by Lance Roberts of STA Wealth Management,

David Rosenberg, in one of his recent missives, wrote:

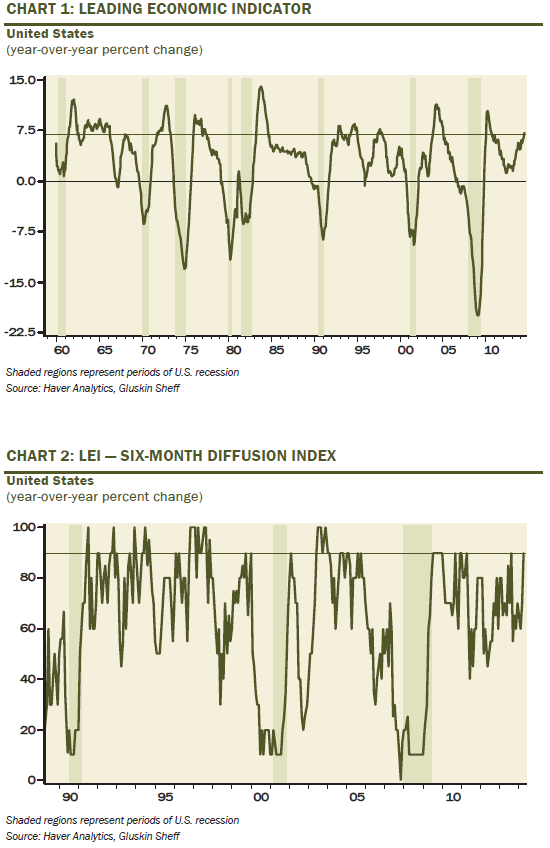

"Historically, when we are within six months of a recession, the year-over-year trend in the LEI turns negative while the diffusion index falls below 30%. At three-months away, the LEI is down 1% YoY and the diffusion index nears 25%. By the time the recession has hit, the LEI is down 4% year-over-year and the diffusion index is at 20%. Alternatively, based on the current trend in the LEI and the level of the diffusion index, history suggests that the next recession is at LEAST four years away."

This is pretty interesting coming from an economist/strategist who was formally considered a perma-bear now turned perma-bull by the media. While the charts above are certainly compelling, it is also important that some historical context be provided.

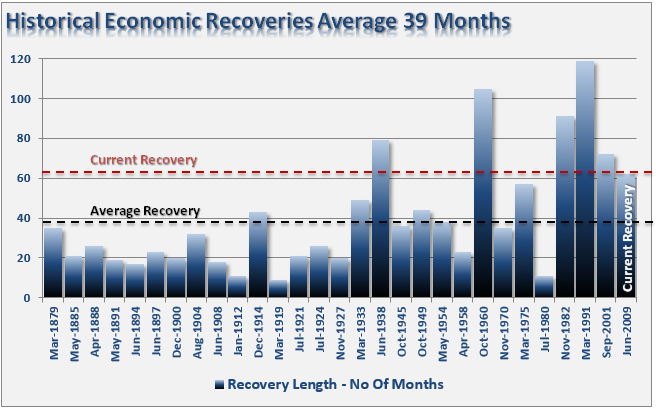

First, the current economic recovery is already the fifth longest on record as shown in the chart below at almost 63 months. If the current expansion did indeed last "at least" another four years; it would make it the second longest expansion in history at 111 months. The only expansion that lasted longer was the period between March of 1991 to March of 2001 which totaled 120 months.

