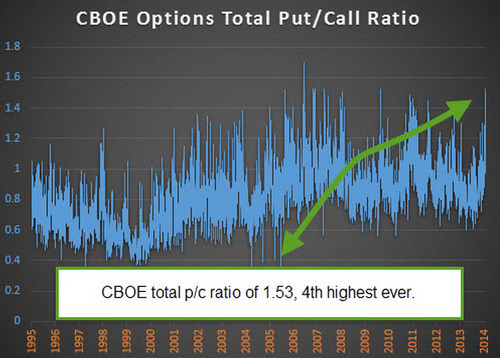

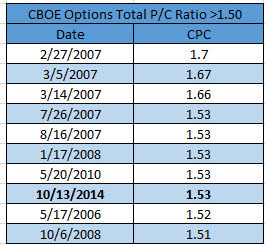

Here are all the times this ratio came in over 1.50. As you can see, yesterday tied for fourth.

The big question though is can we call this event bullish? Here are the results after big spikes in the put/call ratio. Like most rare indicators, they tend to happen in clusters. To take care of this, one month had to pass between signals for them to count. This left just six signals.

Not really the contrarian buy signal is it? Sure, just six signals could be viewed as statistically insignificant and potentially random. Still, this is one of those things I’d still rather know than not know.

Thanks to Far & Away for the image.