by Don Vialoux, EquityClock.com

Pre-opening Comments for Wednesday November 12th

U.S. equity index futures were lower this morning. S&P 500 futures were down 8 points in pre-opening trade.

Third quarter reports continue to pour in. Companies that reported overnight included Dow Chemical, JM Smucker’s, Macy’s, Rockwell Automation, Sea World and Beazer Homes.

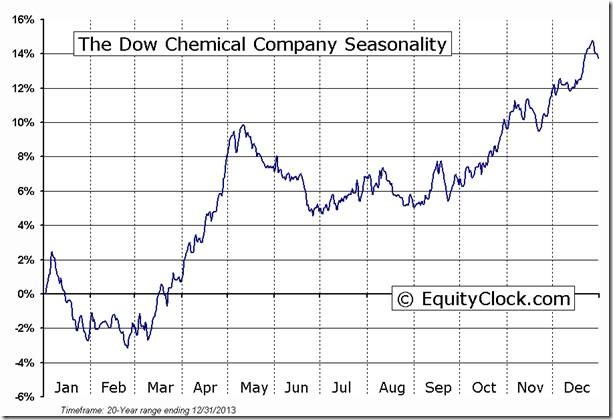

Dow Chemical gained $0.63 to $50.15 after announcing an additional $5 billion buyback program for a total program valued at $9.5 billion. In addition the company announced a 14% increase in its annual dividend. ‘Tis the season for strength!

Alibaba gained $0.59 to $115.13 after HSBC initiated coverage with an Overweight rating. Target is $148.

Viacom slipped $0.68 to $68.85 after Bernstein downgraded the stock from Market Perform to Underperform. Target is $71.

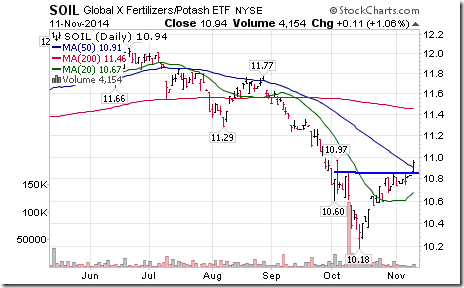

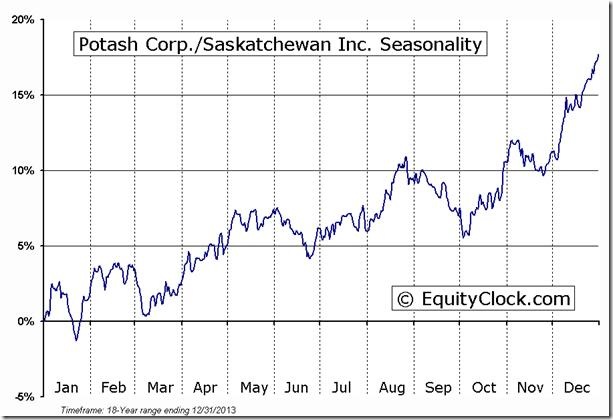

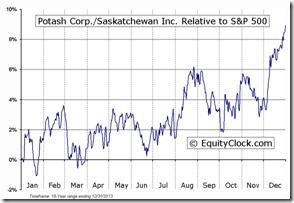

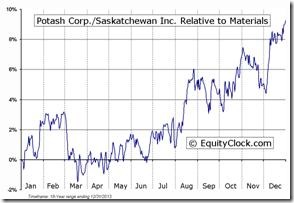

Potash Corp (POT US$33.34) is expected to open higher after Capital Group disclosed an increase in its stake in the company to 83.1 million shares or just above 10% of outstanding shares.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2014/11/12/stock-market-outlook-for-november-12-2014/

Interesting Charts

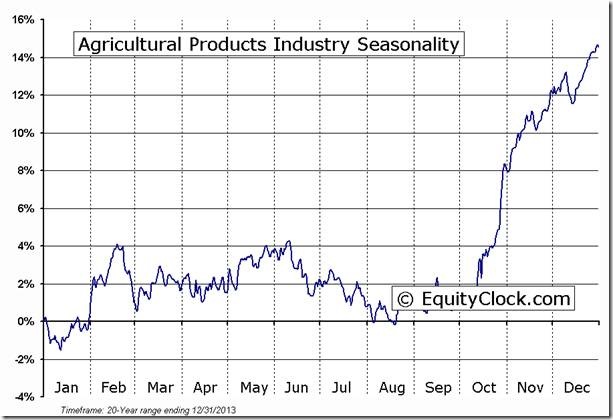

The agriculture ETF broke above $54.64. Tis the season for strength!

Fertilizer stocks led the advance.

StockTwits Released Yesterday @equityclock

Quiet bullish action by S&P stocks at 10:45. Breakouts were $BAC, $LNC, $VAR and $XRX. Breakdown: $KORS

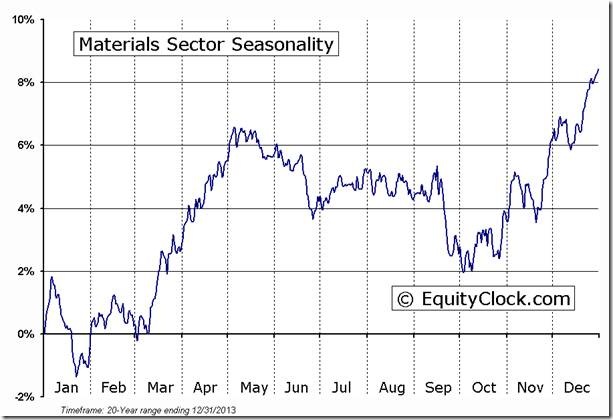

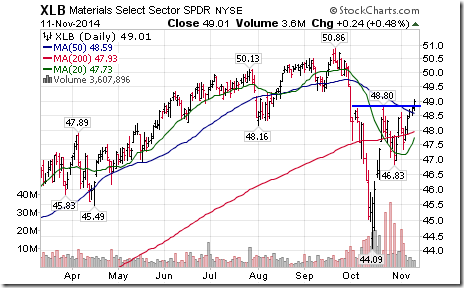

Nice breakout by $XLB above $40.80 due to strength in chemical stocks. ‘Tis the season for Materials!

Strength in $XLB is despite a breakdown by its Steel subsector, $SLX

Technical Action by Individual Equities Yesterday

By the close, one more S&P 500 stocks broke intermediate resistance: Ford. No TSX 60 stocks broke support or resistance.

An Opportunity to “Pay it forward”

Tech Talk’s favourite charity is Wellspring, a charity that offers free support services for people with cancer. Wellspring is a network of community-based centers that offer programs providing support, coping skills, and education to cancer patients and their families.The center here in Oakville serves over 4,000 people resident mainly in Mississauga, Oakville and Burlington. Services offered at the Oakville center includes group support, financial planning, programs focusing on nutrition, relaxation and exercise as well as updated education by medical experts. Jan and Don Vialoux offer their time, talent and treasure to the center. Don Vialoux is a prostate cancer survivor. Wellspring is entirely support by individual and corporate donations and does not receive funding from the United Way or federal/provincial governments. All donations are tax deductible. More information on Wellspring and its services is available at http://www.wellspring.ca/

Now is the time to “Pay it forward” for the free services offered by this blog! Wellspring is holding its annual holiday “Light Up Wellspring” fund raising program. Contributors can help to “Light Up” the Oakville center by donating:

$5 for a bulb

$25 for a strand of bulbs

$250 for a wreath of bulbs

All proceeds go toward providing cancer patients and their loved ones with much needed support programs at Wellspring.

Please join us at 6:30 PM EST on November 27th at Wellspring’s Holiday Open House when the lights will be switched on. The event will include festive refreshments, a bake sale, bazaar and silent auction.

If unable to attend, charitable donations can be made through http://www.wellspring.ca/

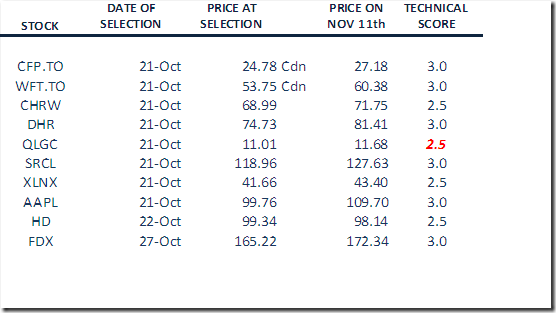

Monitored List of Technical/Seasonal Ideas

Green: Increased score

Red: Decreased score

A score of 1.5 or higher is needed to maintain a position

CAE was deleted with a profit of 1.2% after its technical score dropped below 1.5

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

POT.TO Relative to the S&P 500 |

POT.TO Relative to the Sector |

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

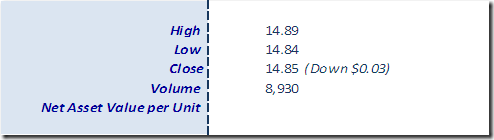

Horizons Seasonal Rotation ETF HAC November 11th 2014

Copyright © Don Vialoux, EquityClock.com