by Don Vialoux, Timing the Market

Interesting Charts

More signs that upside momentum in equity indices has stalled:

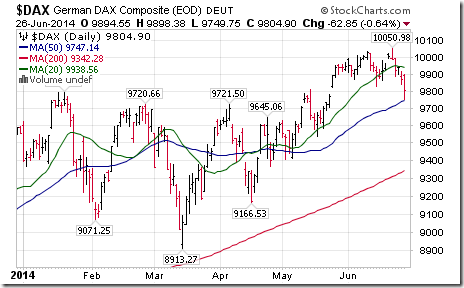

· European equity indices and related ETFs remain under pressure. The Frankfurt DAX is down 2.5% and the Paris CAC has lost 3.7% since highs reached last week.

· Percent of S&P 500 stocks trading above their 50 day moving average dropped from 88.60% last week to 79.60% yesterday.

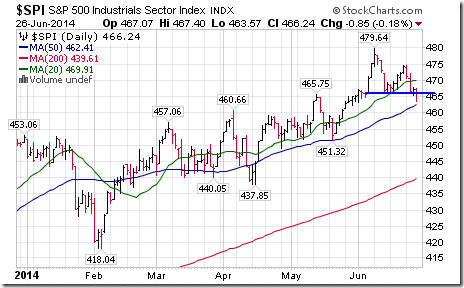

· Yesterday, the S&P Industrial Sector Index broke below support and its 20 day moving average to establish an intermediate downtrend.

CSTA News

The Canadian Society of Technical Analysts will hold its annual meeting starting at 11:00 AM EDT on Wednesday, July 16th. Location is the Sheraton Centre (123 Queen Street West in Toronto. Speaker is Ray Hansen, former Technical Analyst at RBC Capital. His topic is “The Secret Life of Spreadsheets. Lunch is served. Everyone is welcome. Register at www.csta.org

Weekly Select Sector SPDR Review

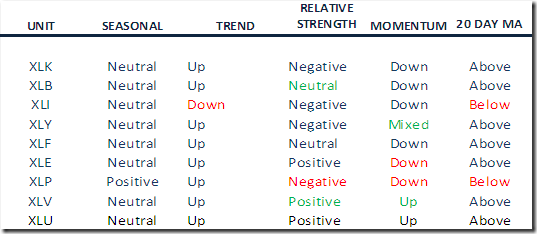

Technology

· Intermediate trend remains up (Score: 1.0)

· Units remain above their 20 day moving average (Score: 1.0)

· Strength relative to the S&P 500 Index remains negative (Score: 1.0)

· Technical score based on the above indicators remains at 2.0 out of 3.0

· Short term momentum indicators are trending down.

Materials

· Intermediate trend remains up.

· Units remain above their 20 day moving average

· Strength relative to the S&P 500 Index changed from negative to neutral

· Technical score improved to 2.5 from 2.0 out of 3.0

· Short term momentum indicators are trending down.

Industrials

· Intermediate trend changed from up to down on a move below $53.96

· Units fell below their 20 day moving average

· Strength relative to the S&P 500 Index remains negative

· Technical score fell to 0.0 from 2.0 out of 3.0

· Short term momentum indicators are trending down.

Consumer Discretionary

· Intermediate trend remains up

· Units remain above their 20 day moving average

· Strength relative to the S&P 500 Index changed from negative to neutral

· Technical score improved to 2.5 from 2.0 out of 3.0.

· Short term momentum indicators turned from down to mixed

Financials

· Intermediate trend remains up.

· Units remain above their 20 day moving average

· Strength relative to the S&P 500 Index remains neutral

· Technical score remains at 2.5 out of 3.0

· Short term momentum indicators are trending down.

Energy

· Intermediate trend remains up

· Units remain above their 20 day moving average

· Strength relative to the S&P 500 Index remains positive

· Technical score remains at 3.0 out of 3.0

· Short term momentum indicators are trending down.

Consumer Staples

· Intermediate trend remains up

· Units fell below their 20 day moving average

· Strength relative to the S&P 500 Index changed from neutral to negative

· Technical score fell to 1.0 from 2.5 out of 3.0

· Short term momentum indicators changed from mixed to down.

Health Care

· Intermediate trend remains up

· Units remain above their 20 day moving average

· Strength relative to the S&P 500 Index changed from negative to positive

· Technical score improved to 3.0 from 2.0 out of 3.0.

· Short term momentum indicators changed from down to up

Utilities

· Intermediate trend remains up

· Units remain above their 20 day moving average

· Strength relative to the S&P 500 Index remains positive

· Technical score remains at 3.0 out of 3.0

· Short term momentum indicators are trending up, but are overbought.

Summary of Weekly Seasonal/Technical Parameters for SPDRs

Key:

Seasonal: Positive, Negative or Neutral on a relative basis applying EquityClock.com charts

Trend: Up, Down or Neutral

Strength relative to the S&P 500 Index: Positive, Negative or Neutral

Momentum based on an average of Stochastics, RSI and MACD: Up, Down or Mixed

Twenty Day Moving Average: Above, Below

Green: Upgrade from last week

Red: Downgrade from last week

Technical Action Yesterday by Individual Equities

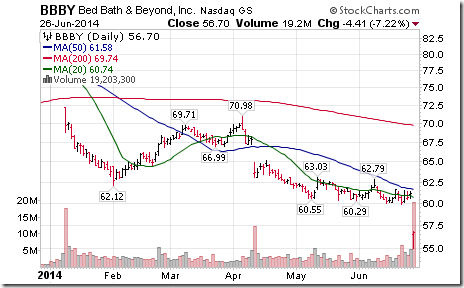

Technical action by S&P 500 stocks was quiet. Three stocks broke resistance (IRM, LEN, TE) and three stocks broke support (BBBY, SPLS, MKC).

Two TSX 60 stocks broke support, George Weston and Commerce Bank

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

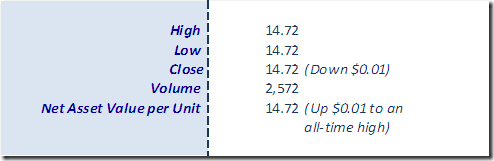

Horizons Seasonal Rotation ETF HAC June 26th 2014

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray