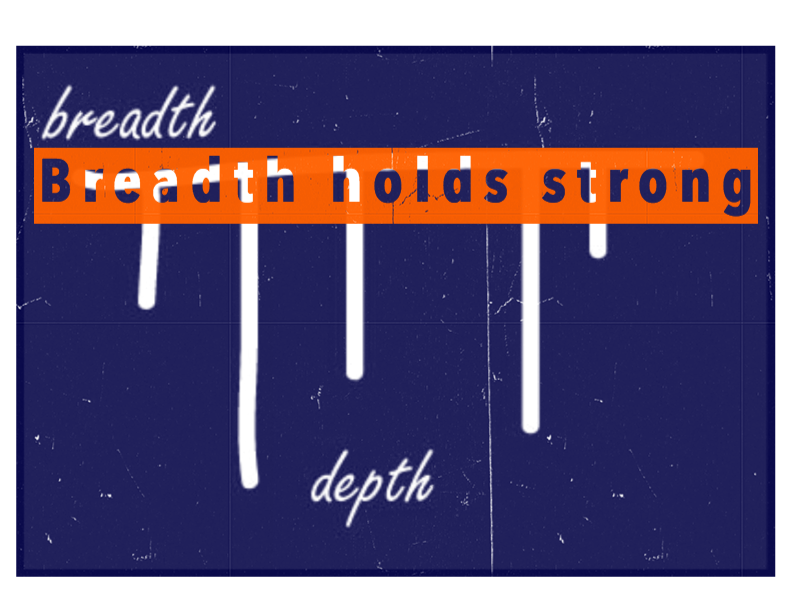

The AD Volume Line held strong during the April pullback and formed a small bullish divergence over the last few weeks. The AD Volume Line is a cumulative measure of AD Volume Percent, which is advancing volume less declining volume divided by total volume. In this example, we are looking at the S&P 1500 AD Volume Line ($SUPUDP). I like to use the AD Volume Line instead of total volume because it represents net buying pressure. Advancing volume represents buying pressure and declining volume represents selling pressure. AD Volume Percent, therefore, is net buying pressure. The AD Volume Line rises when buying pressure is stronger and falls when selling pressure is stronger.

Click this image for a live chart

The chart above shows the AD Volume Line moving lower the first two weeks of April and holding above the March low. Meanwhile, notice that the S&P 1500 did not hold its March low. The higher low in the AD Volume Line amounts to a bullish divergence and indicates that net buying pressure remains strong. The AD Volume Line surged towards its early April high last week and remains in a clear uptrend. I view this as positive for the broader market, especially large-cap stocks because large-caps dominate the most active lists on the NYSE and Nasdaq.

Good weekend and good trading!

Arthur Hill CMT

Copyright © StockCharts.com Blog