by Ben Carlson, A Wealth of Common Sense

“If every stock you own is on the new high list, you’re a momentum guy. If every stock you own is on the new low list, you’re out of business.” – Leon Cooperman

Mean reversion is one of the most powerful forces in all of finance. Above average performance is eventually followed by below average performance. Good times can lead to bad times and the best time to invest is during the bad times.

But this concept is generally reserved for the broader markets, not individual stocks. The problem with ‘buy when there’s blood in the streets’ is that sometimes individual stocks don’t comes back from the dead.

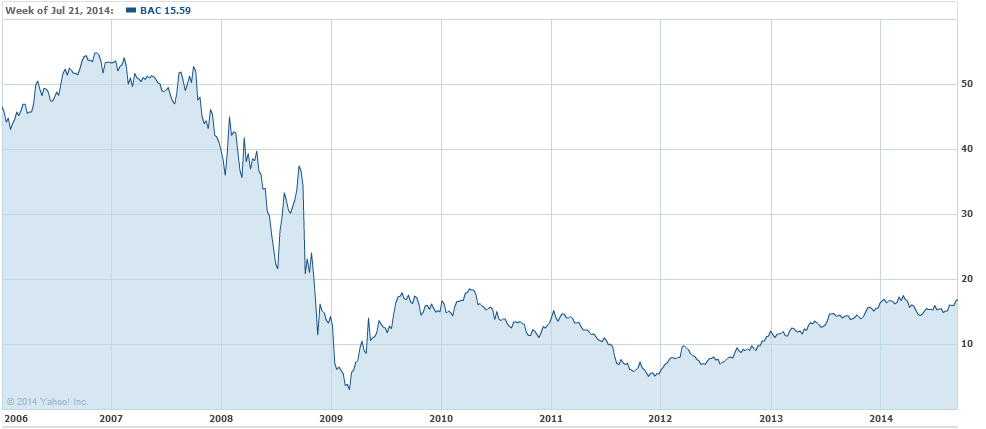

Although the market was spitting out tons of value during the financial crisis, not everything available at fire-sale prices worked out. I remember a portfolio manager friend of mine told me he was buying American International Group (AIG) hand over fist when it hit a few bucks a share. “All it has to do is come back half way to the prior peak and I’ll be rich.”

You can see this strategy didn’t work out that well:

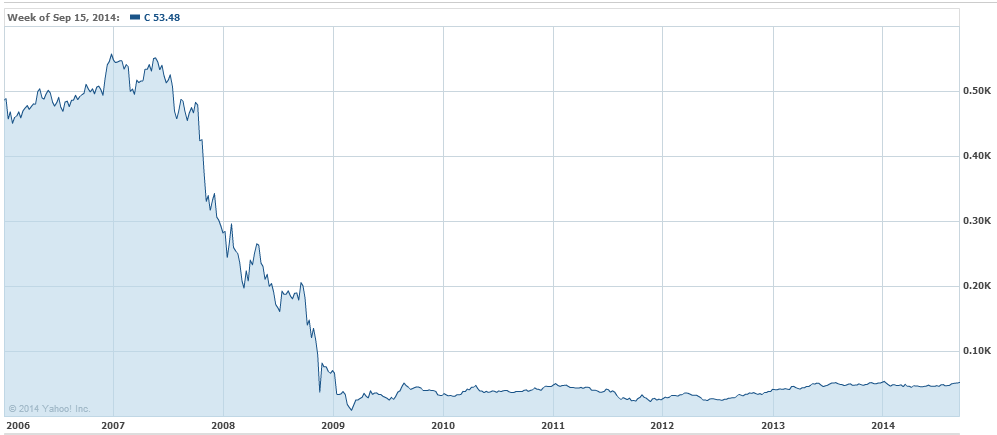

The same thing happened to a number of well-know financial stocks, including Bank of America (BAC):

The same thing happened to a number of well-know financial stocks, including Bank of America (BAC):

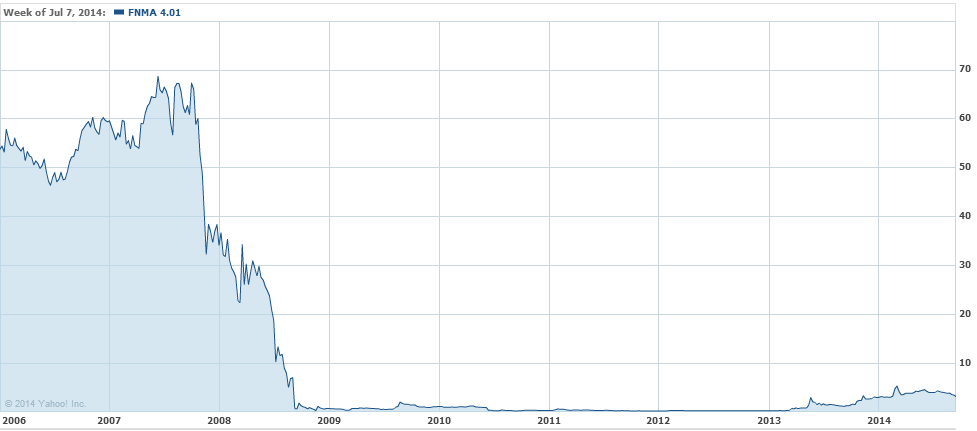

Citigroup (C):

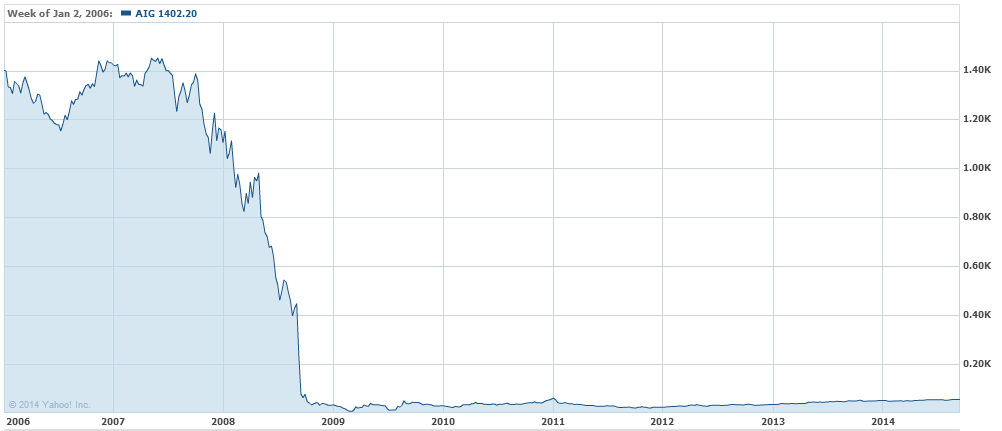

And Fannie Mae (FNMA):

One of the most common behavioral biases when buying individual stocks is anchoring to previous levels or the purchase price of a stock. The first thing investors do when researching a stock is pull up a historical chart of past prices. The fact that a company traded for a certain price in the past gives investors a false sense of hope that it will automatically go back to that previous price point. Sometimes this works, but trying to catch a falling knife can be a dangerous strategy if you don’t know what your’re doing.

My friend Michael Batnick shared some great statistics on individual stocks a couple of weeks ago that puts this into perspective from the standpoint of the overall market:

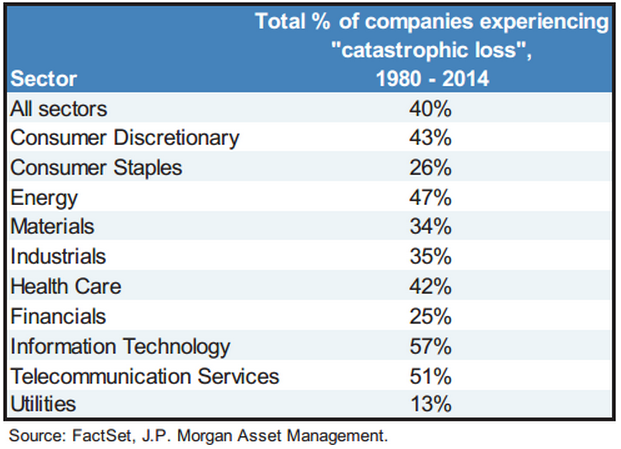

Using a universe of Russell 3000 companies since 1980, roughly 40% of all stocks have suffered a permanent 70%+ decline from their peak value. Looking at the table below, we see that nearly sixty percent of Tech companies have had a catastrophic loss, which they define as “a 70% decline from peak value with minimal recovery.”

Averaging down in a losing stock sounds like a great strategy in theory. And it is, assuming you have a good idea about the future prospects of the business in question and are fairly certain the market is undervaluing the company. Stating the obvious, this is not an easy task.

Be fearful when others are greedy but make sure you understand what you’re buying into.

Source:

The risk of concentrated portfolios (Irrelevant Investor)

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © Ben Carlson, A Wealth of Common Sense