by Sharon Fay, AllianceBernstein

It’s often hard to resist the temptation of an inexpensive, passive equity allocation. But we think you can find plenty of good reasons to go active just by looking around the markets today.

We understand the appeal of passive investing. It offers lower fees and simplicity. And many investors are skeptical about the ability of active managers to consistently beat a benchmark. Often, a passive portfolio can be a good complementary component to an active allocation, especially in large-cap developed markets.

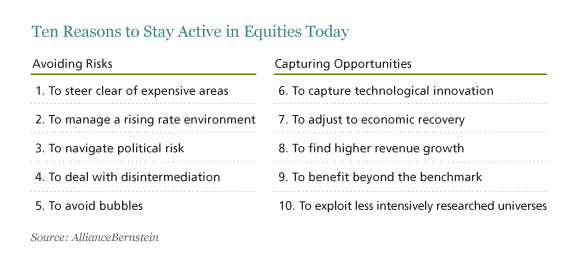

Yet there’s also a lot of evidence supporting the benefits of an active approach. Today, we see many risks that are hard to avoid by hugging a benchmark—and opportunities that simply cannot be captured by going passive. Not every point is relevant to every investor in every market. But we can think of ten good reasons to stay active in equities today.

1. To steer clear of expensive areas—when a stock or sector becomes pricey, a benchmark will still hold it. Even after the decline in high momentum stocks this year, many Internet and biotech names aren’t cheap. An active manager can think twice about owning a stock trading at an exponential multiple to its future earnings—or decide to focus on specific companies where the disruption potential appears to justify the valuation. This applies to sectors too. US utilities trade at about 16.3 times trailing earnings—slightly below the S&P 500. But that’s a high price to pay for a sector that has delivered annualized earnings growth of 0.3% a year over the last five years—well below the broader market’s growth of 9.5%. Yet by buying the S&P 500, you would automatically be stuck with about 6% of your portfolio in utilities.

2. To manage a rising rate environment—what will happen when interest rates rise from current, historical lows? Stocks in some “safer” (income-oriented) industries like tobacco and telecom tend to have a negative sensitivity to rising rates. On the other hand, many stocks that are more cyclically exposed could do well as rising rates signal a healing economy. Active managers can fine tune their exposures accordingly.

3. To navigate political risk—there’s no such thing as an exchange-traded fund that can prepare for—or react to—an unfolding political crisis, whether in Ukraine, the Middle East or Washington. Similarly, in many emerging markets, government meddling in companies and industries poses unique challenges. An active investor can make a measured assessment of when political involvement isn’t worth the risk.

4. To deal with disintermediation—many industries face disruption because of technological change. Remember Blockbuster video or Kodak? Today, countless large, benchmark companies are facing similar threats to traditional businesses, from shoemakers in China to banks around the world. Benchmarks aren’t very good at keeping away from tomorrow’s Blockbuster.

5. To avoid bubbles—this is perhaps the classic passive flaw. In 1980, the US energy sector ballooned to 27% of the S&P 500. In 1999, the technology sector accounted for 29% of the index. Both sectors collapsed in the subsequent two years. Japanese stocks reached 44% of the MSCI World Index in 1988—more than five times more than today and a bigger weight than the US at the time. Active investors should always be on the lookout for the next market bubble—and you never know where one might pop up. For example, REITs now comprise almost 9% of the US small-cap index—toward the high end of its 10-year history.

6. To capture technological innovation—benchmarks look backwards, by definition. So they are unlikely to help you benefit from the cutting-edge companies of tomorrow that will post rapid growth with new technologies.

7. To adjust to economic recovery—every country is at a different stage of its economic cycle. In a global portfolio, a selective procyclical tilt can help focus on those companies that are best positioned to benefit from regional variations of recovery. And in a single-country or regional portfolio, an active manager can shift toward companies that appear to be in the right place at the right time of an economic rebound.

8. To find higher revenue growth—in an era where it’s becoming harder to expand profit margins, companies that can increase revenue may have an advantage. An index isn’t really able to point your portfolio toward high revenue growers that have a better chance of posting stronger earnings in a tough environment.

9. To benefit beyond the benchmark—there’s always something exciting going on just out of the benchmark. When emerging markets underperformed in a recent quarter, frontier markets—that aren’t included in typical EM indexes—held up much better. What about surging M&A activity in the pharmaceutical industry? An active US portfolio might find a way to buy a British or Swiss drugmaker that isn’t in its benchmark but could benefit from the trend.

10. To exploit less intensively researched universes—small- and mid-cap stocks are fertile ground for active managers, because these companies tend to get much less coverage by analysts. We’ve built a “mind share index” to measure the intensity of research based on the frequency that analysts publish and adjust estimates. Based on this measure, we found that large-cap companies get more than three times more attention than small-cap companies. The same concept can be applied to emerging markets. The return and diversification potential from companies in frontier markets can’t be obtained in a typical emerging markets benchmark. And frontier market indices are even more prone to the vulnerabilities of benchmarks in general, as they tend to be heavily weighted toward a few countries.

This blog was originally published on InstitutionalInvestor.com.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Sharon Fay is Head of Equities at AllianceBernstein (NYSE:AB).