by Don Vialoux, Timing the Market

Apr 29

Technical action yesterday in individual

equities

Technical action by S&P 500 stocks was extraordinary.

Seventeen stocks broke support (mainly late morning) and 13

stocks broke resistance.

Among TSX 60 stocks, Saputo was notable for its upside

breakout to an all-time high.

Tweets forwarded yesterday (With charts added)

Nice breakout by $K above resistance at $66.77 to an all-time

high. One of Jon’s picks on BNN. See seasonality chart:

http://charts.equityclock.com/kellogg-company-nysek-seasonal-chart

Mild bullish technical action this morning! Breakouts were

$SPLS, $K, $KO, $PG, $PM, $AIV, $XL. Breakdowns were $PCLN,

$BAC, $FFIV and $CLF

Technical action turned significantly bearish this afternoon.

$RAI broke resistance. $CMG, $DiSCA, $WAT, $CRM, $FLIR and

$TEL broke support

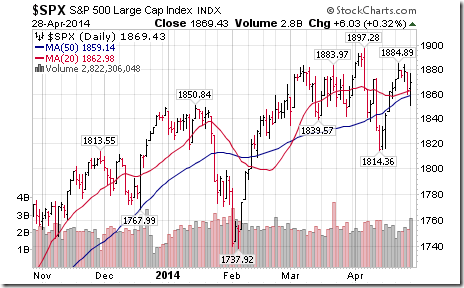

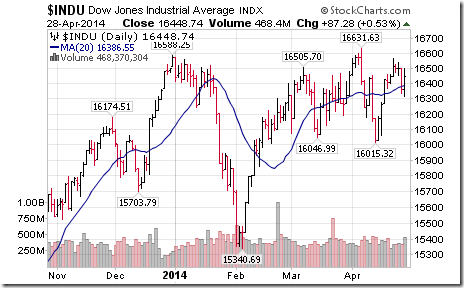

S&P 500 has fallen below its 20 and 50 day moving average

this afternoon. The Dow has fallen below its 20 day moving

average. Bearish!

Editor’s Note: Both the S&P 500 and Dow Industrials

recorded greater than average inter-day volatility yesterday,

typical of equity indices that are near an intermediate peak.

Volatility comes at a time when U.S. equity markets transit

from their period of seasonal strength (October

28th to May 5th) to their period of

volatility (May 6th to October 27th).

