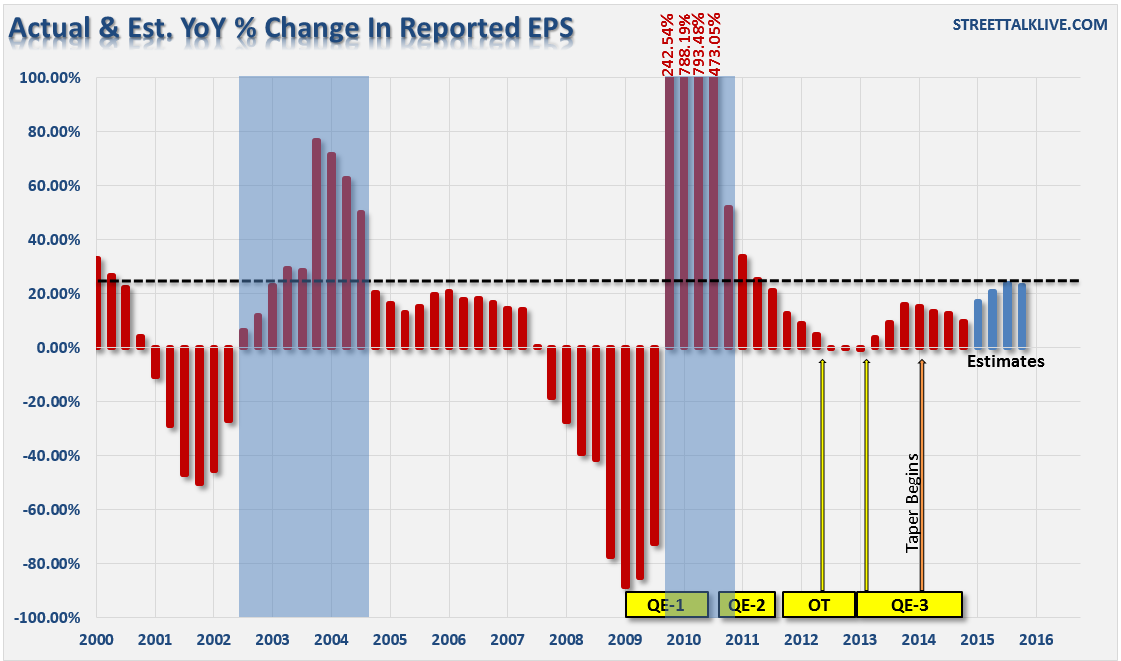

The problem is that the expectations of earnings growth in the future is currently at levels that do not generally exist outside of a recessionary recovery. The chart below shows the actual and estimated annual percentage change in earnings for the S&P 500 going back to 2000. (Note: The percentage changes from the financial crisis lows were so great that I had to cap them and label them accordingly.)

There are several important points to consider with respect to this data.

1) Following recessions earnings changes are the greatest as the annual EPS change from lower levels yields significantly higher percentage changes. (i.e., Increasing EPS by $10 yields a 100% growth rate from $10 to $20 versus just 10% when growing from $100 to $110)

2) Earnings growth has been highly supported in recent years by not only massive share buybacks, cost cutting and other accounting mechanization but also from Federal Reserve interventions. That surge in liquidity increased share values significantly which allowed for high levels of stock based M&A that supported earnings growth. Notice that "Operation Twist" EPS growth slowed significantly but exploded once QE-3 was introduced back into the system. Also, the growth rate of EPS has begun to slow once the Federal Reserve began to taper, and how now eliminated, their bond purchasing activities.

3) The current estimates for EPS growth going into 2016 are currently at levels that exceed historical norms.

With deflation and weak economic growth plaguing every single country outside of the U.S., it is highly likely that estimates of stronger economic growth will be disappointed. Eventually, market participants will realize that current valuations far exceed economic realities and a reversion to norms will occur. That is just a function of how markets work as excesses are eliminated. The challenge for investors is not only realizing that this will eventually be the case, but also the capability to manage portfolio risk accordingly.

Investor Complacency Is Extremely High...Again

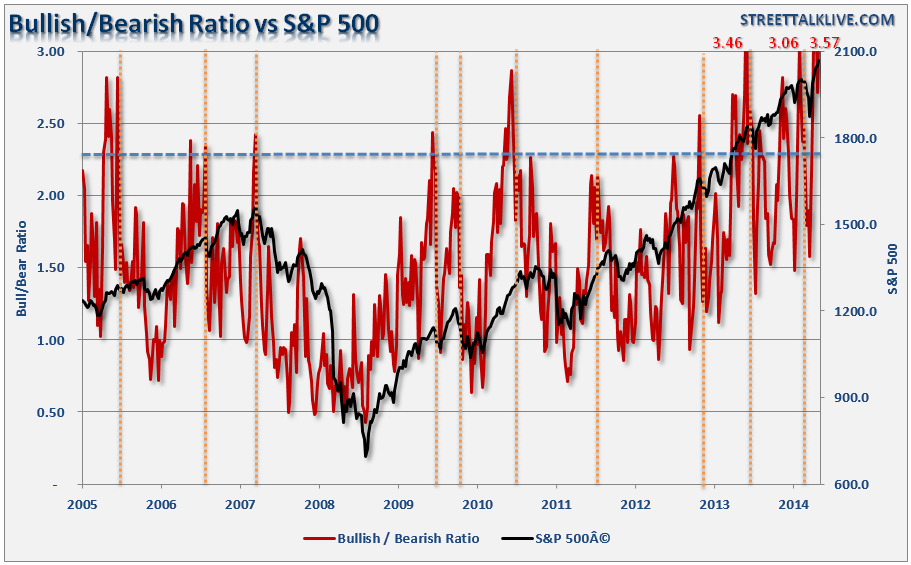

Since the beginning of the last round of Quantitative Easing by the Federal Reserve investor exuberance has been pushing levels not seen recent history. This is shown in the chart below which is a composite bull/bear ratio of both individual and institutional investors.

While extreme levels of optimism does not mean that the markets are about to crash, it does suggest that the current advance that created the bullish exuberance is likely near its end.

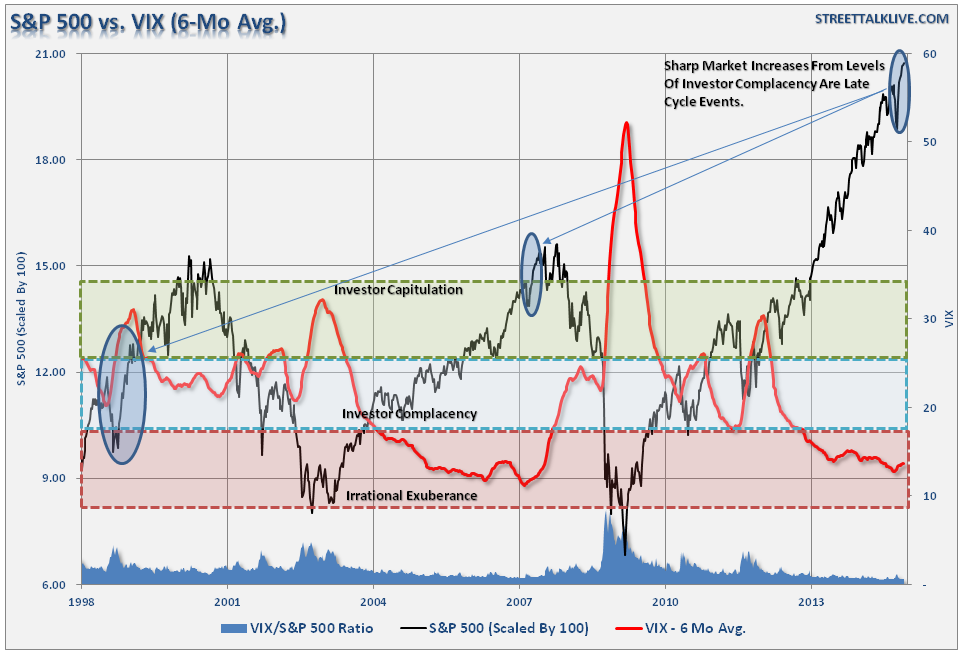

This can also be visualized in the extremely low levels of volatility in the S&P 500. I have used a 6-month average of the weekly volatility index to smooth the data, however, the latest readings of volatility are current near the lowest levels on record.

One other point to consider is that the recent spike in the markets is not a normal market advance but rather one that has been more symbolic of excess late stage exuberance as investors rush to take on additional risk.

Again, while NONE of this data suggest that a major market correction is imminent, it does suggest that reducing risk in portfolios temporarily may pay dividends in the near term.

Retail Sales Much Weaker Than Headlines Suggest

While it "Tis" that time of the season to whip out credit cards and buy stuff for people that they don't really need, like that "Huxtable-Like" sweater that you Aunt Marge gave you last year, retail sales are seen as the pulse of the consumer. A strong shopping season suggests that the consumer is doing better while a poor turn-out suggests the economy is weaker than expected.

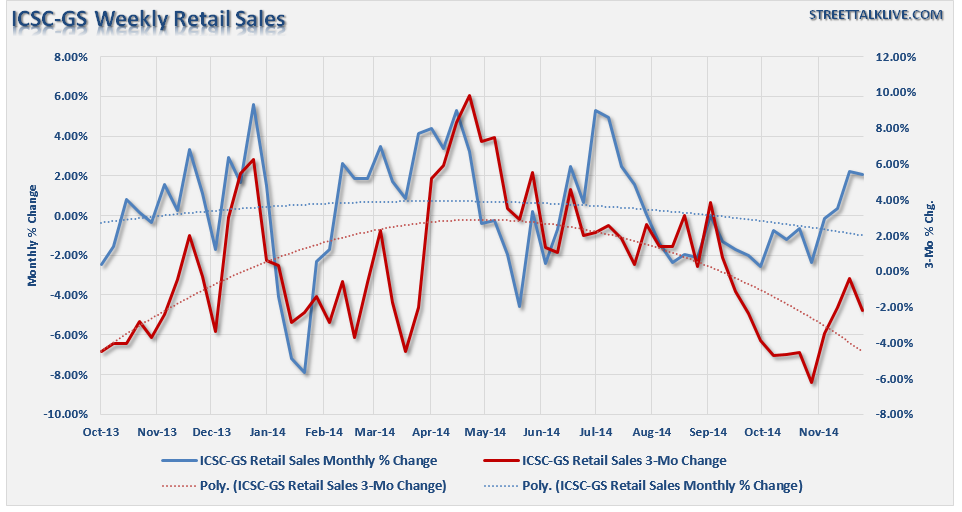

The chart below is a real-time indication of retail sales produced by the International Council of Shopping Centers in conjunction with Goldman Sachs. As of the most currently reported week (November 29th) retail sales fell by 1.77% from the previous week as "Black Friday" promotions ended with a relatively dull "thud." However, weekly data is so noisy that it is hard to derive any real conclusion from one week to the next, so I have smoothed the data using a 4-week average. The chart below shows both the monthly % change is reported retail sales as well as the 3-month average of the monthly change.

They are two important points. Despite surging consumer confidence surveys from the Census Bureau, consumers themselves are less optimistic than they were last year this time. Secondly, the current surge in consumer spending appears to have now exhausted itself, and we may see a second year of more sluggish retail demand than currently estimated.

Currently, discretionary stocks are running well ahead of actual consumer spending, and it is likely that weaker consumer demand will also soon be reflected in both corporate profits and capital expenditure plans by corporations.

Lastly, as discussed previously, there is no evidence of that that the recent decline in gasoline prices boosts consumption. In fact, there is more evidence that suggests sharply falling energy prices actually curtails spending by consumers as the decline in commodities is more reflective of a weak economic environment. My friend Sigmund Holmes recently penned addressed this point:

"Lower oil prices are not the equivalent of a tax cut. At best, it just re-distributes spending from one group of people to another. More spending by the newly favored group will just be offset by reduced spending by the other. One might also consider that the oil companies have used the increased cash flow to borrow and spend some more (look at debt issuance by energy companies and C&I loans). If they have more borrowing capacity than individuals – and I’m pretty certain they do – then the net effect on the economy of reduced spending by energy companies may well be negative."

Newton's third law of motion states:

"For every action there is an equal and opposite reaction."

In any economy, nothing works in isolation. For every dollar increase that occurs in one part of the economy, there is a dollars worth of reduction somewhere else. The real issue is what the fall in commodities in general, including oil, is telling us about the real state of the economy.

Copyright © STA Wealth Management