Why is the Yield Curve Flattening?

by Dr. Ed Yardeni

September 24, 2014

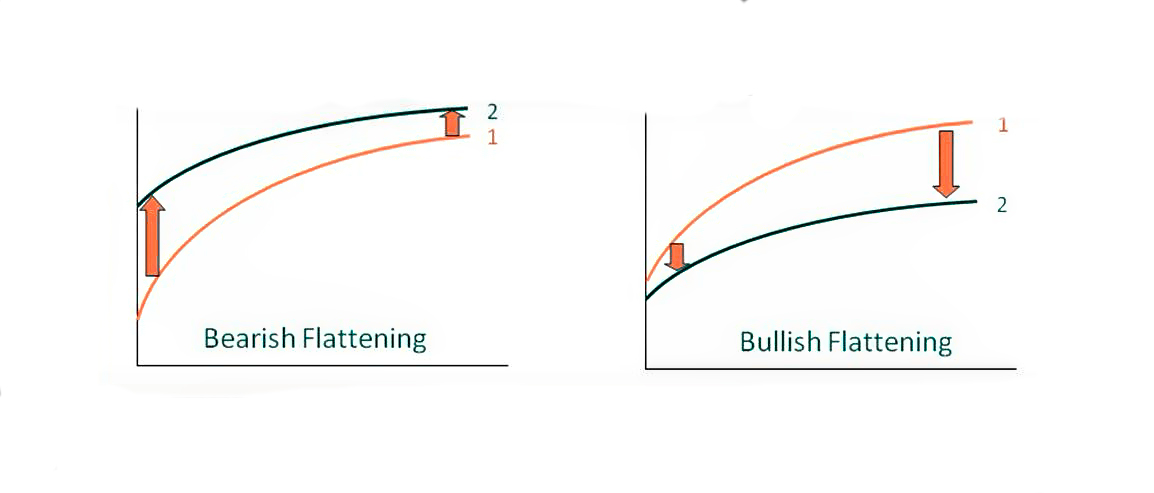

Gundlach thinks that this is remarkable. He suggests that strong economic data are driving the short end of the yield curve higher on expectations that the Fed will start tightening sooner. However, the economy might be more vulnerable to rate hikes than is widely appreciated. He concludes that “if you read the tea leaves of the bond market, it might be if the Fed raises rates even moderately like to 1% or 2%, maybe the economy can’t take it.”

Gundlach may be right. However, I have been noting that the widely unexpected drop in US bond yields since the start of the year is mostly attributable to the plunge in Eurozone yields. They declined broadly on Friday, with the yield on the 10-year German government bond falling to 1.04%. The yield on the 10-year government bond in Spain dropped to 2.19%. On Thursday the ECB announced that Eurozone lenders had borrowed just €82.6 billion through the new TLTRO, falling short of many analysts’ expectations and increasing the likelihood that the ECB will have to implement QE despite legal hurdles to doing so.

Today's Morning Briefing: Yellen’s Spin. (1) Fairy dust in the air. (2) “2014 by 2014” was achieved intra-day on Friday. (3) The third press conference was the charm--giving a new meaning to time. (4) Yellen says pay no attention to “dot plot” for the third time. (5) Will interest-rate hikes be at a “measured” pace? (6) How the Fed caused the last financial crisis. (7) The other Bond King explains the yield curve. (8) TLTRO disappoints. (9) Selfies and their BFFs. (10) Married couples in households with and without kids are no longer the majority. (11) Singles living solo account for 28% of households, while those living with someone else are at 24%. (12) “This Is Where I Leave You” (+). (More for subscribers.)