by Don Vialoux, Timing the Market

Pre-opening Comments for Wednesday July

23rd

U.S. equity index futures were higher this morning.

S&P 500 futures were up 3 points in pre-opening trade.

The Canadian Dollar gained US 0.17 cents after release of

Canadian May Retail Sales at 8:30 AM EDT. Consensus was an

increase of 0.5% versus a gain of 1.1% in April. Actual was an

increase of 0.7%.

Second quarter results continue to pour in. Companies

that reported overnight included Apple, Biogen Idec, Boeing,

Broadcom, Delta Airlines, Dow Chemical, Electronic Arts, EMC,

Freeport McMoran Copper & Gold, General Dynamics, Intuitive

Surgical, Juniper Networks, Microsoft, Norfolk Southern,

Northrop, Pepsico, Whirlpool and Xilinx.

Dupont fell $0.46 to $64.49 after JP Morgan downgraded

the stock from Overweight to Neutral. Target is $67.

Intuitive Surgical gained $52.84 to $445.00 after

reporting higher than consensus second quarter results and

after Raymond James and Stifel Nicolaus upgraded the stock.

McDonalds dropped $0.82 to $95.45 after Baird,

Susquehanna and Sterne Agee downgraded the stock.

Microsoft added $0.74 to $45.57 after Pacific Crest and

Bank of America upgraded the stock.

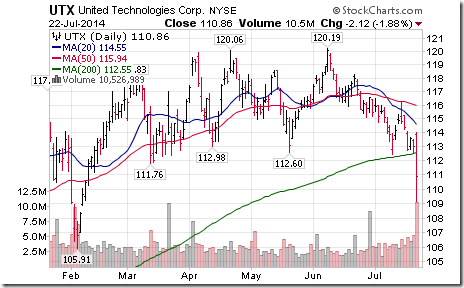

United Technologies fell $0.31 to $110.55 after Wells

Fargo downgraded the stock from Outperform to Market Perform.

Xilinx dropped $0.34 to $41.81 after BMO Capital and

William Blair downgraded the stock.

EquityClock.com’s Daily Market

Comment

Following is a link:

http://www.equityclock.com/2014/07/22/stock-market-outlook-for-july-23-2014/

Interesting Charts

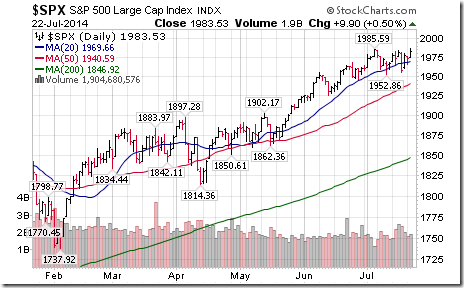

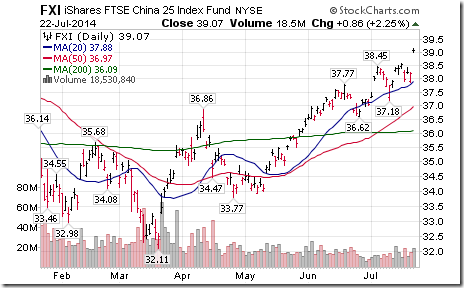

Investment flows are moving from the Euro into the U.S. Dollar.

Investment flows into the U.S. Dollar plus encouraging economic

news from China triggered strength in U.S. and Chinese

equities. The S&P 500 touched an all-time high.

Responses to Second Quarter Reports

Yesterday

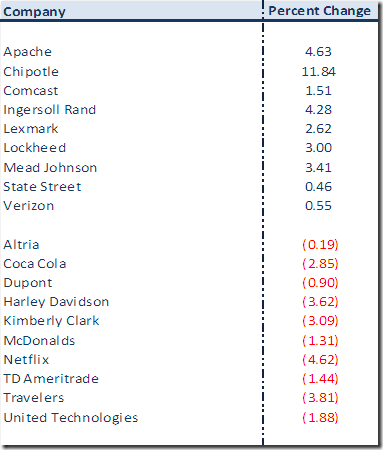

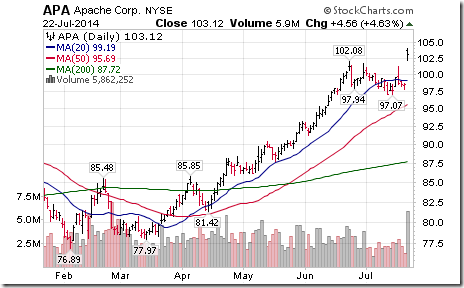

Responses were exceptionally strong in both directions.

Following is a summary of gains/losses recorded by the 19

S&P 500 companies that reported before the open:

Technical Action by Individual

Equities

Technical action by S&P 500 stocks (Break outs and Break

downs) on average was bullish. Twenty one stocks broke

resistance and seven stocks broke support.

Three TSX 60 stocks broke above resistance: Commerce Bank,

Weston and Gildan Activewear.

Special Free Services available

through www.equityclock.com

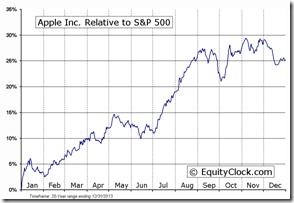

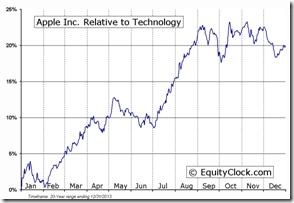

Equityclock.com is offering free access to a data base showing

seasonal studies on individual stocks and sectors. The data

base holds seasonality studies on over 1000 big and moderate

cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Follow is an example:

FP Trading Desk Headline

FP Trading Desk headline reads “Mamma bear market looks

well down the road”. Following is a link:

http://business.financialpost.com/2014/07/22/mamma-bear-market-looks-well-down-the-road-rosenberg/

Disclaimer: Comments, charts and opinions

offered in this report by www.timingthemarket.ca

and www.equityclock.com

are for information only. They should not be

considered as advice to purchase or to sell mentioned

securities. Data offered in this report is believed to be

accurate, but is not guaranteed. Don and Jon Vialoux are

Research Analysts with Horizons ETFs Management (Canada) Inc.

All of the views expressed herein are the personal views of the

authors and are not necessarily the views of Horizons ETFs

Management (Canada) Inc., although any of the recommendations

found herein may be reflected in positions or transactions in

the various client portfolios managed by Horizons ETFs

Management (Canada) Inc.

Individual equities mentioned in StockTwits are not

held personally or in HAC.

Horizons Seasonal Rotation ETF HAC July

23rd 2014

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray