by Sober Look

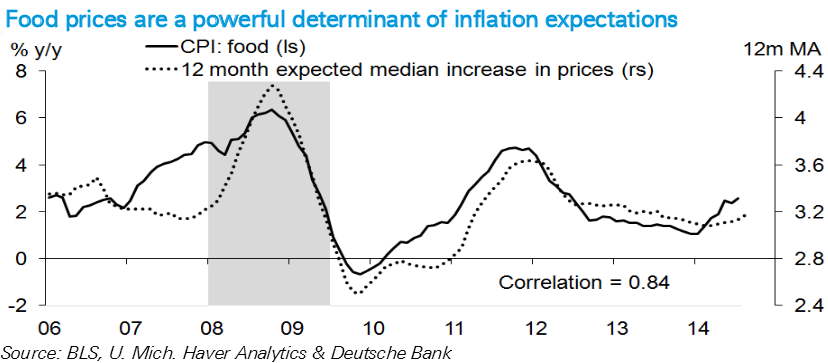

Economists and central bankers tend to be less focused on what consumers pay at the grocery store because food and energy prices have historically been more volatile - remember, it's just "noise". However what they can't ignore is how shoppers view inflation - i.e. inflation expectations. And food prices have a significant impact on households' views on future inflation.

Deutsche Bank: - ... food prices factor significantly into households’ perceptions of overall price pressures. This is illustrated in the following figure, which shows year-ahead inflation expectations from the University of Michigan Survey of Consumer Sentiment versus CPI food. In fact, it is worth noting that CPI food demonstrates a higher degree of correlation with one-year price expectations than either the headline or core metrics — and it similarly surpasses energy, core goods, core services and shelter. ... while forecasters are focusing on service-sector inflation in general and shelter inflation more specifically, they should be careful to not ignore mounting food price pressures, because this category could provide important insight toward the evolution of inflation expectations. If food price inflation accelerates, as we project, the stability of inflation expectations could degrade - and this would be a vexing development for monetary policymakers.

Source: Deutsche Bank

Copyright © Sober Look