by Mawer Investment Management, via The Art of Boring Blog

Two important events involving Russia occurred in the last week. First, Russia amassed a highly suspicious buildup of 20,000 troops on the Ukrainian border. Second, Russia’s yield curve inverted. The reaction to the first event has been international alarm and intense media coverage. The reaction to the second has been crickets. Yet there is significance in both events: each one says the same thing about the mindset of Vladimir Putin.

Let’s start with the buildup of Russian troops on Ukraine’s border, which is a signal easy to understand. Russia claims that it has amassed the troops to support ‘humanitarian’ causes in eastern Ukraine. Of course, no one I’ve encountered believes this explanation to be legitimate, speculating instead that Russian troops are there to support the separatists or advance Russia’s agenda. Thus, the troops imply that Putin will ignore the West and interfere directly in Ukraine’s civil war.

Notably, this is also what Russia’s yield curve implies, although it likely warrants a more thorough explanation. Unfortunately, it is difficult to understand the logic without some understanding of yield curves and what it means for them to invert, so what follows is a short explanation. (Readers with existing understanding of inverted yield curves may want to skip ahead.)

Your Wooly Neighbour: Making Sense of the Yield Curve

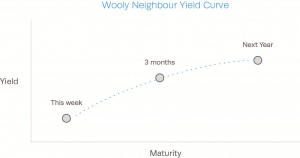

What is a yield curve? Fundamentally, it is just a graph of different interest rates for similar debt across different contract lengths. For a simple graph, it offers a lot of information.

Let’s imagine that you lend money to your wooly neighbour. Since your neighbour is a character who rarely remembers to mow his lawn or pick up his mail, you decide it is best to lend him the money through three different contracts, with payments due at different times in the year, and charge him interest. You also realize that the longer the money is lent to him, the higher the risk of default – so you charge him a higher interest rate for the longer contracts. If these interest rates were then charted in a graph, it would create the Wooly Neighbour Yield Curve. It would chart up and to the right (the typical shape).

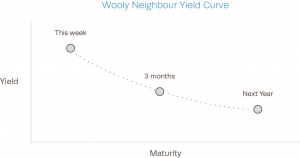

Now imagine that you hear through the grapevine that your neighbour will be arrested tomorrow (and will be released shortly thereafter). When he comes to borrow some money for the week, you give it to him – but at a much higher interest rate, since you are much less sure you’ll be paid back. The Wooly Neighbour Yield Curve would change – instead of a positive slope, it would be inverted (chart up and to the left). This is rare.

While this is an oversimplification, it captures the basic idea behind a yield curve. Yield curves are powerful because they summarize the cumulative viewpoint of lenders for a given borrower – whether that borrower is your wooly neighbour, U.S. municipal governments or Russia. In doing so, yield curves reveal important market perceptions of economic growth, inflation, and borrower creditworthiness. In fact, their simple shape communicates a lot of information: where positive sloping yield curves typically reflect a view of a healthy future economy, inverted yield curves often indicate the perception of a near-term crisis or recession.

Most importantly, the yield curve matters because its shape and level feed back into an economy through the banking system. The yield curve is part of a feedback loop. And it is this feedback loop that matters now for Russia.

Russia’s Dilemma

Russia is now in an economic sore spot. Having thoroughly alienated Europe and the United States by what seems to be support for the Ukrainian separatists, Russia now contends with a slew of trade sanctions that limit economic growth by cutting off the movement of capital and the trade of goods and services. These sanctions and the corresponding investor concern have resulted in an outflow of capital from the country, prompting Russia’s currency, the Ruble, to fall. In reaction to the falling Ruble, the Russian Central bank has increased interest rates with the hope that this will stem the outflow of capital, as higher rates should theoretically increase Russia’s attractiveness to foreign investors. But this is where Russia now finds itself in a bind.

The problem is Russia’s yield curve. In the last year, the Russian Central Bank has raised its key borrowing rates three times to shore up foreign interest and to fight inflation. In total, the key borrowing rate has been lifted 2.5% in less than eight months, which has resulted in the front-end moving higher and the long-end moving lower. Between these moves and investor concern, Russia’s yield curve flattened and is now inverted (with the exception of the very near-term).

Source: Bloomberg

This inverted yield spells trouble for Russian banks. When yield curves invert, they create an unprofitable environment for banks, which profit from the spread between short and long-term rates. When the yield curve is flat or inverted, new loans become less profitable, banks make fewer loans, and the credit engine of the economy is choked off. And credit is essential for economic growth.

This is precisely the situation in which Russia and its banks now find themselves. Sanctions have already placed a burden on the Russian economy; an inverted yield curve makes the whole situation worse. For Russia, this is not good.

The Russian Central Bank is now in a difficult position. On the one hand, the Russian Central Bank wants to stem capital outflow and fight inflation (above 7% this year), which would suggest keeping interest rates at a high level. On the other hand, high interest rates and an inverted yield curve are very likely to choke off the Russian economy, at a time when economic growth is already weak.

Something has to give. Hypothetically, either the Ruble should weaken, the Russian economy should weaken, or both. While it is technically possible that Russia can navigate the crisis without the Ruble falling further or the economy tail spinning, this scenario is unlikely. For starters, it is difficult to see how this could occur without some return of investor confidence. Given the presence of Russian troops on Ukraine’s border, investor confidence may be difficult to come by.

The Putin Mindset

Russia’s economic woes can be traced to one man: Putin. The country’s economic position could be alleviated virtually overnight with the decision to cooperate with the West. Sanctions would be removed, normal trade relationships would resume and foreign capital would gradually return to the country. Yet there is little indication that this is Putin’s intent. Just like the troops amassing on Ukraine’s border, the inverted yield curve is a strong signal of just how bad the Russian economic condition could become – and how much domestic pain Putin appears prepared to tolerate to achieve his goals (whatever these may be).

In the investment industry, it is often said that two countries with significant trade relationships will not go to war against each other. While this argument is deductively seductive, it’s empirically empty. History is full of examples in which economically tied countries warred. Britain and Germany were trade partners up to World War I. The Americans depended on the British before independence. People get divorced. Economic interdependence is an important consideration but not the only factor in the relationship between two countries.

Although we cannot know definitively what is on Putin’s mind, it’s clear that 20,000 troops on the border of Ukraine and an inverted yield curve are not just noise, they are signals.

This post was originally published at Mawer Investment Management