Since 2010 and well after the introduction of quantitative easing, which has helped the economic recovery, the returns of diversified portfolios are decreasing and have reached levels that may not justify further investment risk. That can prompt a massive move into cash and the excess liquidity can push interest rates down unless a new bubble forms that can absorb it but with adverse consequences down the road.

In this article I consider an ETF portfolio invested in SPY, TLT, GLD and DBC with weights of .50, .30. .10 and .10, respectively, i.e. 50% of the capital is invested in stocks, 30% in bonds, and gold and commodities get 10% allocation each. Below is the chart of the total arithmetic return of this portfolio for each year after 2010:

The first indicator pane shows the return of the ETF portfolio with mentioned weights for 2014 YTD, the second since the start of 2013, the third since the start of 2012 and so on. Below is a plot of the yearly total returns:

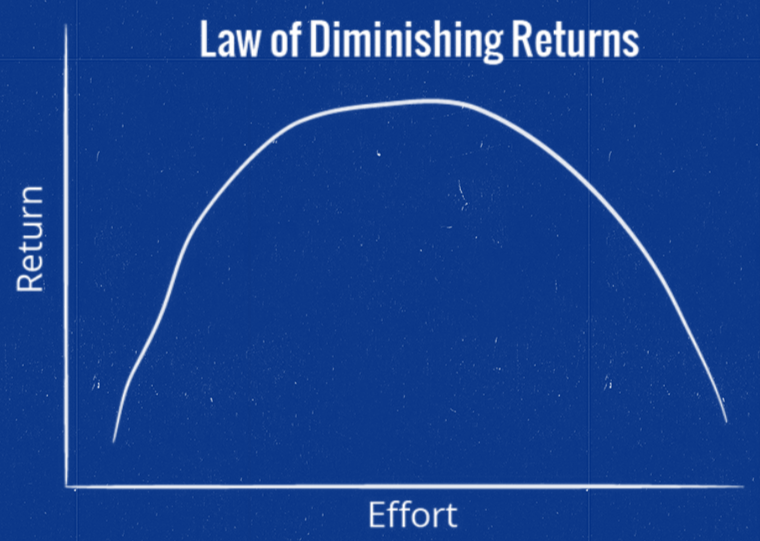

The law of diminishing returns is shown in action on the above chart. From a 14.25% return in 2010 straight down to a 5.67% return YTD. Unless a bubble is formed somewhere, current returns do not justify additional risk. But if a bubble is formed, the gains will be short-lived, until it bursts. I guess everyone hopes to get out first, or worse, the professionals hope to get out before the retail crowd.

Cul de sac? I think so, until the next major wealth creation period that may or may not take too long but I hope it will not be robots kicking everyone out of work because the problems will be raised to another level of complexity.

Copyright © Price Action Lab