by Cullen Roche, Pragmatic Capitalism

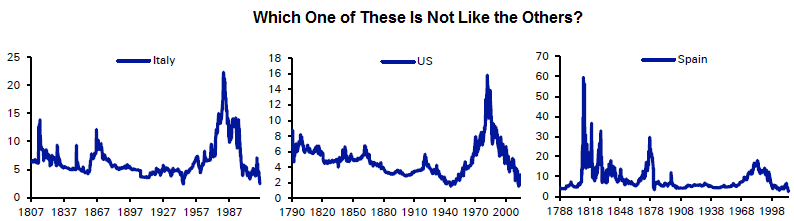

Here’s some really long-term perspective for you – this chart via Deutsche Bank shows the nominal yields for several government bond markets at present. The trend is generally the same in all of these charts so they don’t actually look all that different, but I’d argue that there’s a big difference in these bonds:

The thing is, the Italian and Spanish bond yields are being suppressed by the ECB’s interventions. But under the surface lies a gigantic risk in owning these bonds. While investors are being paid close to nothing for owning these bonds now there is still a substantial amount of solvency risk involved in owning these bonds. The thing is, because the European Monetary Union is incomplete, each of the nations using the Euro are the equivalents of states in the USA. So the risk of insolvency is very real. In other words, they are essentially users of a foreign currency and can be determined insolvent by virtue of not being able to obtain the necessary funding to remain solvent in that currency.

Of course, it would take a political event for that to occur (the EMU has to essentially choose to let one of the countries go bankrupt), but it might not be as far fetched as you think. Say, for instance, that Italy’s debt to GDP ratio just continues to worsen and Germany slowly realizes that this country can’t reverse course without debt forgiveness or its own currency. In that case Germany could essentially choose to pull the plug on letting Italy use the Euro and decide that it’s best to part ways as it becomes clear that the currency union just isn’t working as planned and Germany doesn’t want to get involved in a fiscal union that would alleviate the pressures.

Now, this risk doesn’t exist in the USA at the federal level. The USA doesn’t have foreign denominated debt and there’s no political risk of the Fed not being able to intervene to hold rates low or buy bonds. But you actually earn less on a Spanish 10 year bond than you do on a US government bond which is priced about the same as an Italian 10 year in nominal terms. In my opinion, you have to be insane to hold these bonds and view them as being near equivalents. In my view, peripheral government bonds are significantly more risky than German Bunds or US government bonds. And that’s largely because there is massive solvency risk due to a very fragile political landscape. Investors who don’t realize this could be taking on significantly more risk they realize.

Copyright © Pragmatic Capitalism