by Cam Hui, Humble Student of the Markets

My vote this week on Ticker Sense blogger poll was bullish and that vote was based on the results of my Trend Model. However, I described myself in my LinkedIn profile as a "left and right brained modeler of quantitative investment systems". In other words, I try to use intuition and experience to interpret my quantitative models. On occasion, they will fail because they are operating beyond the limitations of what they were designed to do.

This may be one of those occasions. My Trend Model is a trend-following model that uses global stock and commodity prices to forecast risk-on and risk-off conditions. Trend following models are, by their very nature, a little slow to pick up trends, but they profit from the bandwagon effect when an investment trend is persistent.

In this case, the markets are overbought and at risk of a reversal - and such whipsaws are serious limitations of trend following models.

Punch above weekly Bollinger Band

Consider, for example, Springheel Jack`s comments about the SPX`s punch above the weekly Bollinger Band on Friday (emphasis added):

At the close on Friday there was a clear punch over the weekly upper bollinger band. These are rare, and even rarer when the weekly RSI 14 is over 70, and this is only the tenth such punch in the last twenty years. I've had a look at the previous nine to see what they can tell us about what to expect next.

My first observation would be that only three of those were at a short term high, though another five topped out within 2% of the punch level, before making a retracement that went at least back below the punch level and ranged in size from 3% to 21%. The exception was in June 1997 which went into an eight day upper band ride that ran up 80 points before retracing 70 points. This is a fairly bearish history, with one strong exception.

Too much bullishness

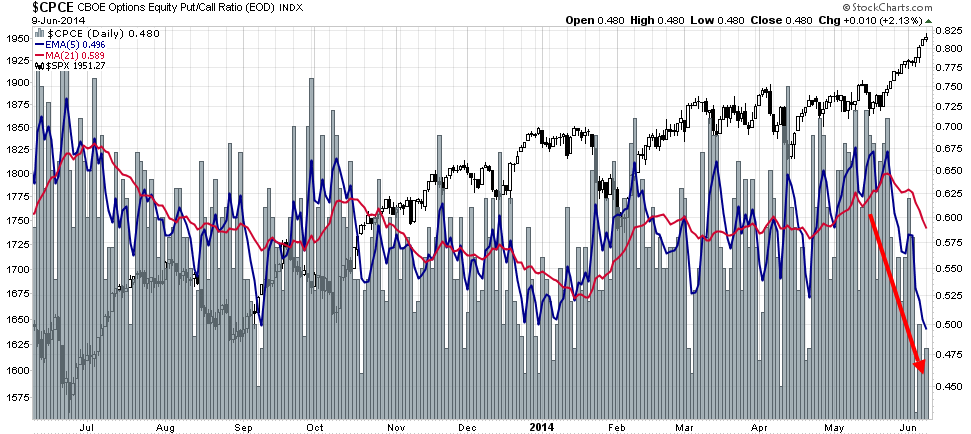

Option sentiment indicators are also signaling excessive bullishness. The equity only put-call ratio is at extremely low levels, as is the 5 day EMA (blue line).

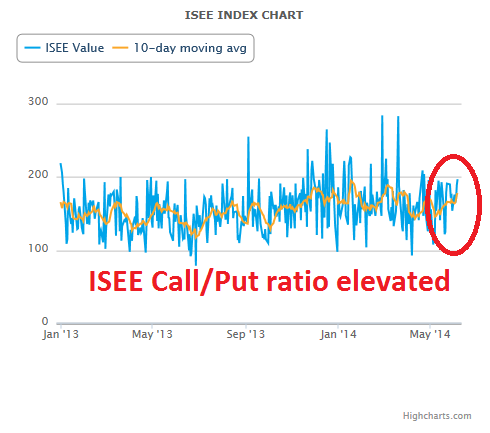

As well, the ISEE equity only call-put ratio is at an elevated reading. These are both contrarian bullish trading signals.

A bull turns cautious

Even Ed Yardeni, who has been bullish on stocks, has turned cautious as the major US equity averages move to new all-time highs:

Any way we slice and dice it, stocks aren’t cheap. At best, they are fairly valued. Of course, the bears say that they are grossly overvalued because they are expecting a recession. In their opinion, the problem is that earnings are at a record high and so are profit margins. So these two are increasingly likely to go down rather than up.

According to the bears, P/Es based on forward earnings are underestimating the overvaluation problem because they are based on analysts’ consensus expectations for earnings that are too optimistic. That’s true if a recession is coming soon. I don’t see one coming soon, so I don’t have a problem using forward P/Es for assessing valuation. Nevertheless, there is a valuation problem, though it isn’t as extreme as the bears say it is.

The combination of these conditions suggest that equity prices are poised to either pause or pull back in the next week or two. In my last post (see How stocks are both cheap AND expensive), I wrote that I would be cautious on equities in the long-term (10 years) and bullish in the intermediate term (next few months). Now I would add that I am cautious on equities for the next week or two.

Bullish or bearish? It depends on your time horizon.

Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. (“Qwest”). The opinions and any recommendations expressed in the blog are those of the author and do not reflect the opinions and recommendations of Qwest. Qwest reviews Mr. Hui’s blog to ensure it is connected with Mr. Hui’s obligation to deal fairly, honestly and in good faith with the blog’s readers.”

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this blog constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or I may hold or control long or short positions in the securities or instruments mentioned.

Copyright © Humble Student of the Markets