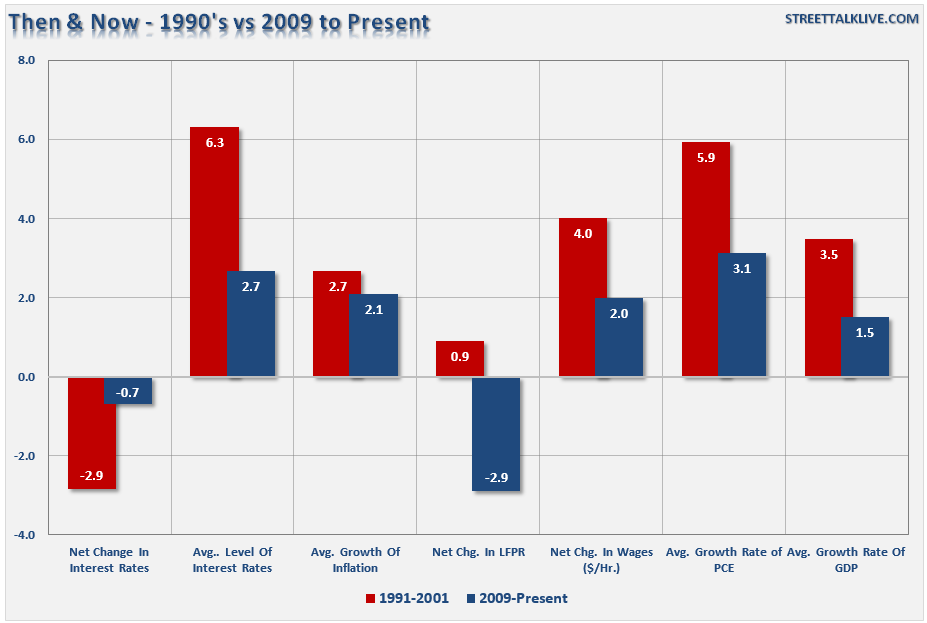

Secondly, the economic environment today is vastly different than it was in the 90's. The chart below shows a comparison between some of the major economic variables of the 90's and today.

One of the major drivers of the economic expansion in the 90's was the decline in interest rates and inflation during that period. During the 90's interest rates fell by almost 3% as compared to just 0.7% currently. However, the yield on lending was also significantly higher and averaged over 6% during that period. The combination of a decline in rates but rates still high enough to generate a reasonable return over inflation made it extremely lucrative for both borrowers and savers. This is not the case currently which is why economic growth has continued to run at sub-par rates.

Moreover, in an economy that is 70% driven by consumption, employment, wages and expenditures are the backbone of a sustained recovery. Since the financial crisis wages have remained weak, real employment elusive and the annual growth rate of PCE has been on the decline. During the 90's the labor force participation rate was increasing versus falling 2.9% over the last five years; wages grew twice as much as today along with the rate of personal consumption expenditures.

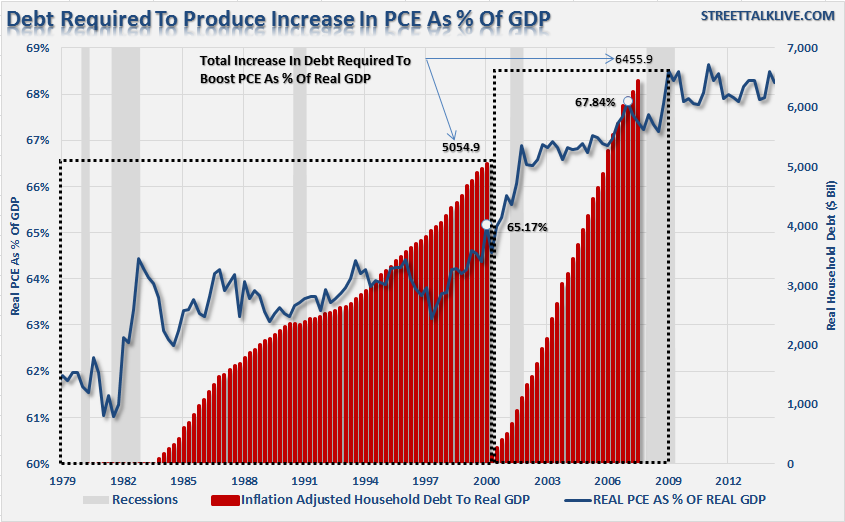

Lastly, the key to all of this, particularly in the 90's, was the ability for consumers to finance their standard of living. As I have discussed many times previously, the ever decreasing rate of interest fostered cheaper financing and higher rates of consumption:

"From 1980 through 2000 total inflation-adjusted household debt grew from $3.8 Trillion to $8.95 Trillion. At the same time, PCE as a percentage of real GDP grew from 62% to 65.17%. In other words, it took $5.054 Trillion in debt to generate 3.17% increase in the PCE/GDP ratio.

However, from 2000 through 2007, the PCE/GDP ratio expanded from 65.17% to 67.84%. This 2.67% increase required an expansion of $6.46 Trillion in debt. Not surprisingly, the diminishing rate of return on debt growth is clearly shown."

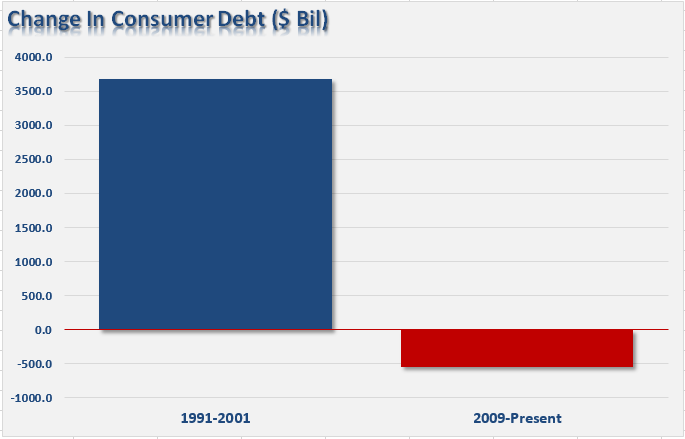

During the 90's consumers increased their debt by almost $3.7 Trillion. That additional purchasing power sustained the economic cycle for much longer than would have been expected. Today, debt has decreased by $548 Billion as consumers, still overleveraged from their spending surge from 2000-2008, continue to struggle to make ends meet in an environment where access to credit remains tight post the financial crisis.

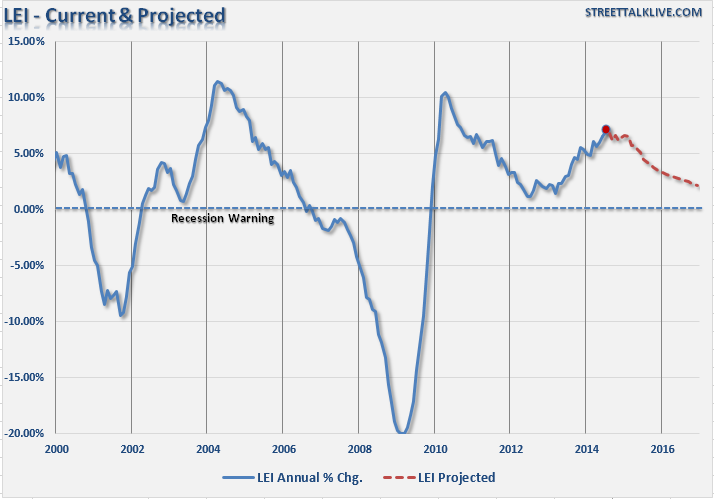

With this background, I can now better address David's point about the Leading Economic Indicators and the prediction for at least four more years of economic growth. The chart below is the LEI index from 2000 to present. The red dot denotes the latest reporting period.

When looking at year-over-year growth rates, it is important to remember that when the current period is being compared to a very weak period in the cycle the index will rise sharply. However, at some point, as where we are currently, the comparative growth rates will equalize, and the index will begin to decline. The dashed red line in the chart below shows what happens when I normalize the current growth rate in the index and project it forward. Even if the LEI grows by 0.5 in every reading through the end of 2014, the index will begin to decline.

From current levels, with the exception of the secular bull market period of the 90's which was fostered by ever declining rates of inflation and interest rates, when the index has begun to decline the length of time to the next recession has not been all that long. It is likely, without the artificial interventions of the Federal Reserve, that the economy would have likely slipped back into a recession in 2012.

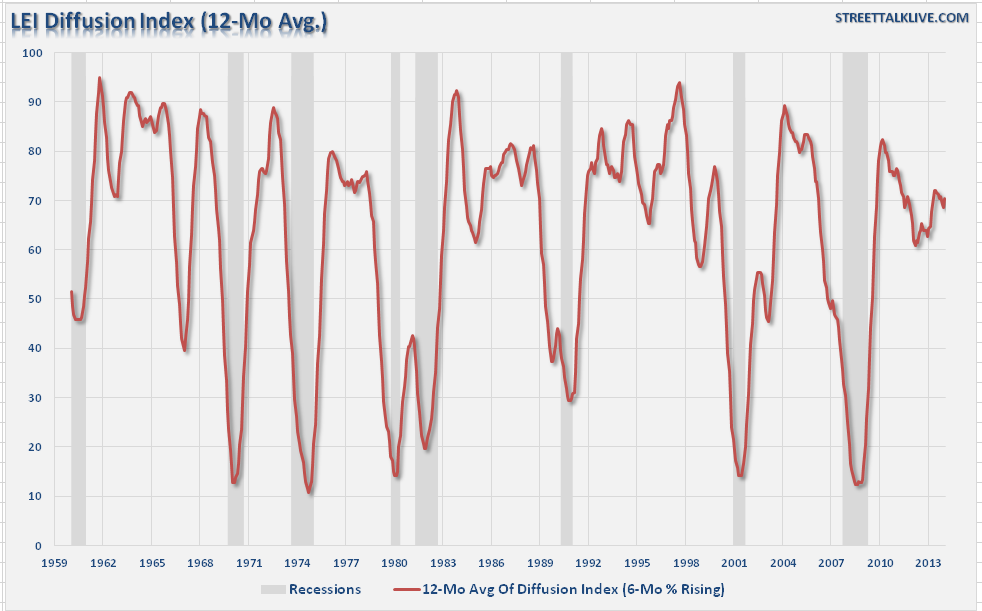

The chart below is the diffusion index as shown by David above smoothed with a 12-month average. By smoothing the data, we can get a little better idea of what it is telling us.

Importantly, what we notice is that the diffusion index is already on the decline which has been historically prevalent 18-24 months prior to the onset of a recession. Even during the go-go economy of the 90's, the smoothed diffusion index peaked in 1998 and the economy entered into a recession roughly 36-months later.

All of this analysis continues to support that the next recession is likely within that 18-24 month window as I addressed in "The Coming Market Meltup And 2016 Recession:"

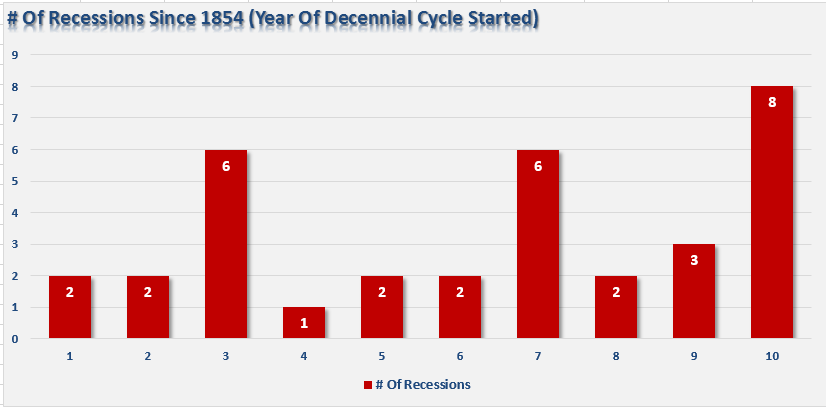

"The statistical data suggests that the next economic recession will likely begin in 2016 with a negative market shock occurring late that year, or in 2017. This would also correspond with the historical precedent of when recessions tend to begin during the decennial cycle. As shown in the chart below the 3rd, 7th and 10th years of the cycle have the highest occurrence of recession starts."

