by Don Vialoux, Timing the Market

Interesting Chart

Natural gas briefly broke above resistance at $4.02 to complete a base building pattern. Strength relative to the S&P 500 Index has just turned positive. “Natty” moved above its 20 day moving average last week. ‘Tis the season for strength in natural gas prices from the end of August to the third week in December.

StockTwit released yesterday

Technicals on S&P stocks were quiet to 10:30 AM. Four stocks broke resistance ($TIF, $AMP, $MTB, $LH. One broke support: $LO.

Technical Action by Individual Equities

After 10:30 AM, two more stocks broke resistance: TDC and WDC. None broke support.

One TSX 60 stock broke support: TLM

Tech Talk at the Toronto World Money Show: Oct.16-18

Free registration! Following is a link:

http://www.moneyshow.com/tradeshow/toronto/world_moneyShow/expert-details.asp?speakerid=6672FT1&scode=036363

Adrienne Toghraie’s “Trader’s Coach” Column

|

Dramarian Traders

By Adrienne Toghraie, Trader’s Success Coach

I am convinced that there are traders who create drama in their lives to justify why they’re not getting the results that their strategy will allow in trading. When I hear traders say to me that their wife has left them, their daughter is getting married, their father has died and various other good reasons for their trading not working, I dutifully empathize with them and typically tell them that they should back off from their trading. These events are normal and natural to anyone’s life and there should be appropriate action to follow when these events occur. When I say that a person is a Dramarian, I am talking about those who have a chronic behavior pattern of one drama after another, which justifies why they are not getting the results that come from following a good strategy.

Drama king personified

Fifteen years ago I met a doctor at a conference who said to me that he had a strategy that would make him extremely wealthy if he could just be consistent in following it. After attending one of my workshops and purchasing all of my products, he said that he wanted to work with me privately. When we went over my Trader’s Evaluation to determine whether he would be a good candidate for private work, I was surprised to see how many psychological issues he had. I suggested that he first participate in my Top Performance Seminar. He agreed to follow my suggestion after he moved, after he had an operation, after he closed down his business, etc. Ten years later with drama after drama, he finally took the seminar and said that he was convinced that he would now be able to follow his rules and wanted to then do some private work. But first – I’m sure you know what followed – one drama after another for another five years.

He finally wrote me and said that he was ready to trade and after a month of being consistent he would work with me privately. Well since then, he has had three dramatic excuses that have kept him from starting.

Drama queen personified

An extremely talented trader was caught up in a world-wind of family problems that caused her to start having problems in keeping up with her trading. This led to losses and uncertainty about herself and her trading. When all the issues were handled, she said that she needed to revamp her trading plan. In the meantime, she volunteered to help with her church’s activities and let herself be drawn into the dramas of rebuilding the church’s attendance. Every time I spoke to her it was one more involvement that she needed to attend to before her trading would start.

“When X happens my trading will begin or get better”

Perhaps you are trading, but know if you did this or that your trading would improve. If you are such a trader, know that you are not alone, but do you want to continue being amongst those who are sitting on the fence of being a highly successful trader?

Let us now stop and notice what those things might be and how long you have been creating reasons, excuses or dramas that hold you back from reaping the rewards of a good strategy.

Take this self analysis – are you:

· Blaming it on others

· Blaming it on activities that you feel obligated to complete

· Always putting trading as profitably as your strategy will allow off into the future

· Not taking that seminar, that course, that private work that would make you the trader you want to be

Prime directive in trading

You should be in trading to earn the profits your strategy or methodology will allow. Put trading first and recognize what is holding you back. Make the commitment now to do what you have left for some day and perhaps you can give up being a dramarian.

Free Monthly Newsletter

More Articles by Adrienne Toghraie, Trader’s Success Coach

Sign Up at – www.TradingOnTarget.com

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

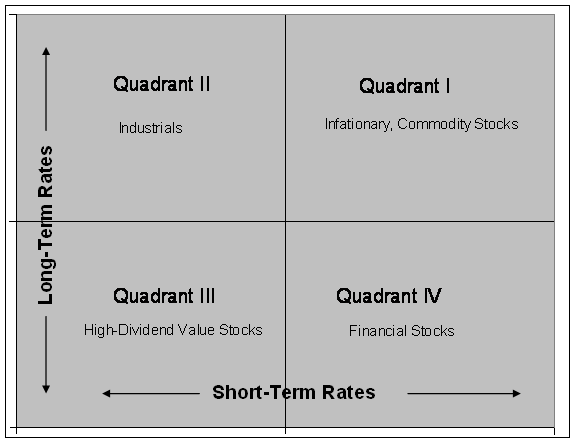

Editor’s Note: Economic sensitive sectors including Industrials (Transportation), Materials (Chemicals), Technology and Consumer Discretionary have a history of rolling over early in September and moving lower until at least the first week in October. Except Consumer Discretionary, these sectors and subsectors recently have underperformed the S&P 500 Index, a technical warning sign. It’s time to use short term strength to take trading profits in these sectors and subsectors.

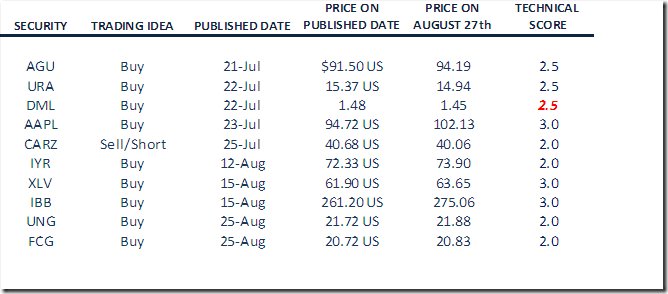

Monitored Technical/Seasonal Trade Ideas

A security must have a Technical Score of 1.5 – 3.0 to be on this list.

Green: Increased Technical Score

Red: Reduced Technical Score

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

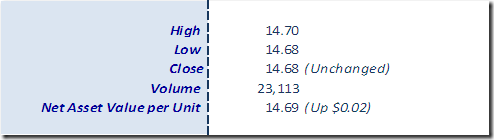

Horizons Seasonal Rotation ETF HAC August 27th 2014

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray