by Lance Roberts of STA Wealth Management,

This past week has seen the market struggle due to continued weak economic data, rising tensions between Russia and the Ukraine and an extended bull market run. As I discussed in yesterday's missive, the market internals are showing some early signs of deterioration even though the longer term bullish trajectory remains intact. Therefore, this week's "Things To Ponder" wades through some broader macro investment thoughts from the safety of your investments to how market tops are made.

1) The Delusions Of Real Returns by Brett Arends, WSJ

This is a topic that I discuss very often with clients. Past performance is no guarantee of future results, and making investment decisions based on such is likely going to leave you very disappointed. Extrapolating 110 year historical average returns going forward is extremely dangerous. First, you won't live 110 years from the time you start saving to achieve those results, and starting valuation levels are critical to your expected returns. Brett does an excellent job discussing this issue.

"Money managers point to historical data going back to the 1920s to show that in the past stocks have produced total returns of about 10% a year over the long term and bonds, about 5%—meaning a standard "balanced" portfolio of 60% stocks and 40% bonds would earn just over 8% a year. (Naturally, their legal departments quickly add that the past is no guide to the future.)

Are these forecasts realistic? Are they sensible? Are they even based on actual logic or a correct reading of the past data?

A close look at the data reveals a number of disturbing errors and logical flaws. There is a serious danger that investors are deluding themselves and that returns from here on may prove far more disappointing than many hope or believe.

This has happened before. Money invested in a balanced fund of stocks and bonds at certain points in the past—such as in the late 1930s, or during the 1960s and 1970s—ended up losing money for many years, after accounting for inflation.

Far from making an annual profit, investors went backward in real, purchasing-power terms. And those losses were even before deducting costs or taxes."

2) Lessons From The Bull Market by Jason Zweig, Joe Light and Liam Pleven

If you do nothing else this weekend - read this article. There are simply too many nuggets of wisdom for me to summarize, but here are a couple of my favorite points.

"Every day, in the newspapers, on financial-news shows and online, dozens of market strategists make bold predictions about the direction stocks are heading. Take their forecasts with a mound of salt. After all, current prices already reflect the sum of stock-market buyers' and sellers' opinions. If one investor is bullish, there must be another investor on the other side at the current price."

"In a speech about intellectual honesty 40 years ago, Nobel Prize-winning physicist Richard Feynman said, 'The first principle is that you must not fool yourself—and you are the easiest person to fool.'

What they should be asking is this: Am I fooling myself into remembering my losses as less painful than they were? Am I itching to take risks that my own history should warn me I will end up regretting? Am I counting on willpower alone to enable me to stay invested and to rebalance through another crash?"

"Investors who hear the phrase 'bull market' might decide it is time to get in on the rally. On the other hand, investors who hear the current bull market in stocks has been running for five years might worry it will soon end. In either case, investors would do better to tune out the chatter. The definition of a bull market is arbitrary, and the term tells investors little about what will happen next."

3) How Market Tops Are Made by Barry Ritholtz via Bloomberg

This is a great follow up to my articles this past week on "10 Signs Of Exuberance" and "Market Internals." Barry interviews Paul Desmond, the Chief Strategist and President of Lowry's Research, who has spent the past five decades analyzing markets. From Barry:

"I spoke with him [Paul Desmond] recently, chatting about his work in identifying market tops. Rather than focus on the usual noise, Desmond suggests anyone concerned about a top should be watching for very specific warning signs. He notes the health of a bull market can be observed by watching internal indicators that provide insight into the overall appetite for equity accumulation.

These four include:

1. New 52-Week Highs

2. Market Breadth (Advanced/Decline Line)

3. Capitalization: Small Cap, Mid Cap, Large Cap

4. Percentage of Stocks at 20 percent or greater from their recent highs"

4) New All Time Highs = Secular Bull Market? by Cam Hui via Humble Student Of The Markets Blog

I wrote an article recently entitled "Correcting Some Misconceptions About A New Secular Bull Market" as the markets pushed toward new highs at the end of 2013. At that time, there was a flurry of articles suggesting that the markets had entered into a new secular bull market. However, my argument against this thesis revolved around the fact the no secular bull market in the history of the known universe has ever started from peak market valuations. Cam Hui brings forward an excellent point:

"Here is a difficult question for those in the secular bull camp. What's the upside from here? Ramsey of Leuthold Weeden Capital Management projects limited upside under a secular bull scenario, even assuming that everything goes right:

If the current cyclical bull unfolds into a secular one that is perfectly average in duration and magnitude (a very tall achievement, in our book), the annualized total return over the next ten years will still be a bit below the long-term average return of 10%. Frankly, we don't find this all that compelling, considering all that must go according to plan for the market to achieve it (i.e. sustained EPS growth at a healthy 6% and an inflated terminal P/E multiple).

He added some of these gains depends on assuming the resumption of a stock market bubble:

Based on the relative positions of these time-tested measures, secular bulls seem to be implicitly betting on the reflation of a multi-generational stock bubble less than 15 years after it popped. The pathology of 'busted bubbles'—which we've detailed at length in the past—doesn't support that bet.

When he puts it all together, my inner investor thinks that, if we are indeed seeing a new secular bull market, the extraordinary measures undertaken by global central banks in the wake of the Lehman Crisis has front-end loaded many of the gains to be realized in this bull."

5) Does Shiller's CAPE Still Work? by Bill Hester, Hussman Funds

It is becoming more difficult for more mainstream commentators, analysts and managers to justify their arguments for a continued bull market when having to contend with rising valuation levels. However, as would be expected, at the peak of every major bull market in history there have always been those that have suggested "this time is different." In 1929, stocks had reached a new permanent plateau. In 1999, old valuation measures didn't matter as it was about "clicks per page." In 2007, subprime credit was "contained" and it was a "goldilocks economy." In 2014, old valuation metrics simply don't account for the new economy. We have always heard the same "sirens song" during every major bull market cycle and, as the sailors of the past, we are ultimately lured toward our demise. Bill Hester does an excellent job breaking down the arguments against Shiller's CAPE valuation metrics.

"More recently the ratio has undergone an attack from some widely-followed analysts, questioning its validity and offering up attempts to adjust the ratio. This may be a reaction to its new-found notoriety, but more likely it's because the CAPE is suggesting that US stocks are significantly overvalued. All of the adjustments analysts have made so far imply that stocks are less overvalued than the traditional CAPE would suggest.

We feel no particular obligation defend the CAPE ratio. It has a strong long-term relationship to subsequent 10-year market returns. And it's only one of numerous valuation indicators that we use in our work – many which are considerably more reliable. All of these valuation indicators – particularly when record-high profit margins are accounted for – are sending the same message: The market is steeply overvalued, leaving investors with the prospect of low, single-digit long-term expected returns. But we decided to come to the aid of the CAPE ratio in this case because a few errors have slipped into the debate, and it's important for investors who have previously relied on this ratio to understand these errors so they can judge the valuation metric fairly.

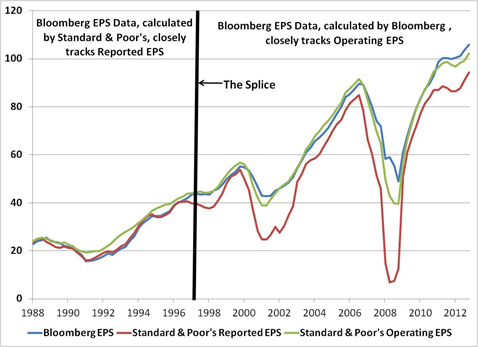

Importantly, the primary error that is being made is not even the fault of those making the arguments against the CAPE ratio. The fault lies at the feet of a misleading data series."

EXTRA: Just Good Stuff To Know

I use Google for just about everything. Email, picture uploads, all of my spreadsheets that I use for blogging, analysis, newsletters, etc. From my phone to my computer, Google has just about all of my data.

That makes me a little more than uncomfortable. If you are like me, then you will find the following links very useful in adjusting things from what Google knows about you to archiving the stuff you put on the site.

Here are 10 important links that every Google user should know.

Have a fabulous week.

Copyright © STA Wealth Management