by Don Vialoux, Timing the Market

Interesting Charts

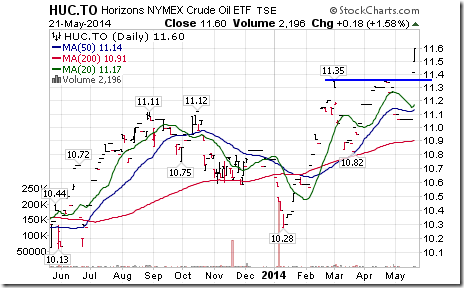

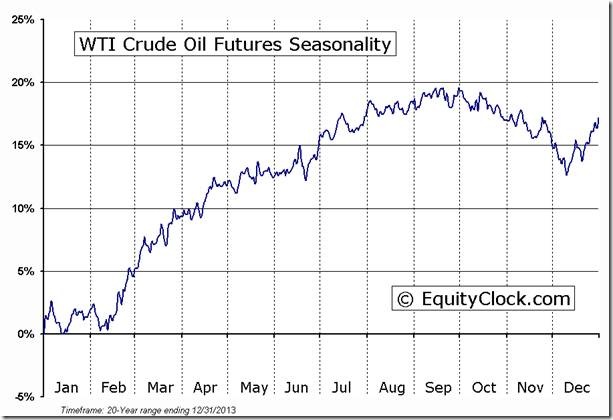

‘Tis the season for crude oil prices to move higher!

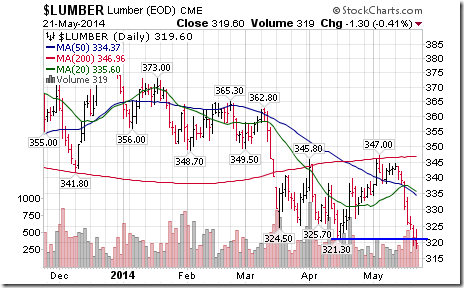

‘Tis the season for lumber prices to move lower! Lower lumber prices also warn about the trend for growth in the North American home building sector.

Technical Action by Individual Equities Yesterday

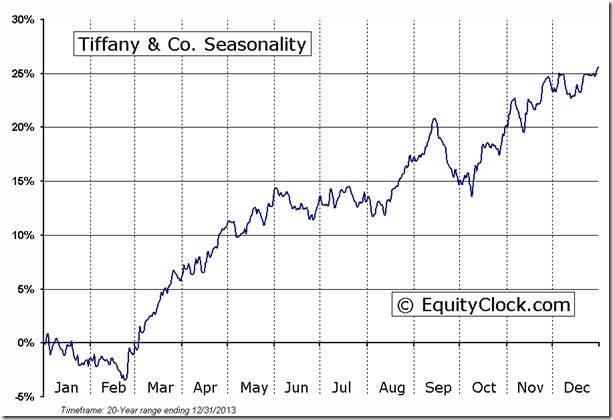

Despite the “mirror image” recovery by U.S. equity indices yesterday relative to their move on Tuesday, technical action by S&P 500 stocks was eerily quiet. Four S&P 500 stocks broke resistance (AutoNation, Tiffany, Aon, Kansas City Southern) and four stocks broke support (Bed Bath & Beyond, Dollar Tree, Family Dollar Stores, Frontier Communications)

No TSX 60 stocks broke significant support or resistance.

FP Trading Desk Headlines

FP Trading Desk headline reads, “Uranium supply cuts needed as spot price continues to tumble”. Following is a link:

FP Trading Desk headline reads, “What’s driving 10 year Treasury yields lower”. Following is a link:

http://business.financialpost.com/2014/05/21/whats-driving-10-year-treasury-yields-lower/

Weekly ETF Column published by GlobeInvestors.com

(Authored by Don and Jon Vialoux)

Headline reads,”Memorial Day can mean opportunities for Canadian investors”. Following is a link:

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Adrienne Toghraie’s “Trader’s Coach” Column

|

No Answer Will Do

By Adrienne Toghraie, Trader’s Success Coach

How many times do you ask questions of yourself or others when you already know the answers? News people and politicians are experts at doing this. And very often if the one who is being asked the question takes the expected answer or a different answer, the answer will be debated and argued. The reasons behind this exchange are:

· They want to be seen as representing the reader or constituent

· They want to make the other person look bad so that they look good

· They want to have ammunition to build up a case against the other person

People also ask questions of themselves when they already know the answers. Traders can wind up in a mental loop of self-sabotage when the solutions to these questions are not addressed. Here are some typical questions:

· Why can’t I make any money?

· Why aren’t my rules working?

· What do I have to do to make money?

· Why are others making money using the same strategy?

· Why do I break the same rules all of the time?

So why does a trader stay in this mental loop of avoiding the answers to the questions or answering the questions, but not doing anything to make changes so that they stop this loop?

· It means he has to do work

· It means that he is wrong

· It means he cannot solve his own issues

· It means that he has to face the fact that he or his strategy must change

· It means that he will have to give time, money and energy to fix these issues

Bryan knew the right questions and knew the right answers

Bryan has been a trader for over twenty years. He has been very consistent in staying at the same level of income, which most traders would envy. For Bryan it was not enough. The questions he was asking were:

· Why can’t I grow my profits and ability to the next level?

· What is between me and my next level of success?

When Bryan filled out my Trader’s Evaluation, it was accompanied with a letter that basically gave all the answers to his issues. I said to Bryan that he would only be able to reach the next step in trading and beyond that if he was willing to overcome the conflict within himself. Rather than asking me, “What conflict?,” Bryan spelled out both the conflict and solution. I told him that he was good at being right and that is what he would continue to get as a reward for the rest of his trading career. What he would not get is becoming the better trader that he said he wanted to be.

Several phone calls and emails later Bryan decided to take my Top Performance Seminar. What he reported during the first break was that, he did not realize that he was already an exceptional trader. He found it a great lesson to listen to the sabotage issues of the other participants and realize that even though he was at a higher level than most of the traders in the room, he had some of the same issues that they described.

Bryan now answers his questions with action towards goals for his trading and life. He has reached a higher level of consistency and is enjoying the process of working on his next best level of performance.

Conclusion

If you are not at the level of success you deserve or want, notice if you are asking questions and not following through on the actions that you know you should take. If you have not been able to complete tasks on your own, get help or you will remain at the same level and continue to be in a mental loop about being right.

Free Newsletter

More Articles by Adrienne Toghraie, Trader’s Success Coach

Sign Up at – www.TradingOnTarget.com

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Investment Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Investment Management (Canada) Inc.

Twitter comments (Tweets) are not offered on individual equities held personally or in HAC.

Horizons Seasonal Rotation ETF HAC May 21st 2014

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray