by Don Vialoux, EquityClock.com

(Editor’s Note: Next Tech Talk report is released on Monday November 10th)

Pre-opening Comments for Thursday November 6th

U.S. equity index futures were higher this morning. S&P 500 futures added 5 points in pre-opening trade.

Index futures moved higher following comments by European Central Bank’s Mario Draghi and following release of economic news at 8:30 AM EST. Mario Draghi pledged to use unconventional methods to ease monetary policy in Europe. Loan rate to large European banks was maintained at 0.05%. Weekly jobless claims were better than expected. Consensus was 285,000 versus 288,000 last week. Actual was 278,000. Third quarter productivity was better than expected. Consensus was growth at a 1.4% rate versus an upwardly revised second quarter growth at a 2.9% rate. Actual was growth at 2.0% rate.

Third quarter reports continue to pour in. Companies that reported after the close yesterday included Wendy’s, QualComm, Tesla, Orbiz, Hospira, Fannie Mae, Whole Foods and Ann.

Duke Energy eased $0.52 to $82.98 after Deutsche Bank downgraded the stock from Buy to Hold.

TransOcean (RIG $28.90) is expected to open lower after Canaccord initiated coverage with a Sell recommendation.

EquityClock.com’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2014/11/05/stock-market-outlook-for-november-6-2014/

Notice comments on Silver and Gold.

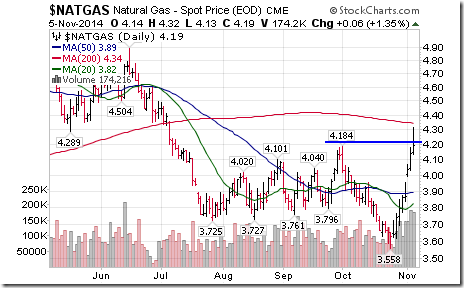

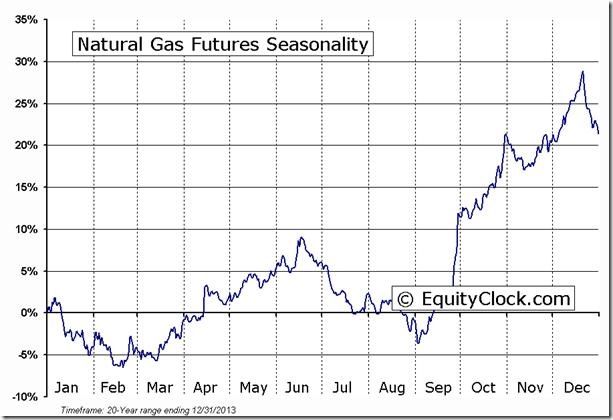

Interesting Chart

Nice breakout by Natural Gas! ‘Tis the season!

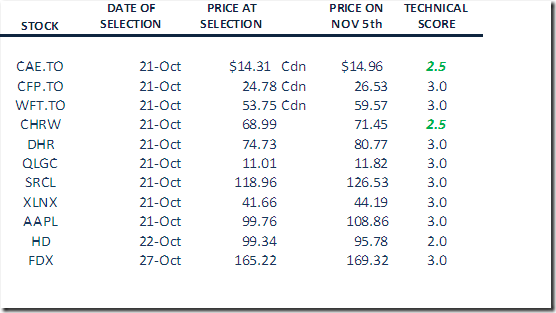

Monitored List of Technical/Seasonal Ideas

Green: Increased score

Red: Decreased score

A score of 1.5 or higher is needed to maintain a position

StockTwits Released Yesterday

Technical to 10:45: Bullish. 13 stocks broke resistance: $SPLS,$CPB,$MDLZ,$WFM,$AMP,$AON,$BRKB,$USB,$ACT,$JNJ, $CA,$NEE,$AET. 2 broke support: $TRIP,$THC.

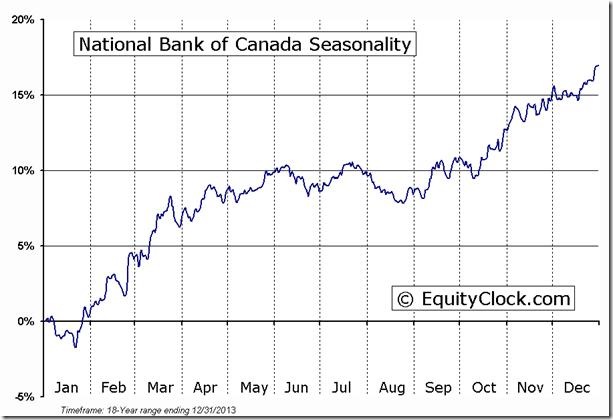

Nice breakout above resistance by $NA.CA above $53.38 to an all-time high. ‘Tis the season for strength!

Technical Action by Individual Equities Yesterday

By the close, 19 S&P 500 stocks broke resistance (adding XL, ISRG, ACN, KLAC, SEE and NRG) and none broke support.

National Bank was the only TSX 60 stock to break resistance. None broke support.

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

|

FP Trading Desk Headline

FP Trading Desk headline reads, “What $1100 means for the Gold sector”. Following is a link:

http://business.financialpost.com/2014/11/05/what-1100-means-for-the-gold-sector/?__lsa=012a-8667

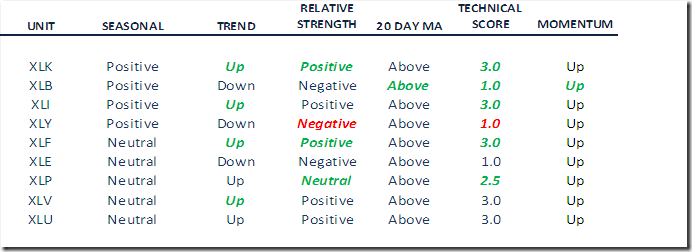

Summary of Weekly Seasonal/Technical Parameters for SPDRs

Key:

Seasonal: Positive, Negative or Neutral on a relative basis applying EquityClock.com charts

Trend: Up, Down or Neutral

Strength relative to the S&P 500 Index: Positive, Negative or Neutral

Momentum based on an average of Stochastics, RSI and MACD: Up, Down or Mixed

Twenty Day Moving Average: Above, Below

Red: Downgrade

Green: Upgrade

Technology

· Intermediate trend changed to up from neutral on a move above $40.57 to a14 year high.

· Units remain above their 20 day moving average

· Strength relative to the S&P 500 Index changed to positive from negative

· Technical score improved to 3.0 from 1.5 out of 3.0

· Short term momentum indicators are trending up, but are overbought

Materials

· Intermediate trend remains down

· Units moved above their 20 day moving average

· Strength relative to the S&P 500 Index remains negative

· Technical score improved to 1.0 from 0.0 out of 3.0

· Short term momentum indicators are trending up.

Industrials

· Intermediate trend changed to up from neutral on a move above $55.31 to an all-time high.

· Units remain above their 20 day moving average

· Strength relative to the S&P 500 Index remains positive

· Technical score improved to 3.0 from 2.5 out of 3.0

· Short term momentum indicators are trending up, but are overbought

Consumer Discretionary

· Intermediate trend remains down

· Units remain above their 20 day moving average

· Strength relative to the S&P 500 Index changed to negative from neutral

· Technical score slipped to 1.0 from 1.5 out of 3.0.

· Short term momentum indicators are trending up.

Financials

· Intermediate trend changed to up from neutral on a move above $23.88 to a six year high.

· Units remain above their 20 day moving average

· Strength relative to the S&P 500 Index changed to positive from neutral

· Technical score improved to 3.0 from 2.0 out of 3.0

· Short term momentum indicators are trending up, but are overbought

Energy

· Intermediate trend remains down

· Units remain above their 20 day moving average

· Strength relative to the S&P 500 Index remains negative

· Technical score remains at 1.0 out 3.0

· Short term momentum indicators are trending up

Consumer Staples

· Intermediate trend remains up

· Units remain above their 20 day moving average

· Strength relative to the S&P 500 Index changed to neutral from negative

· Technical score improved to 2.5 from 2.0 out of 3.0

Health Care

· Intermediate trend remains up.

· Units remain above their 20 day moving average

· Strength relative to the S&P 500 Index remains positive

· Technical score remains at 3.0 out of 3.0

· Short term momentum indicators are trending up, but are overbought

Utilities

· Intermediate trend remains up

· Units remain above their 20 day moving average

· Strength relative to the S&P 500 Index remains positive

· Technical score remains at 3.0 out of 3.0

· Short term momentum indicators are trending up, but are overbought.

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

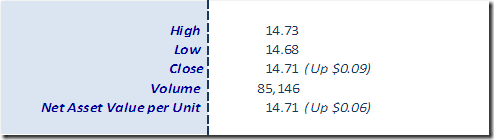

Horizons Seasonal Rotation ETF HAC November 5th 2014

Copyright © Don Vialoux, EquityClock.com