(Note: No pre-opening comments today due to a previous commitment)

Interesting Comment from MarketWatch.com last night

Headline reads,”Stocks typically pop after mid-term elections”. Following is a link:

Interesting Charts

Technical action by markets yesterday was dominated by weakness in the U.S. Dollar Index. The Index is substantially overbought and its momentum indicators are showing early signs of rolling over. However, one trading day does not make a trend.

Grain prices finally are showing early technical signs of bottoming thanks partially to weakness in the U.S. Dollar.

In addition to grain prices, most commodities priced in U.S. Dollars moved higher: gold, silver, copper, crude oil, etc.

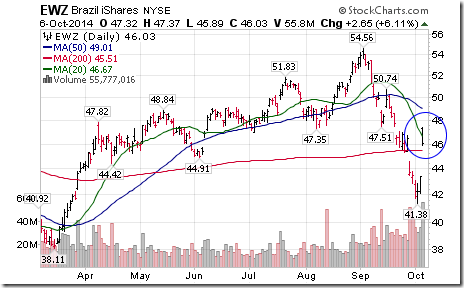

Brazilian stocks and related ETFs responded strongly to election results over the weekend. The “right-of-center” candidate has gained momentum in the polls prior to the final run-off election later this month.

StockTwits Yesterday

Quiet bullish action by S&P 500 stocks to 10:45 AM. Breaks above resistance: $TSN, $WMT, $BDX, $ISRG, $DNB, $SRE. None broke support.

Technical Action by Individual Equities

No additional changed were recorded by S&P 500 stocks.

Among TSX 60 stocks, Thomson Reuters briefly broke resistance to reach a 12 year high.

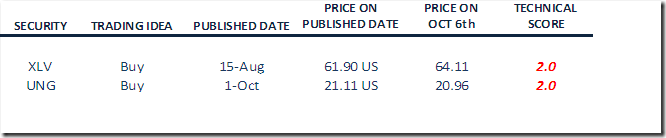

Monitored Technical/Seasonal Trade Ideas

A security must have a Technical Score of 1.5 – 3.0 to be on this list.

Green: Increased Technical Score

Red: Reduced Technical Score

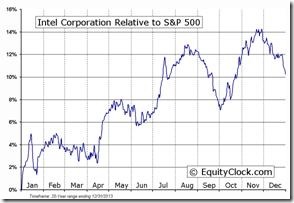

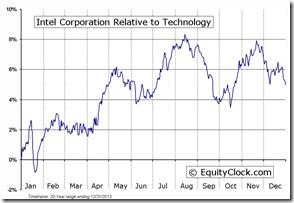

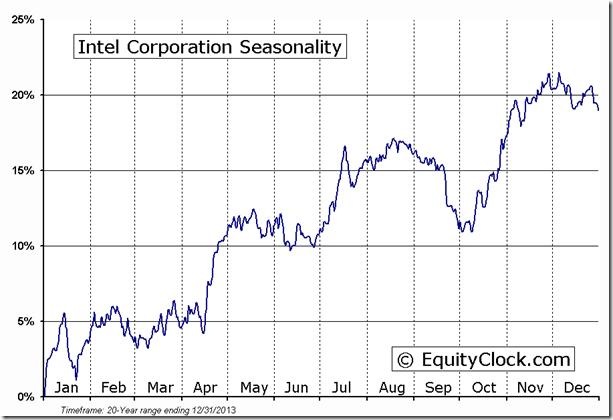

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

INTC Relative to the S&P 500 |

INTC Relative to the Sector |

Weekly Tech Talk/Horizons Seasonal/Technical Report

Following is a link:

http://www.horizonsetfs.com/campaigns/TechnicalReport/index.html

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

Horizons Seasonal Rotation ETF HAC October 6th 2014

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/HLIC/15de06f3fb225c2e83f60e298583ea99.png)