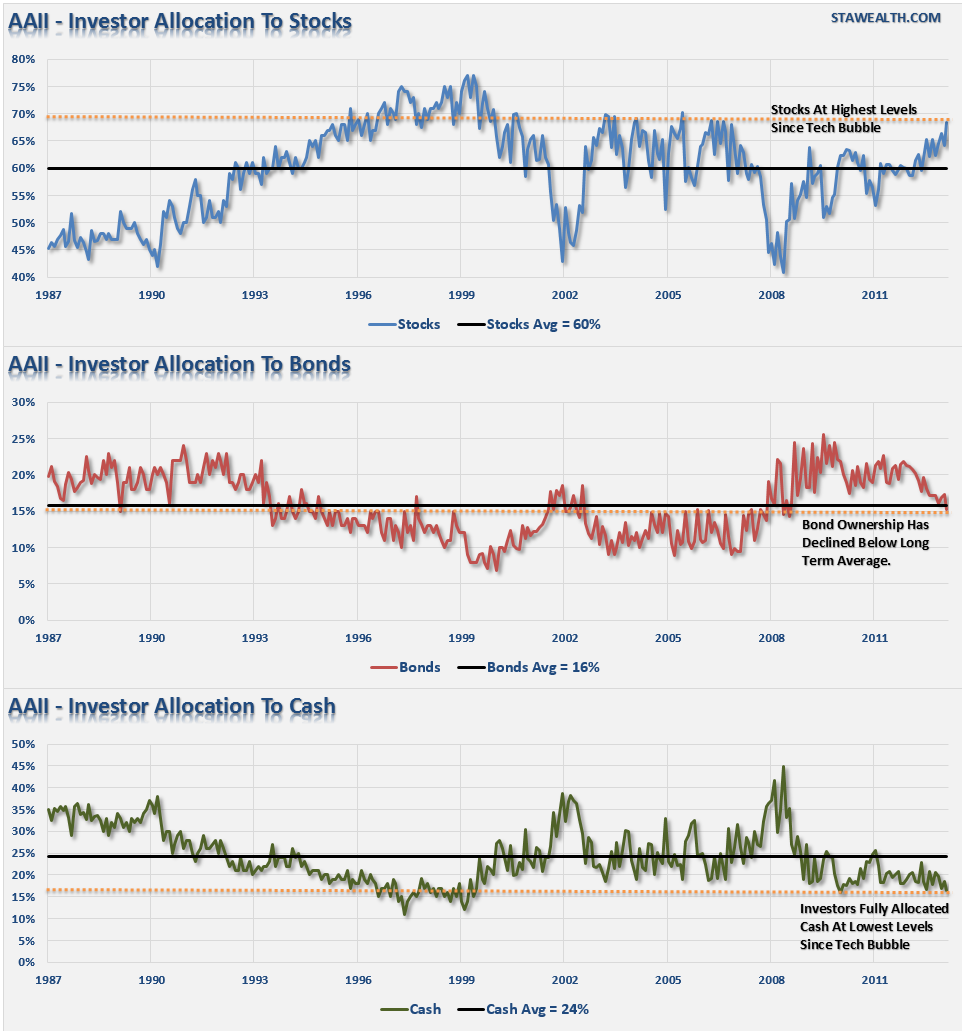

With the Fed's artificial interventions suppressing interest rates and inflation, it is likely that the bullish mania could continue into 2015 as the "herd mentality" is sucked into the bullish vortex. This is already underway as shown recently in "Charts All Market Bulls Should Consider" which showed individuals are once again piling into stocks and depleting cash reserves in the hopes of "getting rich quick."

While anything is certainly possible, it is highly unlikely that the current economic environment is supportive of another four years of a "struggle along" economy. With the Eurozone on the brink of a recession, Japan likely already in one and China heading for trouble; it is highly likely the global deflationary pressures will impact the already weak growth rates of the domestic economy. When considering that 40% of corporate profitability is generated from exports, and the bulk of recent profits per share over the last two years generated primarily by share repurchases, there is little "slack" available to offset a global drag.

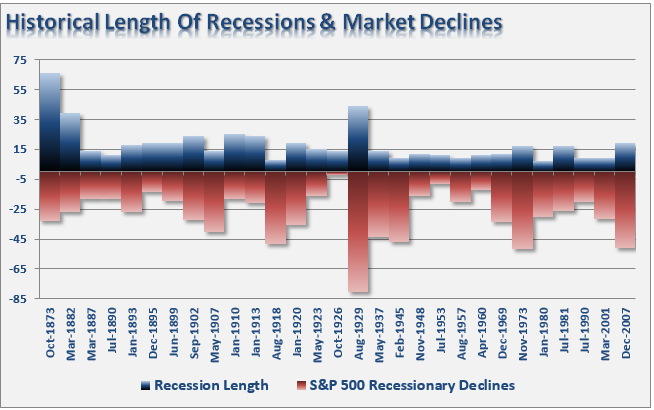

For investors, the most important reason to be aware of the onset of a recessionary spat in the economy is because of the related repricing of assets during these periods. While recessions tend to be fairly short in length, drawdowns have averaged roughly 30%.

Given the artificial supports during recent years, the extreme extension in assets prices, record levels of margin debt and the chase for yield in "junk credits," it is highly possible that the next recessionary decline could be much larger than the historical average.