by Don Vialoux, EquityClock.com

Pre-opening Comments for Thursday December 4th

U.S. equity index futures were higher this morning. S&P 500 futures added 2 points in pre-opening trade. Index futures responded to another 4% gain by the Shanghai Composite Index in overnight trading.

The Bank of England maintained its key lending rate at 0.5%. The European Central Bank maintained its key lending rate at 0.05%.

Index futures were virtually unchanged following release of the Weekly Jobless Claims report. Consensus was a drop to 292,000 from 314,000 last week. Actual was a drop to 297,000.

Alcoa added $0.07 to $17.28 after Wells Fargo initiated coverage with an Outperform rating.

Toronto Dominion fell $0.55 to US$49.50 after reporting less than consensus fourth quarter earnings.

Procter & Gamble gained $0.79 to $90.79 after Credit Suisse upgraded the stock from Neutral to Outperform. Target is $105.

Wal-Mart slipped $0.74 to $84.20 after UBS downgraded the stock from Buy to Neutral.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2014/12/04/stock-market-outlook-for-december-4-2014/

Jon Vialoux on BNN last night

Following are links:

http://www.bnn.ca/Video/player.aspx?vid=500205

http://www.bnn.ca/Video/player.aspx?vid=505933

http://www.bnn.ca/Video/player.aspx?vid=505936

http://www.bnn.ca/Video/player.aspx?vid=505939

http://www.bnn.ca/Video/player.aspx?vid=506223

http://www.bnn.ca/Video/player.aspx?vid=506224

http://www.bnn.ca/Video/player.aspx?vid=505948

http://www.bnn.ca/Video/player.aspx?vid=505951

Interesting Charts

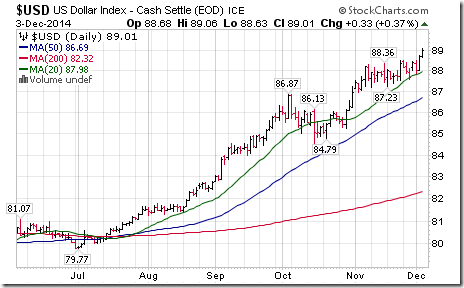

The U.S. Dollar continues to strengthen, particularly relative to the Euro.

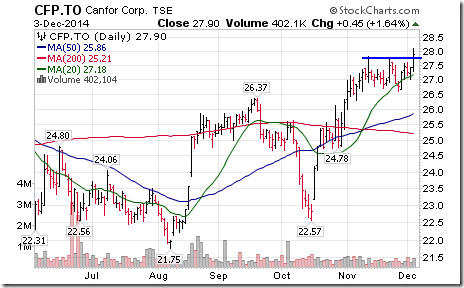

Despite strength in the U.S. Dollar, lumber stocks on both sides of the border have entered into another momentum spurt.

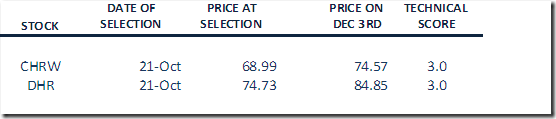

Monitored List of Technical/Seasonal Ideas

Green: Increased score

Red: Decreased score

A score of 1.5 or higher is needed to maintain a position

StockTwits released yesterday @equityclock

Technical action by S&P 500 stocks to 10:15 AM: Quiet. Breakouts: $MS, $BLL. Breakdown: $MAT

Technical Action by Individual Equities Yesterday

After 10:15 AM another 14 S&P 500 stocks broke resistance (BK, NLSN, ADI, HHS, CSC, GIS, AIZ, GLW, PBI, BWA, EXPE, CME, STT, TEG) and two stocks broke support (CLX, CPB)

One TSX 60 stocks broke resistance, Enbridge.

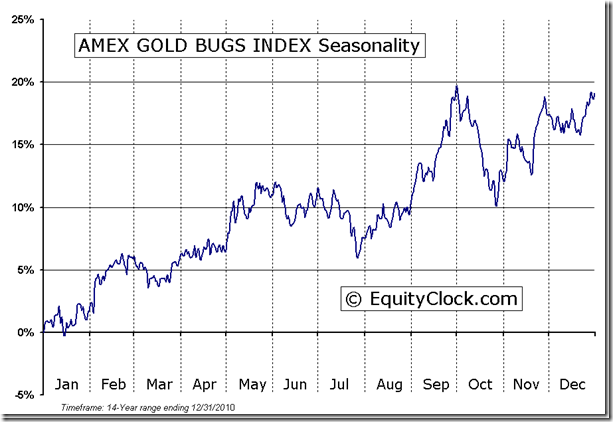

Gold equities and related ETFs appear to be forming base patterns. Strength relative to the S&P 500 Index is turning positive. The Gold Bug Index already is trading above its 20 day moving average. However, technical signs of a breakout are lacking. Stay tuned.

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Seasonal influences are positive from mid-December to the end of February and from late July to the end of September.

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

Horizons Seasonal Rotation ETF HAC December 3rd 2014

Copyright © Don Vialoux, EquityClock.com

![clip_image001[5] clip_image001[5]](https://advisoranalyst.com/wp-content/uploads/HLIC/075e80cb8e5368ac649b65c843effcc7.png)

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/HLIC/42ad78e8b43538e74ecaad487bbf6daa.png)