by Ryan Lewenza, Nort American Equity Strategist, TD Wealth

Highlights from this report:

The Q4/13 earnings season is just about wrapped up in the U.S., while Canada is roughly three-quarters through its earnings season. Overall, Q4 earnings were solid in the U.S. and we score the earnings season a B+. Canadian earnings continue to lag and we score the quarter a C. In today’s report we provide our key observations in the quarter and discuss the outlook for earnings going forward. Highlights include:

· S&P 500 Index (S&P 500) Q4/13 earnings are projected to be $28.42/share, which equates to 13.5% Y/Y growth, based on Bloomberg estimates. This continues the trend of improving earnings growth, and was the strongest Y/Y growth rate since Q4/11.

· On the bottom line, 74% of companies within the S&P 500 beat their earnings estimates, which was in line with Q3/13, but well above the long-term average rate of 62%.

· As we’ve witnessed in recent quarters, corporate managers remain cautious in their outlooks, with 76 companies within the S&P 500 guiding lower for the upcoming Q1/14. With just 15 companies providing positive guidance for Q1/14 earnings, the negative/positive (N/P) ratio remained elevated at 5.07 for Q1, which is well above the long-term average of 2.5.

· S&P/TSX Composite Index (S&P/TSX) Q4/13 earnings are projected to come in at $198.45/share, according to Thomson First Call estimates. Based on this estimate, earnings are projected to decline 5.7% Y/Y in the quarter. For the full year, S&P/TSX earnings are projected to decline 3% Y/Y in 2013, but rebound 12% to $902.19/share in 2014. We continue to forecast below consensus earnings of $875/share for the S&P/TSX in 2014.

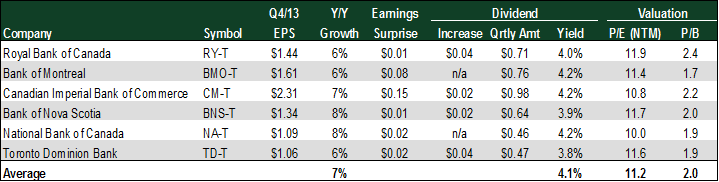

· One bright spot for Canadian earnings is the financials sector, driven by the “Big 6” Canadian banks. Bank earnings grew 7% Y/Y, coming in above TD Securities estimate for 5% growth. Four of the six banks (RY, CIBC, TD, and BNS) raised their quarterly dividend in Q4/13, with the group dividend yield now at 4.1%. Despite the strong price appreciation from the group over the last few years, valuations are still reasonable with the group trading at 11.2x forward earnings, a discount to its 10-year average P/E of 12.2x.

Q4/13 Earnings results and dividend announcements for the “Big 6” Canadian banks

Read/download the complete report below: