Popular Memes That Are Partially or Completely BS

As the US markets head higher, contrary evidence is being explained away in one fashion or another. This is part of a larger issue: popular memes persist despite evidence that correlations don't (or do) exist.

Not all stories are neat; the current bull market is no exception. Evidence that support different conclusions are always present. Better to acknowledge those differences in order to better understand how solid the foundation for the current market really is.

Below are just a few memes that have recently been popular that are partially or completely BS.

The late-1990s are a useful benchmark.

Higher short-interest is necessarily bullish.

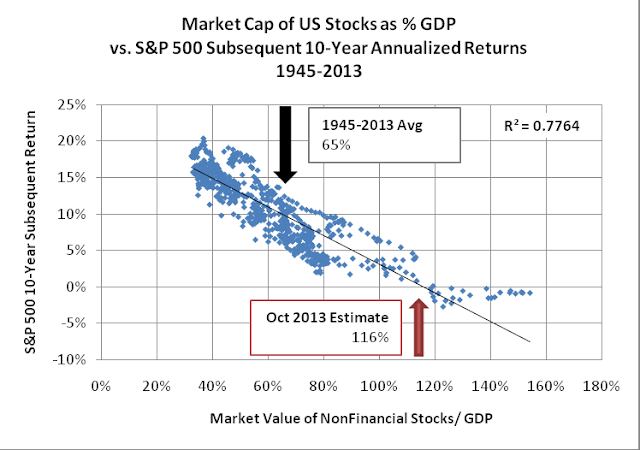

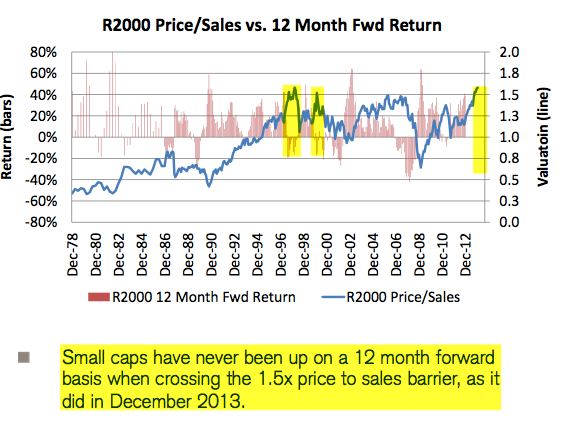

Valuation doesn't matter.

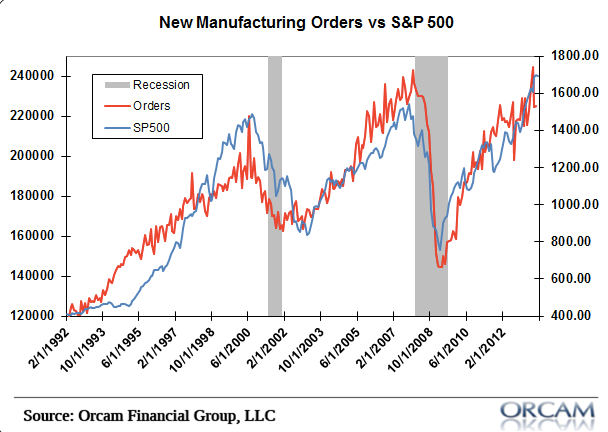

Fundamentals don't matter.

The stock market needs a strong dollar.

The economy is not the stock market.

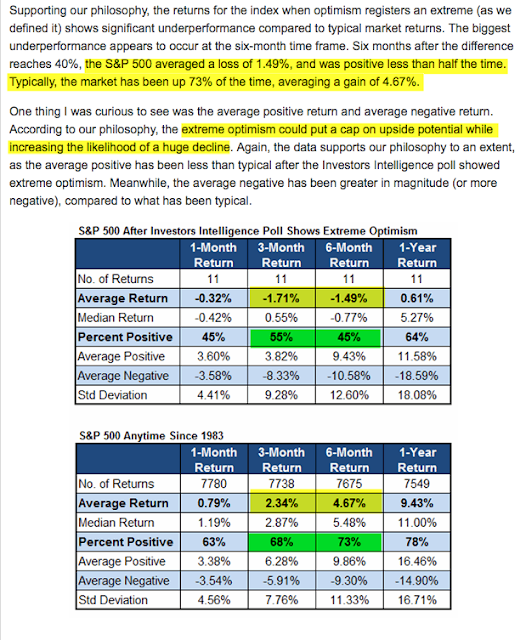

Sentiment is junk science.

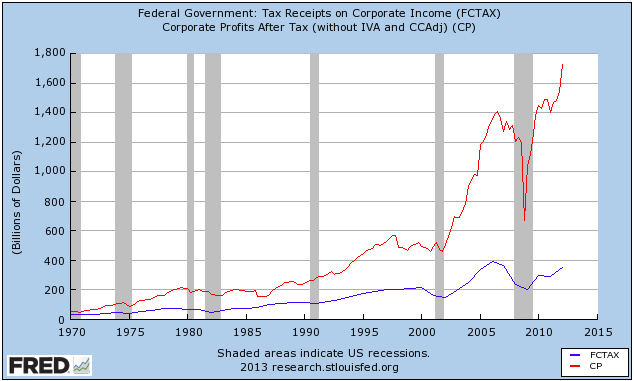

Taxes are crippling US corporations.

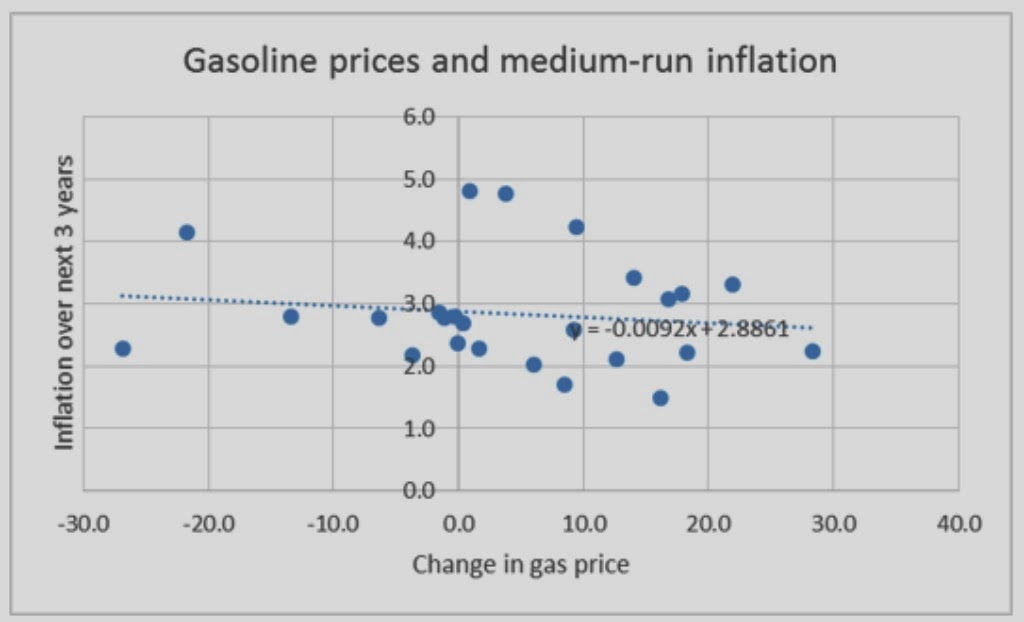

Measures that exclude food and energy systematically underestimate inflation.

A low Vix is bearish.

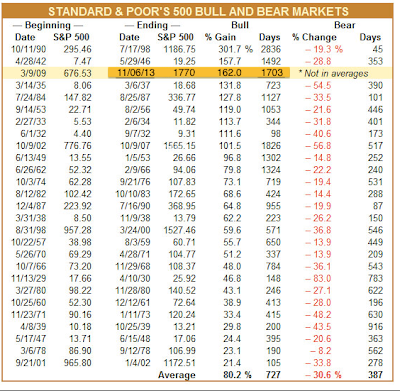

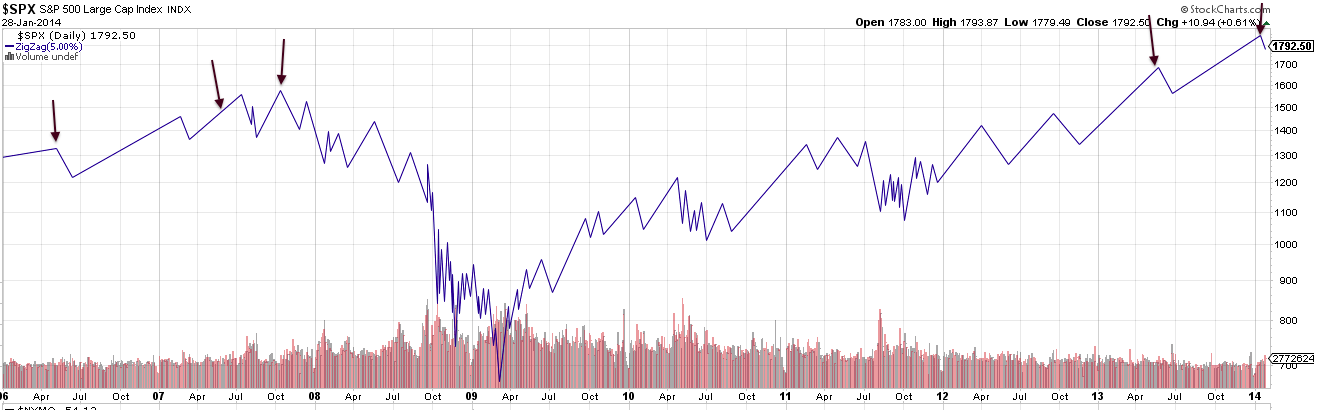

The current bull market is young.

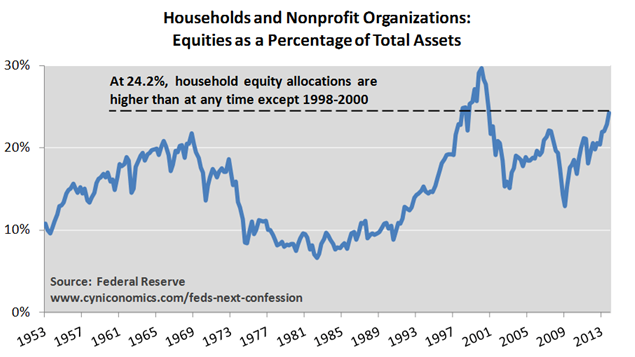

Individual investors have yet to embrace the bull market.

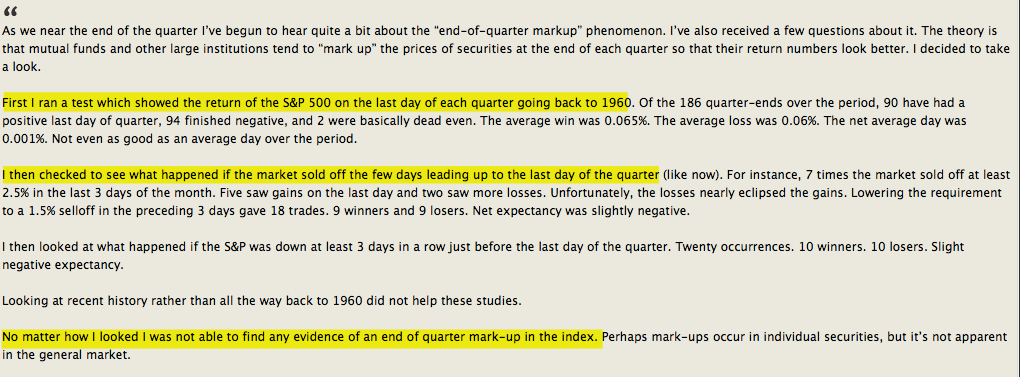

Stock prices are marked up at the end of each quarter (window dressing).

The stock market cannot correct if everyone is talking about a bubble.

Expanding breadth is a sign of a healthy market

Copyright © The Fat Pitch