The Hardest Part

by Ben Carlson, A Wealth of Common Sense

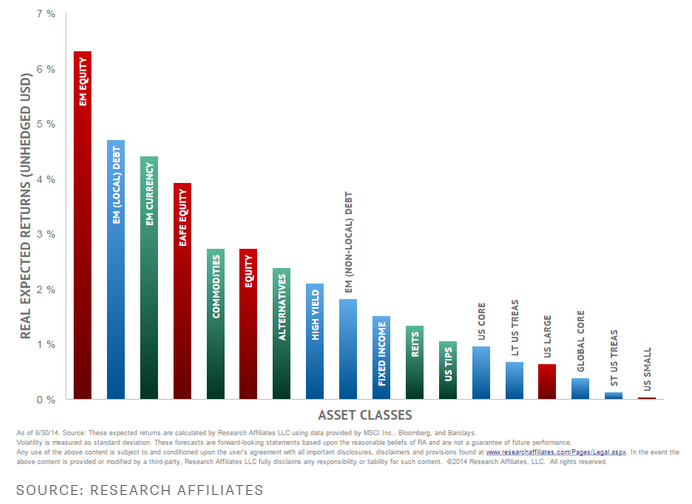

Research Affiliates has a useful new online tool that allows investors to play around with expected risk and return statistics for a number of different markets. You can sort by asset class, country or region. Here’s one that shows the 10 year real expected returns for a handful of asset classes:

You should notice an interesting pattern in this chart – the expected returns for U.S. stock and bond markets are all clustered on the right side of the chart with very low numbers while emerging market and developed foreign markets have much higher expected performance on the left.

This makes sense, in theory. The higher an asset’s recent performance the lower the expected future returns should be and the lower the recent performance the higher the expected future returns should be.

You can see from the latest 5 year annual return numbers how dramatically the U.S. has outpaced the rest of the world:

- S&P 500 (SPY) 16.3%

- S&P 600 Small Cap (SLY) 19.0%

- EAFE (EFA) 6.2%

- Emerging Markets (VWO) 4.9%

- Europe (VGK) 6.8%

- Japan (EWJ) 5.5%

Every single foreign market listed here has performed below average while U.S. stocks have been way above average. No market can keep up that kind of outperformance forever. The problem is that many of these foreign countries are a complete mess right now, while the U.S. continues to be the proverbial least dirty shirt in the laundry hamper.

There are many reasons that make it very logical to stay away from some of these regions. The European Union was poorly conceived from a fiscal standpoint considering the differences among the economies of the countries involved. Japan has been in a deflationary death spiral for over two decades. Emerging market growth is slowing while high inflation and currency issues are a regular occurrence in many of the countries. If you’re making a pros and cons list, the cons probably outweigh the pros right now.

This is one of the hardest parts about investing. It never feels right to invest or rebalance into a cheaper investment class because usually things are cheap for a reason. You’re never going to find a market on sale because things are going great. But remember, markets tend to perform better when things are going from terrible to bad than from good to great. Investing where the expectations are high usually leads to disappointment while low expectations usually plant the seed for future gains.

It’s impossible to time these things with any precision, but using history and mean reversion as a guide tells us that international markets will play catch-up eventually. It’s timing that will always get you if you try to make a bold call one way or the other.

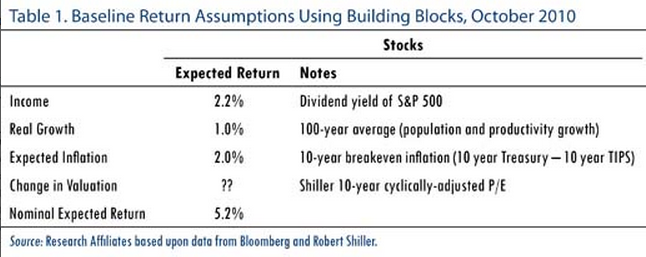

Case in point, take a look at the return assumptions that Research Affiliates put out in late 2010 for U.S. stocks:

Since these estimates were published the S&P 500 is up around 90% in total. That’s 17% per year or about 12% higher than their estimate. There’s nothing wrong with their methodology. It’s just that it’s very difficult to make these kinds of predictions. This is why any expected return data needs to be taken with a big shaker of salt. It’s hard enough to predict the inflation and growth rates, but trying to pin down the change in valuation is nearly impossible. No one knows what people will be willing to pay for stocks in the future.

Many investors have been hearing about the possibility of low future returns for a number of years now. It’s a very compelling case. But these projections should be utilized to set reasonable expectations and not much else. If they end up being too low and you’re surprised on the upside, that’s a good thing, especially if it forces you to save more money to make up for a perceived shortfall.

Just don’t get caught up trying to use these types of expected return assumptions to try to time the market. Certain investors have been caught doing this for the entire bull market. Ask them how that’s working out.

If markets traded exclusively on fundamentals it would make it a lot easier on everyone. But they don’t. Sentiment, trends, investor allocations and the current make-up of the economic and market landscape play a huge role in determining the performance of any market. Most of the time these factors outweigh the fundamentals.

Setting reasonable expectations is a great way to manage risk. But use your expectations as a baseline case, not something that’s set in stone.

Check out their site for more:

Research Affiliates

Further Reading:

The Psychology of Low Returns

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © A Wealth of Common Sense