by Ben Carlson, A Wealth of Common Sense

“Stocks, although suffering from inflation in the short term, protect against it in the long term.” – William Bernstein

Last week a reader sent me a passage from Nassim Taleb’s book, Antifragile, and asked me what I thought about it in the context of low probability events. Specifically, this reader was worried about hyperinflation.

Here’s some of what Taleb had to say in the book:

Economic models are extremely fragile to assumptions, in the sense that a slight alteration in these assumptions can, as we will see, lead to extremely consequential differences in the results. And, to make matters worse, many of these models are “back-fit” to assumptions, in the sense that the hypotheses are selected to make the math work, which makes them ultrafragile and ultrafragilizing.

Note one fallacy promoted by Markowitz users: portfolio theory entices people to diversify, hence it is better than nothing. Wrong, you finance fools: it pushes them to optimize, hence overallocate. It does not drive people to take less risk based on diversification, but causes them to take more open positions owing to perception of offsetting statistical properties — making them vulnerable to model error, and especially vulnerable to the underestimation of tail events.

I actually agree with much of what he’s saying here. Far too many people in the world of finance put complete faith into their models without acknowledging that a small change to a single variable can have a large impact on the estimated outcome. There is also far too much data-mining that goes on with an extreme hindsight bias.

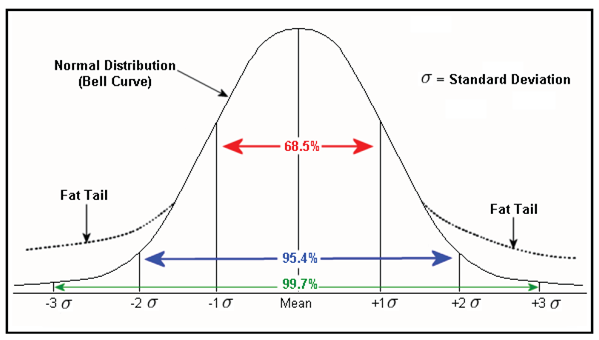

But you have to be careful about planning for low probability events such as hyperinflation. Yes, it’s tempting to assume the magnitude of the outcome could be huge if you’re right, but you have to ask yourself how long you’ll be waiting for a fat tail event to hit.

After John Paulson nailed the subprime mortgage trade everyone was looking for opportunities with very little downside, but huge upside. This is the Babe Ruth Effect which states that it doesn’t matter how many times you’re right, but how big the payoff is when you are (The Babe stuck out a lot but hit plenty of home runs when he made contact).

The problem is that although these fat tail events seem to happen much more often than the economists and statisticians would predict, they’re always different.

So if you’re betting on a specific fat tail risk, such as hyperinflation, you better have a good reason for it because it’s a very low probability event and the payoff isn’t as much of a sure-thing as you might think. And even though there’s been a chorus of Fed-haters calling for hyperinflation since QE began, inflation has stayed subdued for a number of years now.

William Bernstein covers hyperinflation in his book, Deep Risk: How History Informs Portfolio Design, as one of the four deep risks investors face (the others are deflation, confiscation by the government and war):

Severe, prolonged hyperinflation damages both stocks and bonds, more so bonds, which may see a total loss. Examples: Weimar Germany, post-WWII Hungary, current day Zimbabwe. Solution: wide diversification among international markets, a tilt towards value stocks and the stocks of commodity-producing companies. Gold bullion, inflation-protected securities and annuities, Social Security payments, fixed-rate mortgages.

The thing is, for this to occur and really have an impact we would probably need to see global hyperinflation, not just here in the U.S. Which would basically be Armageddon. It probably wouldn’t matter what you invested in. You might as well buy canned food with some guns and ammo. We’d all be screwed anyways.

Bernstein actually does recommend a small amount of precious metals equities in a portfolio to hedge out an inflation shock like we experienced during the 1970s.

While this sounds good in theory, I think investors have to be careful about trying to hedge too many risks. Adding a little bit of gold or maybe a small allocation to a bear market fund sounds like a good idea in the event of a blow-up. But putting something like 2-3% of your portfolio in a hedge, as some advise, isn’t going to help you at all since the majority of your portfolio will still be subject to the whims of the market.

It almost comes down to go big or go home if you’re going to make that kind of bet. Otherwise it’s more or less a waste of an allocation in your portfolio. Diversification is a good thing, but over-diversification can cancel out some of the benefits. Trying to hedge every possible situation can lead to sub-optimal performance. You need to take some risk to make money in the markets.

Even though any fat tail event is always a possibility I still think it’s better for investors to focus on what is probable, not everything that’s possible. Anything can happen, but what normally happens? You can’t be a contrarian for the sake of being a contrarian at all times. It only works at the inflection points.

And the next fat tail crash won’t come from something everyone is talking about. A black swan is something that comes as a surprise, so it’s very difficult to position for it ahead of time.

Sources:

Antifragile

Deep Risk

Further Reading:

Yes, Size Matters

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © A Wealth of Common Sense