by Don Vialoux, Timing the Market

Brooke Thackray on BNN’s Market Call Tonight

Following are links to last night’s appearance:

http://www.bnn.ca/Video/player.aspx?vid=359279

http://www.bnn.ca/Video/player.aspx?vid=364278

Interesting Charts

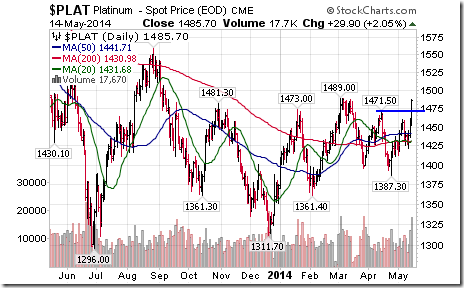

Platinum and Palladium moved higher yesterday on news that violence during a strike at South African mines has escalated. Metal inventories accumulated prior to the strike have been depleted and shortages loom unless the strike is settled soon. Nice breakout by Platinum! Palladium closed at a three year high. Seasonal influences for both metals are positive until the end of May.

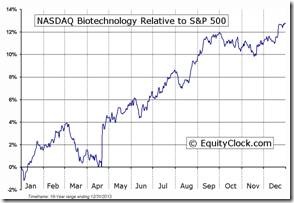

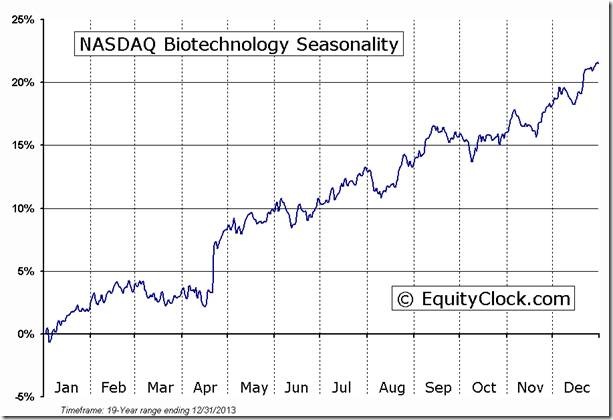

The biotech sector was notable for its strength yesterday. The sector has a brief, but profitable seasonal trade between mid-April and the first week in June. Strength is related to anticipation of research news to be released at the annual American Society of Clinical Oncologists (ASCO) conference held each year in Chicago. This year the conference is held between May 30th and June 3rd. Many biotech companies are scheduled to present results from their cancer research at the conference. Larger companies including Bristol Myers and Merck also are scheduled to present. The NASDAQ Biotech ETF is developing a potential bottoming pattern. Units recently moved above their 20 day moving average, have started to outperform the S&P 500 Index and their momentum indicators are trending up. A move above $235.84 will establish an uptrend. Interesting seasonal trade until the first week in June, but not for the “faint of heart”!

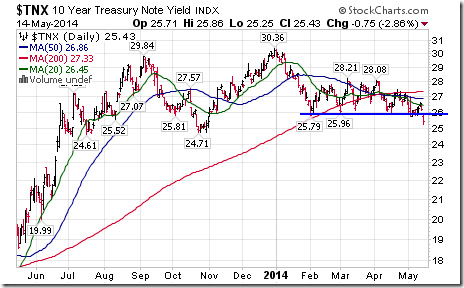

The drop in yield for long term Treasuries and corresponding strength in Treasury prices raise questions about strength in the U.S. economy following the weather-related recovery in the first quarter. A clearer picture is revealed today when reports such as the May Empire State Manufacturing Index and the May Philadelphia Fed Manufacturing Index are released. Unless these indicators show additional strength relative to strong data released in April, U.S. equity markets will come under pressure. Failure by the S&P 500 Index and Dow Jones Industrial Average to follow through on the upside after reaching all-time highs on Monday is a technical warning sign.

Horizons Simulated Trading Competition Using ETFs

Horizons launches its simulated trading competition using ETFs on May 20th. Everyone is welcome. Cost to participants is zero. Should be fun! Cash prize is $13,000. Following is a link giving more details and a connection to register:

http://thebiggestwinner.stocktrak.com/home.aspx

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

NASDAQ Biotechnology Seasonal Chart

^NBI Relative to the S&P 500 |

FP Trading Desk Headline

FP Trading Desk headline reads, “Get ready to buy emerging market stocks”. Following is a link:

http://business.financialpost.com/2014/05/14/get-ready-to-buy-emerging-market-stocks/

Adrienne Toghraie’s “Trader’s Coach” Column

|

The Trader Blahs

By Adrienne Toghraie, Trader’s Success Coach

Are you experiencing the trader blahs? If so, you have a lot of company. In the process of becoming a trader there may be times when you feel the trader blahs. During those times, you may have a difficult time feeling any positive thoughts and feelings and may find it impossible to break into a smile about anything. Life may seem dark and fearsome and full of uncertainty.

“So, how’re you doing?” I asked a trader at a conference who I had not seen in a long time. “I’ve got a really bad case of the blahs,” he replied and proceeded to list all of the things that were going wrong in his life, in trading, and in the world in general. He made a very good case for feeling hopeless, helpless, and ready to throw in the towel. To his surprise, I congratulated him. “You’re right!” I said. “There’s no reason to go on. I would pack it up, go to bed, put the covers over my head and say goodbye cruel world.”

The contrarian/resister

Our trader had built the perfect case for feeling down. What I wanted to do was to shock him out of his emotional lethargy. He really did want help in moving out of his downward cycle; but, if I had attempted to talk him out of his position, he would have been forced to prove I was wrong and he was right. He would have argued with me until he was adding even more evidence to his case. Nothing would have changed except he would have been even more wedded to the blahs.

The minute I agreed with him, however, he found himself telling me that things actually were not as bad as he had painted them to be. Soon, he was building a case for a positive outcome by listing all of the things that were going right, despite the fact that there were things going wrong in other areas. By the time he was finished showing me that I was wrong, he left our conversation smiling.

The very same strategy for helping someone out of the blahs that I used for the trader at the conference does not work for everyone. I know because I used it on another trader in the depths of depression who became very angry with me and accused me of not caring about him. “Here I am, asking you for some support and help and you’re just making me feel even worse.” He stomped off, and had a new target – “me” and not himself. I should

have seen that reaction coming. He was more interested in making me the culprit than in pulling out of the blahs. In fact, making me responsible for his feelings actually made him feel better, although he would never admit it.

The proactive trader

And then there was a third trader who was also feeling the blahs, and for good reason. He had just lost his well-paying fulltime day job in the IT world, which meant that he was now dependent upon his trading to support his family. Unfortunately, he was not ready to make the leap into full-time trading either financially or emotionally.

The difference between this third trader and the first two is the fact that he was eager for help in finding a way out of his emotional decline, and in turn, out of his financial decline as well. As I began to suggest strategies, he immediately started to create his own recovery plan. It was clear that, regardless of the actual specifics of the plan, the act of creating a plan of action was exactly what he needed to stimulate him out of the blahs.

A plan for getting out of the blahs

Of the three traders mentioned above, I had the most hope for the last trader. He was taking responsibility for the way he was feeling, for the circumstances in which he found himself, and for creating his own plan to get out of his emotional and personal troubles. He had sought out help, had listened, and felt no need to resist or argue.

When you’re not feeling your best, remember the last time you felt this way and how you interacted with those around you:

Did you look for help?

Did you resist help?

Did you take responsibility?

Did you take action?

If it did not go well, you can be fairly certain that you were either a resister or a contrarian. So, here is the plan our third trader created. It may not be the right one for you, but hopefully, it will inspire you to start building your own plan:

1. He decided that he would feel a lot better about himself and his situation if he created a plan of attack. (He liked the word “attack.” It was empowering).

2. He recognized the fact that talking about what was happening to him and how he was feeling was quite helpful, so he decided his first step would be to network with a group of traders in a chat room.

3. He stepped up his exercise and health regimen and created a plan to support his physical and mental energy.

4. He decided to return to the business plan he developed two years ago and rework all of his goals, strategies, financial details and resources.

5. In order to maintain his financial viability, he decided on a two pronged approach that would have him actively looking for another full-time IT job using an employment coach while putting together a small consulting business in the IT support area using the contacts he had made in his former job.

Conclusion

While the world may seem depressing all around you, the choices that you have are – how you feel about it and the actions that you take. Yes, it is true that there are many traders that are not making money, but it is also true that a good trader will make money no matter what the markets are doing. Ask yourself, where is your focus? Always keep your focus on your highest good in order to bring out the best in yourself.

Free Newsletter

More Articles by Adrienne Toghraie, Trader’s Success Coach

Sign Up at – www.TradingOnTarget.com

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Investment Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Investment Management (Canada) Inc.

Twitter comments (Tweets) are not offered on individual equities held personally or in HAC.

Horizons Seasonal Rotation ETF HAC May 14th 2014

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/2019/08/cb8fee891cc9c4a0cd536c90472d0ee5.png)