Gold Market Radar (May 20, 2014)

For the week, spot gold closed at $1,293.46, up $4.67 per ounce, or 0.36 percent. Gold stocks, as measured by the NYSE Arca Gold Miners Index, declined 1.30 percent. The U.S. Trade-Weighted Dollar Index rose 0.19 percent for the week.

Strengths

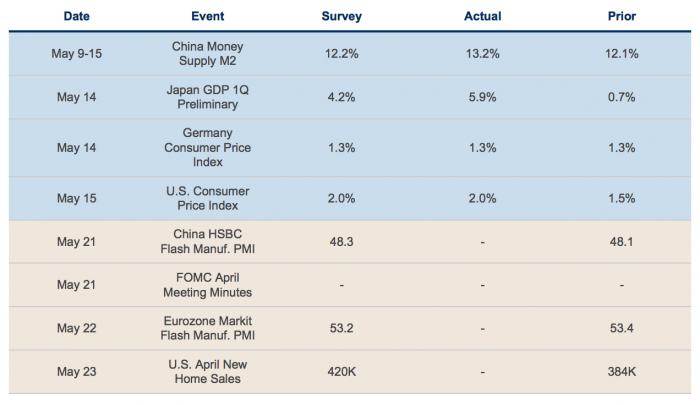

- U.S. inflation has undoubtedly picked up, and is likely to rise toward the Federal Reserve’s target. A number of important inflation readings outpaced the official U.S. Consumer Price Index (CPI) this week: (1) services inflation rose 2.5 percent; (2) food prices have risen more than 10 percent year to date; and (3) core import prices are rising, thus abating the deflationary impact they had over the past two years. In addition, Treasury Inflation-Protected Securities (TIPS) have been rising since the beginning of the year, and really spiked this month, in anticipation of higher inflation. This recent move lower in real yields has not yet been transmitted into higher gold prices.

- Palladium climbed to the highest price since August 2011, and 15 percent year to date, as concerns mounts over supply restrictions in South Africa. Meanwhile, the Russian government has moved to purchase palladium from local producers, with markets speculating the country’s Gokhran palladium stockpiles are near exhaustion. On a similar note, platinum demand is expected to increase 35 percent this year in India alone as local jewelers seek to replace the volumes lost when gold import curbs took effect.

- Balmoral Resources announced drill results at the Bug Lake footwall at its Martiniere property in Quebec, with intercepts as high as 1,138 grams per tonne over five meters. The stock surged over 20 percent intraday as there remains significant expansion potential at Martiniere. Similarly, Rio Alto Mining reported assay results at La Arena showing the size and life of the oxide resource around the Calaorco Pit is likely to increase, thus allowing the company to pursue the proposed Phase II expansion of its flagship project.

Weaknesses

- Chinese gold and silver jewelry sales fell 30 percent in April, according to the National Bureau of Statistics. However, as Macquarie analysts pointed out, the year-over-year comparison is misleading due to the fact that April 2013 was an exceptional month for gold jewelry sales as gold prices dropped over $100 per ounce.

- Ivanhoe Mines, which holds controlling interests in the Platreef platinum deposit in South Africa and the Kamoa copper and Kipushi zinc mines in the Democratic Republic of Congo, dropped 16 percent on Thursday after it announced it will require further funding by the end of June to continue with its development plans. Despite the known potential and attractiveness of these three projects, the sources of financing are uncertain at a time when investors have been reluctant to fund exploration and development projects.

- South African’s National Union of Mineworkers (NUM) announced that two of its members were killed as they reported to work at Lonmin’s platinum mine. The attack occurred as Lonmin sidestepped the AMCU union and made an offer to miners directly in a bid to end a four-month long platinum workers strike. Lonmin’s employees unaffiliated with the AMCU have been reportedly subject to intimidation and assaults.

Opportunities

- A Bloomberg report shows China is on pace to import two-thirds of non-Chinese mined gold production as demand rises 31 percent. China is expected to import more than 1.45 million kilograms this year, while gold supply is not expected to change materially in 2014 from 2.3 million kilograms in 2013. Going forward, China’s dependence on foreign gold is likely to increase given that gold reserves in China are made up of small- to medium-sized deposits of low-grade ore.

- Barclays’ North America precious metals analysts are optimistic on the gold space following the earnings’ wrap-up this week. According to Barclays, the large number of earnings’ beats, together with reiterated or raised guidance, show that the pendulum “swung too far.” In general terms, there was broad outperformance industry-wide in the first quarter, possibly marking the beginning of a new cycle of rising expectations. Companies like Agnico Eagle Mines, Mandalay Resources, and OceanaGold showed the investing community that there is plenty of value in gold stocks, even after the drop in gold prices.

- Australia’s Northern Star Resources is poised to become the second largest miner in the country following the recent acquisition of Newmont’s Jundee mine. The acquisition is expected to bring Northern Star’s production up from 350,000 ounces to 550,000 ounces. For a total consideration of $91 million, Northern Star will retain all of Newmont’s existing staff and equipment, thus allowing the company to increase its free cash flow immediately. The company also expects to increase the asset’s resources through an exploration program around the mine.

Threats

- BofAML is of the opinion that the Chinese government’s focus on quality over quantity of growth is likely to result in short- and medium-term weakness by allowing selective defaults. Next week’s China HSBC Flash Manufacturing PMI will be an important indicator for gold. The PMI’s three-month average is sitting at 48.2, while analysts’ expectations call for a 48.3 reading. Any reading above this is likely to be perceived as contributing to the stabilization of the Chinese economy and should be bullish for gold as it indicates expectations of rising future incomes.

- ISI’s Weekly Economic Report suggests that its Diffusion Index of company surveys, which has been used as a leading indicator, has peaked in a way that resembles the “Sell in May’ peaks of the previous three years. As such, the Fed minutes for the April Federal Open Market Committee (FOMC) meeting to be released next Wednesday are likely to be the next catalyst for stocks and gold. Further to that, Friday’s new home sales report is of special importance given the sharp decline seen in March, which analysts are forecasting to be corrected by the April reading.

- India has announced it raised its benchmark import price for a number of commodities in an effort to stave off the appreciation of the Indian Rupee following the primary elections. The price benchmarks for gold and silver will be raised, which will result in small hikes to import tax bills.