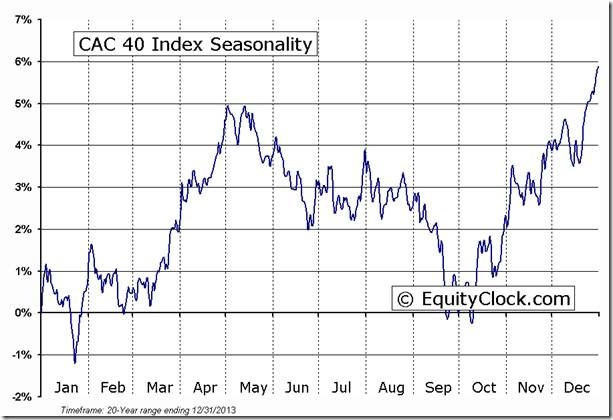

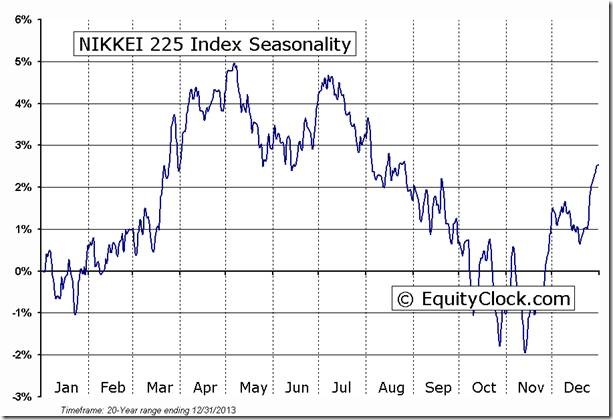

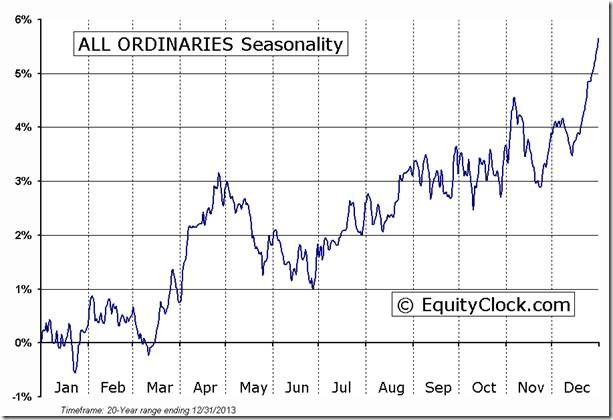

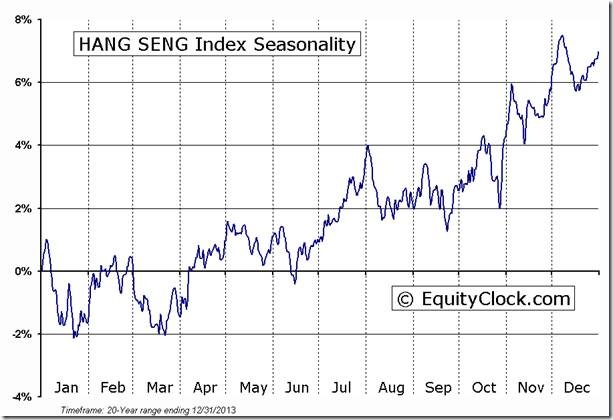

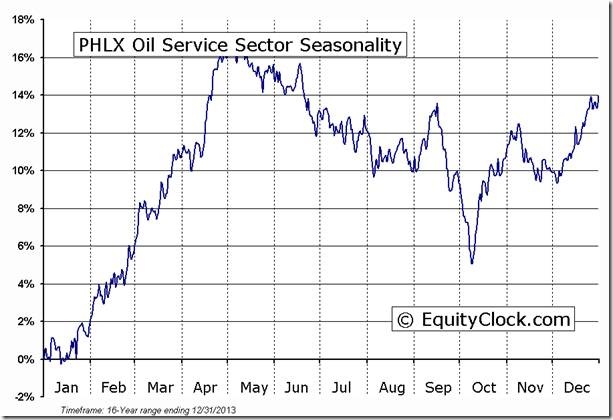

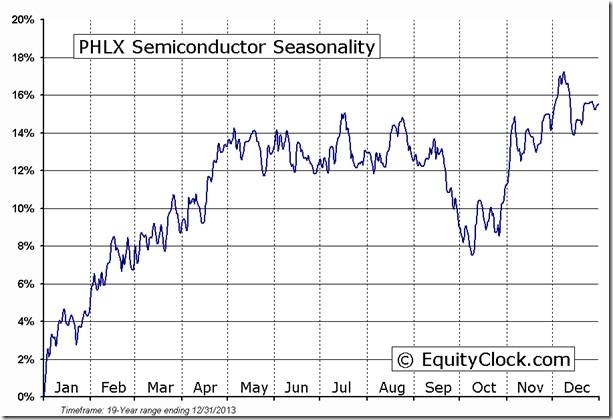

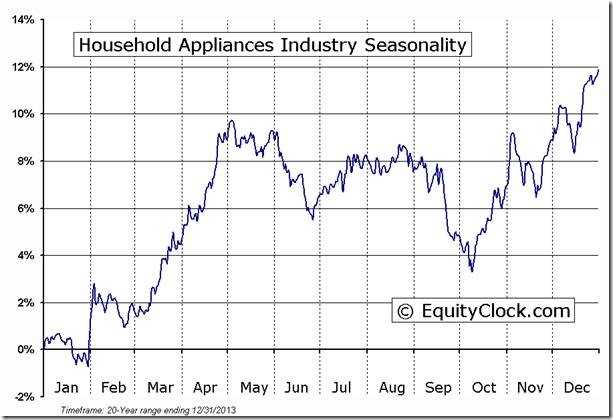

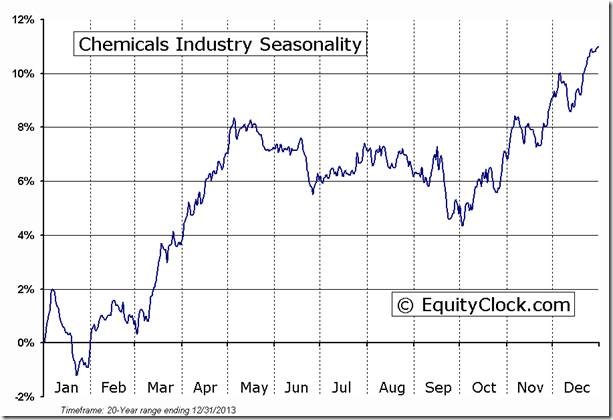

Market and Sector Seasonality That Historically

Peaks Near The End Of April

Following are the seasonal charts from www.EquityClock.com . A

examination of their price charts also show that most have

reached an intermediate peak during the past three weeks.

NIKKEI 225 Index Seasonal Chart

Chemicals Industry Seasonal Chart

Comments on Markets by Dave

Skarica

I have enclosed a new article on Addicted to Profits on why

the market is showing a lot of similarities to 1937 and what

these means for investors.

Please go to

www.addictedtoprofits.net to read it.

Tomorrow I will have a new video on the markets and how to

protect yourself against a potential bear market.

Sincerely,

David Skarica

Disclaimer: Comments, charts and opinions

offered in this report by www.timingthemarket.ca

and www.equityclock.com

are for information only. They should not be

considered as advice to purchase or to sell mentioned

securities. Data offered in this report is believed to be

accurate, but is not guaranteed. Don and Jon Vialoux are

Research Analysts with Horizons ETFs Management (Canada)

Inc. All of the views expressed herein are the personal

views of the authors and are not necessarily the views of

Horizons ETFs Investment Management (Canada) Inc., although

any of the recommendations found herein may be reflected in

positions or transactions in the various client portfolios

managed by Horizons ETFs Investment Management (Canada)

Inc.

Twitter comments (Tweets) are not offered on

individual equities held personally or in HAC.

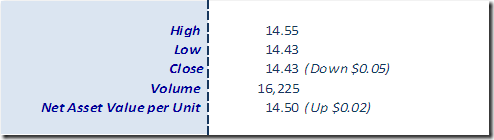

Horizons Seasonal Rotation ETF HAC April

28th 2014

Leave a Reply

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray