by Ryan Lewenza, North American Equity Analyst, TD Wealth

Attached is our latest edition of The Technical Take. Highlights of today’s report include:

Highlights:

· We believe the S&P/TSX Composite Index (S&P/TSX) is due to take a break after advancing 6% since its February lows. We are targeting the S&P/TSX to pull back to 13,800 to 14,000, which is the convergence of: 1) previous resistance, now support; 2) the 50-day moving average (MA); and 3) the lower channel line. If correct in our call for a short-term pull back, we would use the opportunity to increase equity exposure, as the long-term technical profile for the S&P/TSX remains constructive.

· The technical profile of gold miners has greatly improved in recent months, with the S&P/TSX Capped Global Gold Index breaking above its year-and-a-half downtrend. If the gold price continues to trend higher and/or hold steady, we believe gold miners could continue to rally given how beaten up they were in 2013.

· The S&P 500 Index (S&P 500) broke above short-term resistance of 1,850, making a new all-time high. The new high for the S&P 500 was accompanied by new highs for: 1) the NYSE Advance/Decline line; 2) a relative high for the Russell 2000 Index versus the S&P 500; and 3) the Dow Jones Transportation Index. For us, this points to a continued strong bull market for U.S. equities. In the short-term, we see the potential for some backing and filling for the S&P 500 as it works off its overbought condition.

· In this week’s report, we highlight Honeywell International Inc. (HON-N), Vermilion Energy Inc. (VET-T) and Finning International Inc. (FTT-T) as attractive buy candidates and recommend investors trim/sell General Motors Co. (GM-N).

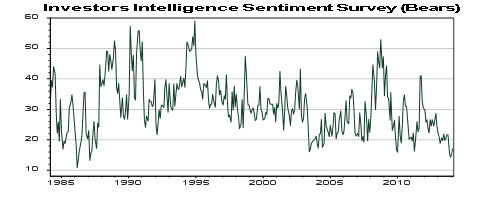

Chart of the Week – The bears are in hibernation. Just 17% of polled “professional” investors are bearish, which is the lowest reading since the mid-1980s

The Technical Take - March 17, 2014

Copyright © TD Wealth