by Don Vialoux, EquityClock.com

Pre-opening Comments for Monday December 1st

U.S. equity index futures were lower this morning. S&P 500 futures were down 10 points in pre-opening trade. Futures are responding to lower than expected Black Friday sales in the U.S.

Carnival slipped $0.35 to $43.81 after Goldman Sachs downgraded the stock from Buy to Neutral.

CSX eased $0.25 to $36.24 after TD Securities downgraded the stock from Buy to Hold.

Deere added$0.88 to $87.50 after Wells Fargo, JP Morgan and Baird upgraded the stock.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2014/12/01/stock-market-outlook-for-december-1-2014/

Changes in the Monitored List

Several stocks on our Monitored list have been deleted because their current period of seasonal strength has ended:

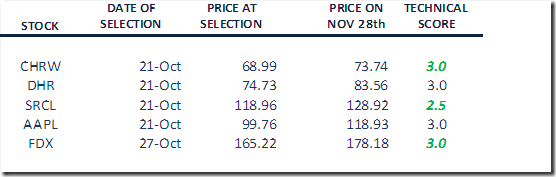

An 8.4% profit in SRCL was taken when its current period of seasonal strength on a relative basis was reached at the end of November

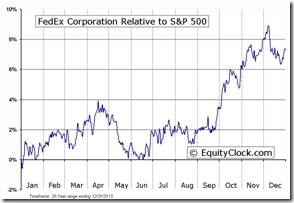

A 7.8% profit in FDX was taken when its current period of seasonal strength on a real and relative basis was reached at the end of November.

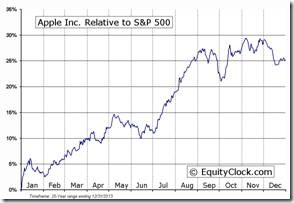

A 19.2% profit was taken in AAPL when its current period of seasonal strength on a real and relative basis was reached at the end of November.

Economic News This Week

November ISM to be released at 10:00 AM EST on Monday is expected to slip to 58.0 from 59.0 in October.

October Construction Spending to be released at 10:00 AM EST on Tuesday is expected to increase 0.5% versus a decline of 0.4% in September.

November ADP Private Employment to be released at 8:15 AM EST on Wednesday is expected to dip to 228,000 from 230,000 in October.

Revised Third Quarter Productivity to be released at 8:30 AM EST is expected to increase to 2.2% from 2.0%.

November ISM Services to be released at 10:00 AM EST on Wednesday is expected to increase to 57.5 from 57.1 in October

Bank of Canada interest rates to be released at 10:00 AM on Wednesday are expected to remain unchanged

Weekly Initial Jobless Claims to be released at 8:30 AM EST on Thursday are expected to fall to 292,000 from 313,000 last week.

November Non-farm Payrolls to be released at 8:30 AM EST on Friday are expected to increase to 225,000 from 214,000 in October. Private Non-farm Payrolls are expected to increase to 215,000 from 209,000 in October. November Unemployment Rate is expected to remain unchanged from October at 5.8%. November Hourly Earnings are expected to increase 0.2% versus a gain of 0.1% in October.

U.S. October Trade Deficit to be released at 8:30 AM EST is expected to slip to $42 billion from $43 billion in September.

Canadian November Unemployment Rate to be released at 8:30 AM EST on Friday is expected to increase to 6.6% from 6.5% in October. Net change in November employment is expected to be 5,000 versus an increase of 43,000 in October.

October Canadian Merchandise Balance to be released at 8:30 AM EST on Friday is expected to dip to a surplus of $50 million from a surplus of $700 million in September

October Factory Orders to be released at 10:00 AM EST is expected to increase to 0.2% versus a decline of 0.6% in September.

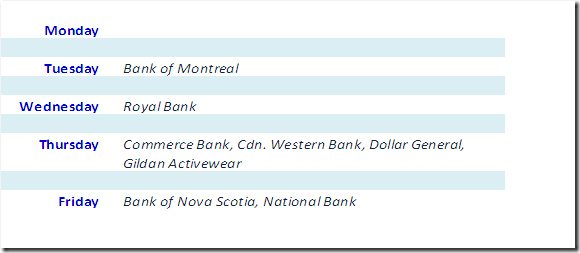

Earnings News This Week

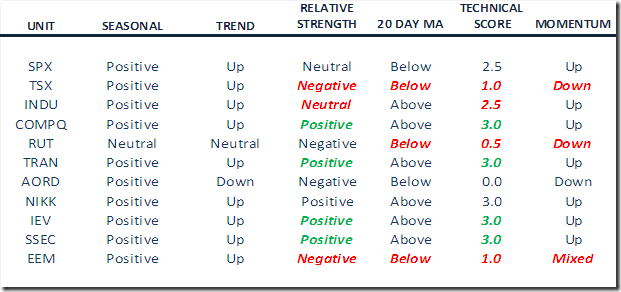

Summary of Weekly Seasonal/Technical Parameters for Equity Indices/ETFs

Seasonal: Positive, Negative or Neutral on a relative basis applying EquityClock.com charts

Trend: Up, Down or Neutral

Strength relative to the S&P 500 Index: Positive, Negative or Neutral

Momentum based on an average of Stochastics, RSI and MACD: Up, Down or Mixed

Green: Upgrade

Red: Downgrade

The S&P 500 Index added 4.06 points (0.20%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average. Short term momentum indicators are trending up, but are overbought and showing early signs of rolling over.

Percent of S&P 500 stocks trading above their 50 day moving average fell last week to 84.00% from 88.40%. Percent is intermediate overbought and showing early signs of rolling over.

Percent of S&P 500 stocks trading above their 200 day moving average slipped last week to 77.40% from 79.40%. Percent is intermediate overbought and showing early signs of rolling over.

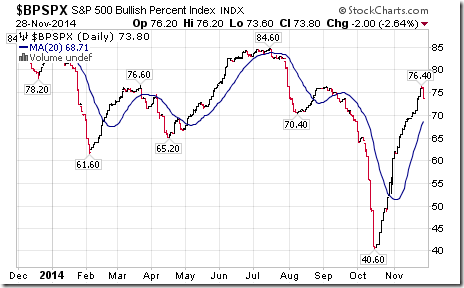

Bullish Percent Index for S&P 500 stocks increased last week to 73.80% from 73.60% and remains above its 20 day moving average. The Index is intermediate overbought.

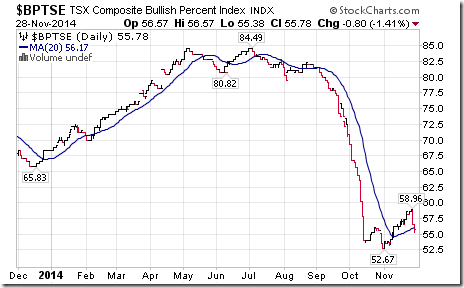

Bullish Percent Index for TSX Composite stocks fell last week to 55.78% from 58.57% and fell below its 20 day moving average. The Index remains intermediate overbought and showing signs of rolling over.

The TSX Composite Index dropped 366.38 points (2.42%) last week. Intermediate trend remains up. The Index fell below its 20 day moving average on Friday. Strength relative to the S&P 500 Index changed to negative from positive. Technical score fell to 1.0 from 3.0 out of 3.0. Short term momentum indicators are trending down.

Percent of TSX stocks trading above their 50 day moving average fell last week to 46.22% from 57.77%. Percent is trending down.

Percent of TSX stocks trading above their 200 day moving average dropped last week to 43.03% from 48.61%. Percent is trending down.

The Dow Jones Industrial Average added 18.18 points (0.10%) last week. Intermediate trend remains up (Score: 1.0). The Average remains above their 20 day moving average (Score: 1.0). Strength relative to the S&P 500 Index changed to neutral from positive. The Average remains above their 20 day moving average. Strength relative to the S&P 500 Index changed to neutral from positive. Technical score slipped to 2.5 from 3.0 out of 3.0. Short term momentum indicators are trending up, but are overbought and showing early signs of rolling over.

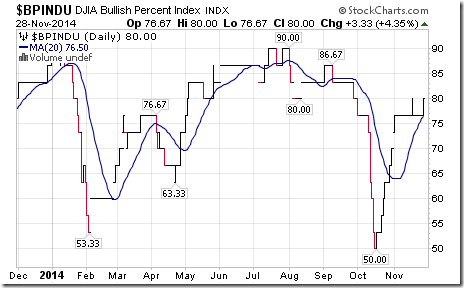

Bullish Percent Index for Dow Jones Industrial Average stocks increased last week to 80.00% from 76.67% and remained above its 20 day moving average. The Index remains intermediate overbought.

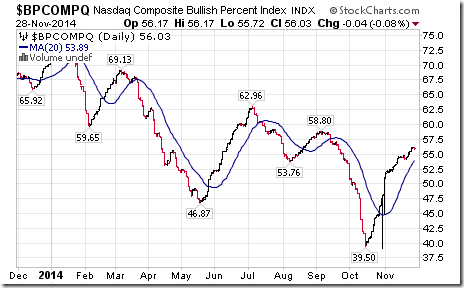

Bullish Percent Index for NASDAQ Composite stocks increased last week to 56.03% from 55.14% and remained above its 20 day moving average. The Index remains in an uptrend, but is intermediate overbought.

The NASDAQ Composite Index gained 78.66 points (1.67%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index changed to positive from neutral. Technical score increased to 3.0 from 2.5 out of 3.0. Short term momentum indicators are trending up, but are overbought.

The Russell 2000 Index added 0.81 (0.07%) last week. Intermediate trend remains neutral. The Index fell below its 20 day moving average on Friday. Strength relative to the S&P 500 Index remains negative. Technical score fell to 0.5 from 1.5. Short term momentum indicators are overbought and trending down.

The Dow Jones Transportation Average added 104.02 points (1.14%) last week. Intermediate trend remains up. The Average remains above its 20 day moving average. Strength relative to the S&P 500 Index changed to positive from neutral. Technical score increased to 3.0 from 2.5 out of 3.0. Short term momentum indicators are trending up, but are overbought and showing early signs of rolling over.

The Australia All Ordinaries Composite Index added 6.01 points (0.11%) last week. Intermediate trend remains down. The Index remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0. Short term momentum indicators are trending down, but are oversold.

The Nikkei Average gained 102.54 points (0.59%) last week. Intermediate trend remains up. The Average remains above its 20 day moving average. Strength relative to the S&P 500 Index remains positive. Technical score remains at 3.0 out of 3.0. Short term momentum indicators are trending up, but are overbought and showing early signs of rolling over.

iShares Europe gained $0.41 (0.92%) last week. Intermediate trend remains up. Units remain above their 20 day moving average. Strength relative to the S&P 500 Index changed to positive from neutral. Technical score increased to 3.0 from 2.5 out of 3.0. Short term momentum indicators are trending up, but are overbought.

The Shanghai Composite Index jumped 196.05 points (7.88%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index changed to positive from neutral. Technical score improved to 3.0 from 2.5 out of 3.0. Short term momentum indicators are trending up, but are overbought.

iShares Emerging Markets fell $0.94 (2.21%) last week. Intermediate trend remains up. Units fell below their 20 day moving average on Friday. Strength relative to the S&P 500 Index changed to negative from neutral. Technical score fell to 1.0 from 2.5 out of 3.0. Short term momentum indicators are mixed.

Currencies

The U.S. Dollar Index gained 0.05 (0.57%) last week. The Index remains above its 20 day moving average. Short term momentum indicators are overbought and have rolled over.

The Euro added 0.57 (0.46%) last week. Intermediate trend remains down. The Euro remains below its 20 day moving average. Short term momentum indicators remain mixed.

The Canadian Dollar dropped US1.47 cents (1.65%) last week. Intermediate trend remains down. The Canuck Buck fell below its 20 day moving average. Short term momentum indicator are mixed.

The Japanese Yen fell another 0.65 (0.77%) last week. Intermediate trend remains down. The Yen remains below its 20 day moving average. Short term momentum indicators are deeply oversold, but have yet to show signs of bottoming.

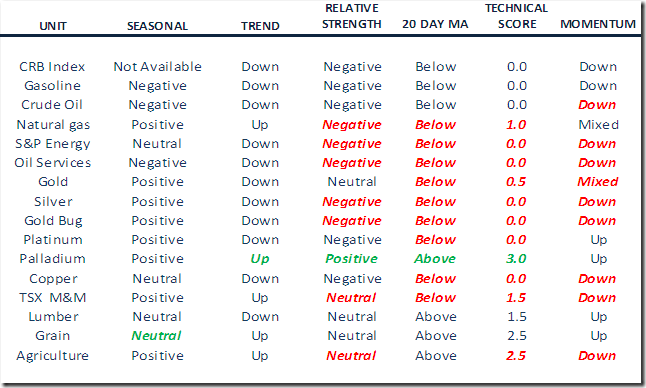

Commodities

Summary of Weekly Seasonal/Technical Parameters for Commodity Indices/ETFs

Seasonal: Positive, Negative or Neutral on a relative basis applying EquityClock.com charts

Trend: Up, Down or Neutral

Strength relative to the S&P 500 Index: Positive, Negative or Neutral

Momentum based on an average of Stochastics, RSI and MACD: Up, Down or Mixed

Green: Upgrade

Red: Downgrade

The CRB Index plunged 14.73 points (5.47%) last week. Intermediate trend remains down. The Index remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0.

Gasoline dropped $0.21 per gallon (10.29% last week. Intermediate trend remains down. Gas remains below its 20 day moving average. Strength relative to the S&P 500 remains negative.

Crude Oil plunged $10.36 per barrel (13.54%) last week. Intermediate trend remains down. Crude remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0. Short term momentum indicators are oversold.

Natural Gas dropped $0.18 per MBtu (4.22%) last week. Intermediate trend remains up. “Natty” fell below its 20 day moving average. Strength relative to the S&P 500 Index changed from positive to negative. Technical score fell to 1.0 from 3.0 out of 3.0. Short term momentum indicators remain mixed.

The S&P Energy Index fell 61.02 points (9.45%) last week. Intermediate trend remains down. The Index fell below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score dropped to 0.0 from 1.5 out of 3.0. Short term momentum indicators turned negative.

The Philadelphia Oil Services Index lost 33.55 points (13.44%) last week. Intermediate trend remains down. The Index fell below its 20 day moving average. Strength relative to the S&P 500 Index changed to negative from neutral. Technical score dropped to 0.0 from 1.5 out of 3.0. Short term momentum indicators are trending down.

Gold fell $22.20 per ounce (1.85%) last week. Intermediate trend remains down. Gold fell below its 20 day moving average on Friday. Strength relative to the S&P 500 Index remains neutral. Technical score slipped to 0.5 from 1.5 out of 3.0. Short term momentum indicators are mixed.

Silver fell $0.91 per ounce (5.55%) last week. Intermediate trend remains down. Silver dropped below its 20 day moving average on Friday. Strength relative to the S&P 500 Index and Gold changed from neutral to negative. Technical score fell to 0.0. Short term momentum indicators are trending down.

The Gold Bug Index plunged 12.64 points (7.21%) last week. Intermediate trend remains down. Silver fell below its 20 day moving average. Strength relative to the S&P 500 Index and Gold changed to negative from neutral. Technical score dropped to 0.0 from 1.5 out of 3.0. Short term momentum indicators are trending down.

Platinum fell $$16.00 per ounce (1.30%) last week. Trend remains down. PLAT fell below its 20 day MA. Strength relative to the S&P 500 Index remains negative. Relative to gold :neutral

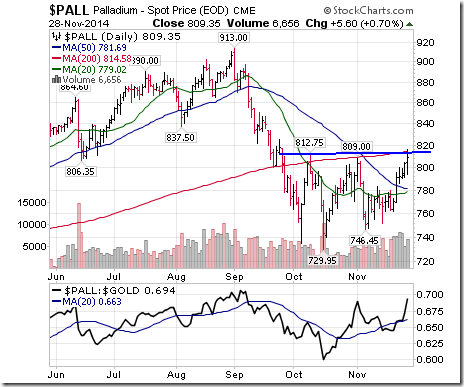

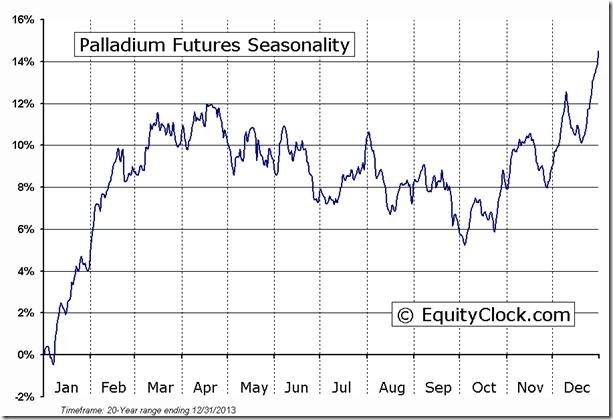

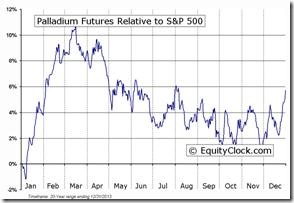

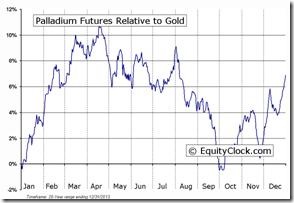

Palladium gained $13.45 per ounce (1.69%) last week. Trend changed to up from down. Move above $812.75 completed a reverse head & shoulders pattern. PALL remains above its 20 day MA. Strength relative to the S&P 500 Index changed to positive from neutral.

Copper dropped 17.2 cents per lb. (5.67%) last week. Intermediate trend remains down. Copper remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score fell to 0.0 from 1.0 out of 3.0. Short term momentum indicators are trending down.

The TSX Metals & Mining Index dropped 54.04 points (7.10%) last week. Intermediate trend remains up. The Index fell below its 20 day moving average on Friday. Strength relative to the S&P 500 Index changed to neutral from positive. Technical score dropped to 1.5 from 3.0. Short term momentum indicators are trending down.

Lumber dropped $3.70 (1.11%) last week. Intermediate trend remains down. Lumber remains above its 20 day moving average. Strength relative to the S&P 500 Index remained neutral.

The Grain ETN gained $0.60 (1.59%) last week. Intermediate trend remains up. Units remain above their 20 day moving average. Strength relative to the S&P 500 Index remains neutral. Technical score remains at 2.5 out of 3.0. Momentum indicators are trending up.

The Agriculture ETF fell $0.78 (1.40%) last week. Intermediate trend remains up. Units remain above their 20 day moving average. Strength relative to the S&P 500 Index changed from positive to neutral. Technical score slipped to 2.5 from 3.0 out of 3.0. Short term momentum indicators are trending down.

Interest Rates

The yield on 10 year Treasuries dropped 12.1 basis points (5.23%) last week. Intermediate trend remains down. Yield remains below its 20 day moving average. Short term momentum indicators are trending down.

Conversely, price of the long term Treasury ETF added $2.39 (1.99%) last week. Intermediate trend remains up. Price remains above its 20 day moving average.

Other Issues

The VIX Index added 0.43 (3.33%) last week. Intermediate trend remains up. The Index remains below its 20 day moving average.

Earnings focus this week is on the Canadian banks.

Tax loss selling pressures will have an influence on equity markets during the next two weeks. Pressures are expected to be less than usual this year because most markets and sectors are trading higher. Sectors that are most vulnerable are energy, precious metals and base metals.

Short and intermediate technical indicators are overbought and showing early signs of rolling over.

Seasonal influences beyond the next two weeks are positive. Here comes the Santa Claus rally between five trading days before the end of the year and the first two trading days in January (i.e. December 22nd to January 5th.

Economic focus this week is on the employment report on Friday. Most data points are expected to confirm slow, but steady growth in Canada and the U.S.

Recent accommodative monetary policy changes in China, Japan and Europe plus lower energy prices favour higher equity prices.

Early technical signs of a peak in the U.S. Dollar Index have appeared, a mildly bonus for equity markets.

The Bottom Line

Preferred strategy is to hold seasonally attractive equity positions and to add to positions on likely weakness during the next two weeks. Preferred sectors include Consumer Discretionary, Industrials and Materials.

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

FUTURE_PA1 Relative to the S&P 500  |

FUTURE_PA1 Relative to Gold  |

Monitored List of Technical/Seasonal Ideas

Green: Increased score

Red: Decreased score

A score of 1.5 or higher is needed to maintain a position

StockTwits Released on Friday @equityclock

Lots of technical action by 11:00 AM: 25 S&P 500 stocks broke resistance. 19 broke support. 15 stocks breaking support were energy stocks.

Canadian energy stocks breaking support: $CVE.CA, $HSE.CA, $TLM.CA, $PWT.CA, $CPG.CA, $CLO.CA

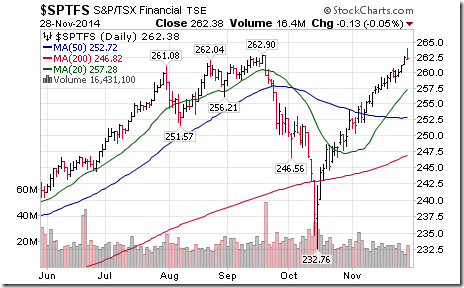

S&P/TSX Financials break to an all-time high. ‘Tis the season!

Canadian financials breaking to new highs: $CM.CA, $MFC.CA, $SLF.CA, $POW.CA

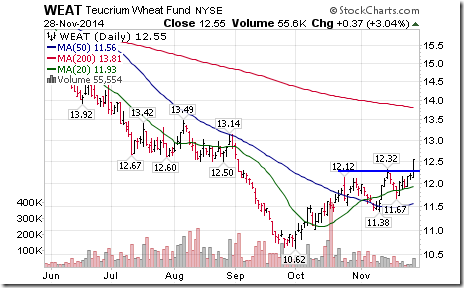

Nice breakout by $WEAT above $12.32. ‘Tis the season for strength in grain prices!

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

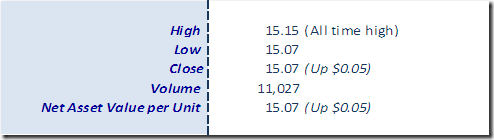

Horizons Seasonal Rotation ETF HAC November 28th 2014

Copyright © Don Vialoux, EquityClock.com