by David Merkel, Aleph Blog

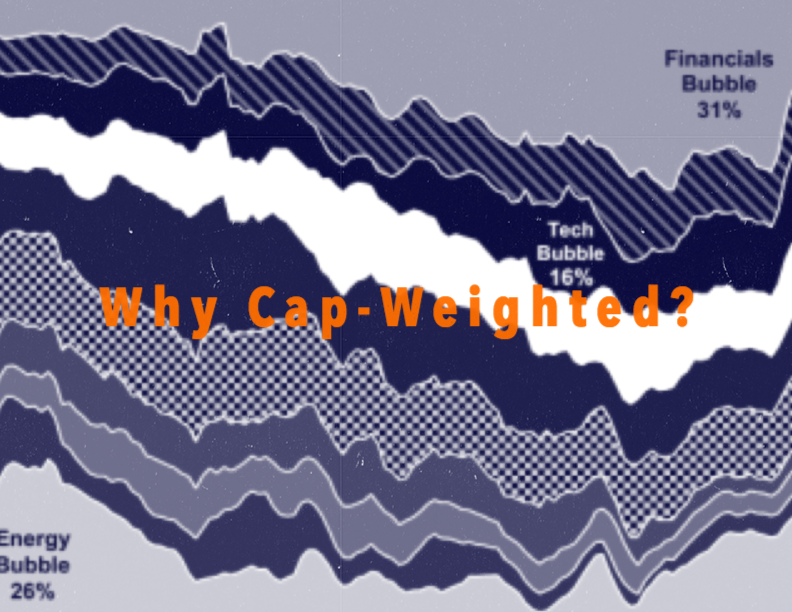

Are index funds that are capitalization-weighted the best funds to invest in? No. So why do we talk about index funds so much? Because they represent the average dollar in the market. In principle, everyone could invest in a comprehensive index fund, and there would be no effects on the market.

But indexes can be enhanced. Tilt your investments to:

- Avoid the biggest firms, their growth opportunities are limited.

- Buy cheap stocks, they out-earn growthier stocks, and have fewer disappointments

- Buy quality stocks, again, fewer disappointments.

- Buy stocks that have been running, they tend to do well in the future.

- Buy stocks with conservative accounting, they tend to outperform.

But the moment you do that, you are an active manager, because not everyone can do what you are doing. Also, each of the anomalies I have indirectly referenced can occasionally be overvalued. As an example, the biggest stocks presently look cheap compared to smaller stocks.

Trying to create “smart beta” is interesting, but let’s just call it enhanced indexing. And if too many people try to do enhanced indexing, guess what? Those stocks will become overvalued, and will eventually sag, badly.

There is no magic bullet in investing. There is the work of evaluating valuations versus future prospects, and that is a challenging task.

If you want average performance, which is better than most get, buy a broad index fund with low fees and hold it. If you want better performance, tilt your portfolio to reflect factors that usually outperform. If you want still better performance, ask what factors are overvalued, and remove them from your portfolio.

As for me, I am happy buying safe and cheap stocks and holding them for three years or so. I’m happy with my picks, and so I adjust my portfolio in small ways quarterly. No need to over-trade. I just keep following my strategy.

Copyright © Aleph Blog