Earnings to the Rescue

October 24, 2014

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

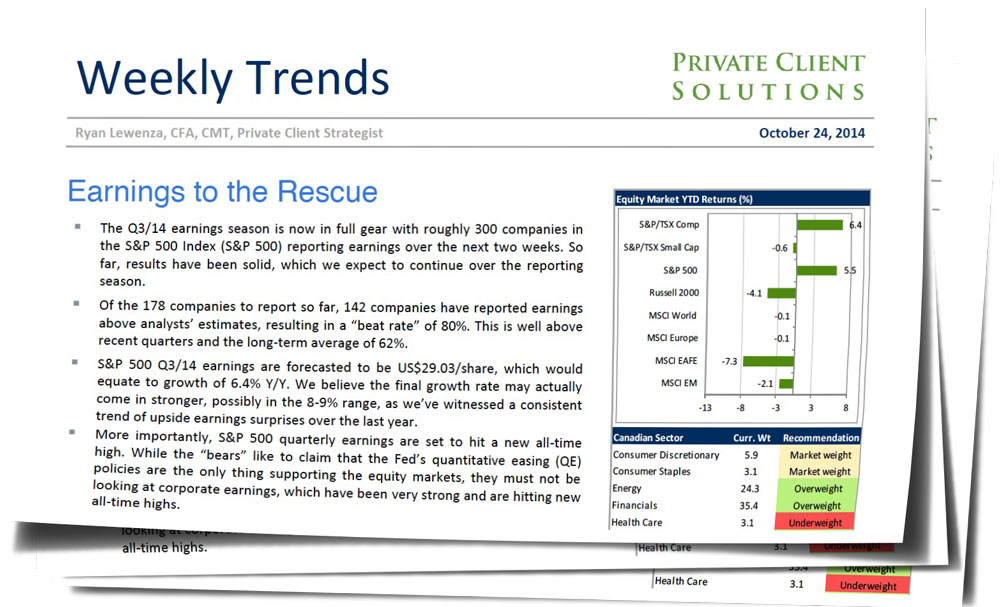

• The Q3/14 earnings season is now in full gear with roughly 300 companies in the S&P 500 Index (S&P 500) reporting earnings over the next two weeks. So far, results have been solid, which we expect to continue over the reporting season.

• Of the 178 companies to report so far, 142 companies have reported earnings above analysts’ estimates, resulting in a “beat rate” of 80%. This is well above recent quarters and the long-term average of 62%.

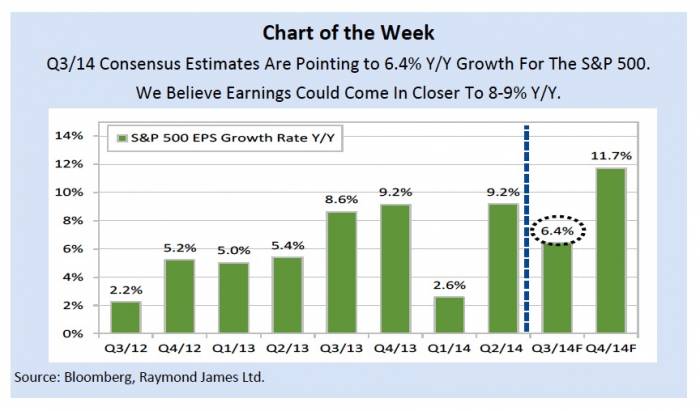

• S&P 500 Q3/14 earnings are forecasted to be US$29.03/share, which would equate to growth of 6.4% Y/Y. We believe the final growth rate may actually come in stronger, possibly in the 8-9% range, as we’ve witnessed a consistent trend of upside earnings surprises over the last year.

• More importantly, S&P 500 quarterly earnings are set to hit a new all-time high. While the “bears” like to claim that the Fed’s quantitative easing (QE) policies are the only thing supporting the equity markets, they must not be looking at corporate earnings, which have been very strong and are hitting new all-time highs.

• We expect corporate earnings to remain healthy in the coming quarters, which should be supportive to equities.