Given that U.S. stocks are no longer cheap and most stock market bargains are now found overseas, Russ believes that U.S. investors should look abroad for equity opportunities.

Broadly speaking, U.S. investors tend to prefer the comfort of home. In this sense, they are no different than investors in other countries, i.e. most investors have what is known as a “home country bias.” However, given that U.S. stocks are no longer cheap and less expensive alternatives can still be found overseas, it may be time for U.S. investors to look abroad for equity opportunities.

As I write in my new weekly commentary, last week U.S. stocks reached new highs and volatility hit its lowest level since before the recession, as an accommodative Federal Reserve (Fed) and a steady stream of mergers and acquisitions trumped escalating violence in Iraq. For the time being, the fighting in Iraq doesn’t appear to be threating the major oil fields in southern Iraq, which are responsible for most of the country’s oil exports, giving investors a reason to shrug off headlines out of the region.

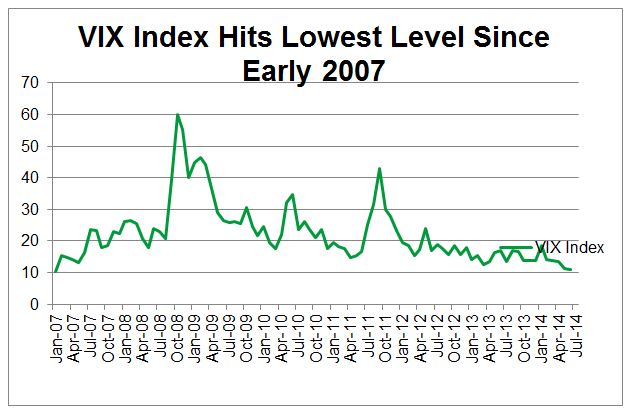

Based on price-to-book metrics, U.S. equities are now trading at their most expensive level since late 2007, while equity market volatility as measured by the VIX is at its lowest level since early 2007, as the chart below shows.

Source: Bloomberg as of 6/19/14

While stocks still appear more attractive than bonds and cash, investors should be cognizant that U.S. equities are no longer cheap and, as the low volatility environment indicates, discounting little in the way of bad news. This means that U.S. equities may be particularly vulnerable to an exogenous shock, such as a deterioration of events in Iraq.

The upshot for investors: I suggest focusing new allocations on select international markets where valuations are less challenging. In particular, I like international developed equities in Japan and Europe as well as stocks in certain emerging markets.

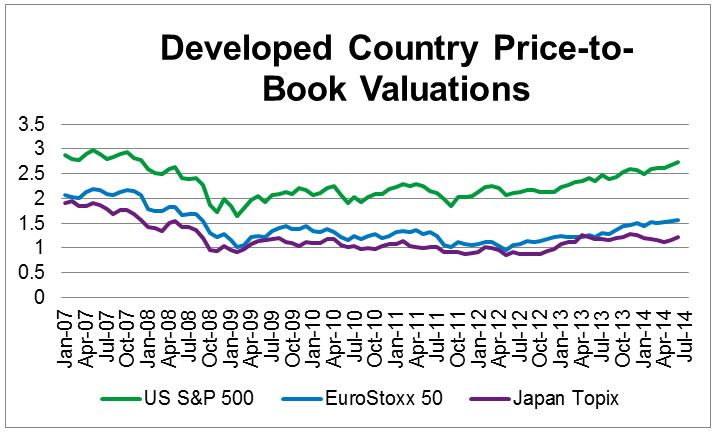

Japanese equity valuations, for instance, are currently among the lowest in the developed world despite Japanese stocks’ recent advance. And as the chart below shows, Japanese and European stock valuations are both well below U.S. stock valuations on a price-to-book basis.

Source: Bloomberg as of 6/19/14

At the same time, there are a number of other factors supporting the case for Japanese stocks, including signs that key structural reform initiatives could regain momentum this summer. The government’s proposed growth initiatives due later this summer include a proposed cut in corporate taxes as well as several proposals to improve corporate governance. Meanwhile, recent market-friendly actions by the European Central Bank could help European stocks over the next few months.

You can read more about the specific international markets I like in my latest Investment Directions commentary.

Sources: BlackRock, Bloomberg

Russ Koesterich, CFA, is the Chief Investment Strategist for BlackRock and iShares Chief Global Investment Strategist. He is a regular contributor to The Blog and you can find more of his posts here.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/ developing markets or in concentrations of single countries.

Copyright © Blackrock