by Don Vialoux, Timing the Market

Interesting Chart

The yield on 10 year Treasuries has completed a bottoming pattern and has developed an intermediate uptrend.

StockTwits Released Yesterday @equityclock

Significant bearish action by S&P 500 stocks to 10:15 AM. Ten stocks broke intermediate support.

Notable among S&P stocks breaking support were energy stocks: $DNR, $RDC, $XOM, $CVX

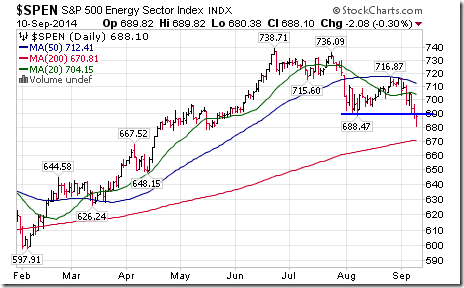

Editor’s Note: The S&P Energy Index also broke support:

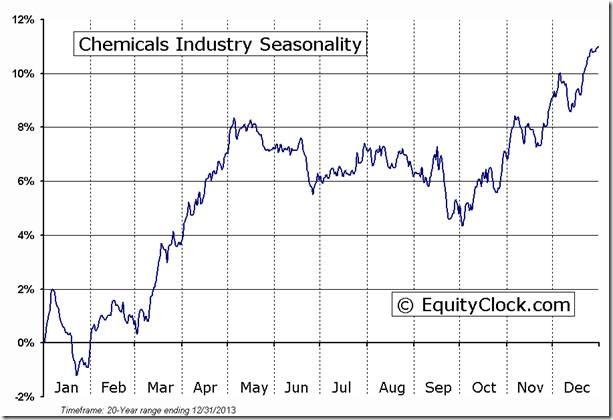

$MON is leading the chemical sector on the downside. ‘Tis the season for chemical stock weakness!

Technical Action by Individual Equities

By the close yesterday, eleven S&P 500 stocks had broken support and two stocks broke resistance (MO and KEY).

Among TSX 60 stocks, Metro broke to a 12 month high and SNC Lavalin broke support.

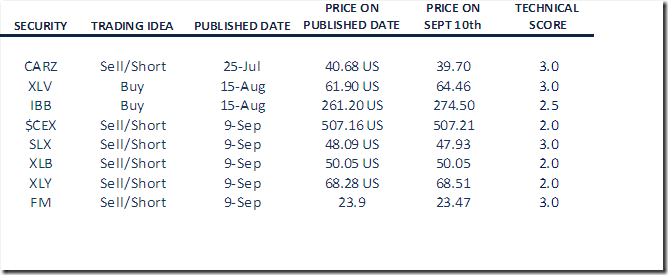

Monitored Technical/Seasonal Trade Ideas

AGU was deleted at a loss of 0.25% and IYR was deleted at a profit of 1.27% after their technical score fell below 1.5

A security must have a Technical Score of 1.5 – 3.0 to be on this list.

Green: Increased Technical Score

Red: Reduced Technical Score

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

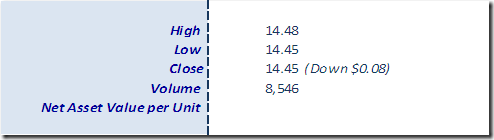

Horizons Seasonal Rotation ETF HAC September 10th 2014

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray