by Paul Moroz, Mawer Investment Management

There was ample time to call off the research trip to Thailand.

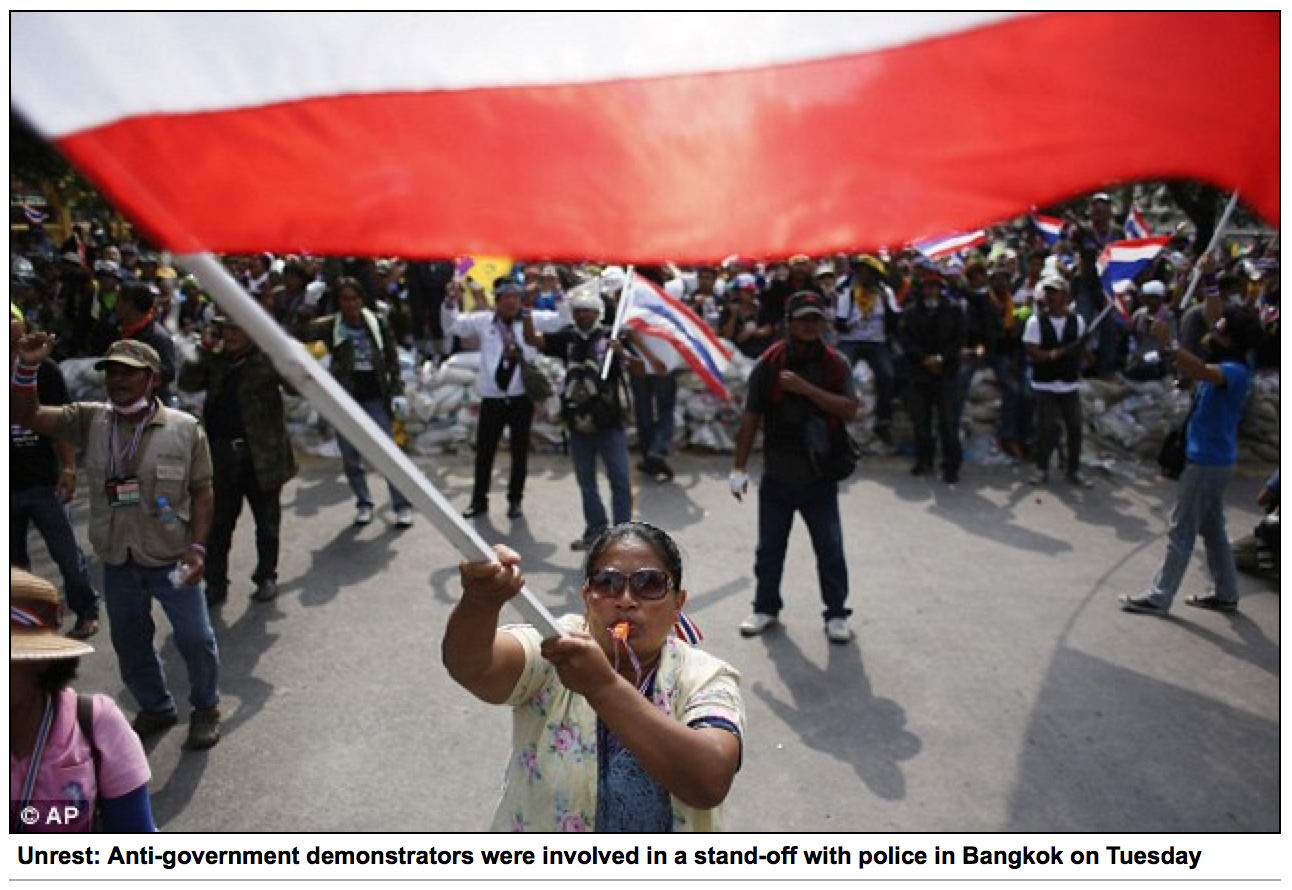

The stars were aligning to make this trip a nightmare. Intersections would be blocked, flash mobs would fill the streets, and political sermons would overtake a city decorated by barbed wire-draped government buildings. Normally bad traffic would degenerate into complete chaos. I knew this could potentially get bad. So why was I still going to Bangkok?

Before I answer that question, let me digress….

The political situation in Thailand is complex. The country has gone through an astonishing 11 coups in the twentieth century alone. The latest occurred in 2006 when Prime Minister Thaksin Shinawatra was ousted by the military and charged with corruption. Even though Thaksin fled to Dubai, his influence remained. Thaksin quietly continued to wield power through the ruling Pheu Thai Party, led by his sister Yingluck Shinawatra, the current caretaker prime minister of Thailand.

The impact of Thaksin’s political influence finally came to a head last November. Political tensions heightened when the lower house introduced the Amnesty Bill, a blatant attempt to pardon Thaksin’s criminal allegations. Seen by many as the very embodiment of government corruption, the bill triggered the ire of the anti-Thaksin crowd (the "yellow shirts") and in the months that followed, street demonstrations steadily gained momentum. In December, Yingluck dissolved the House of Representatives and called for an election to be held on February 2. Believing that the electoral process would remain democratically unjust, protesters planned a shutdown of Bangkok.

As Murphy's Law would have it, the dates of this shutdown corresponded exactly with my meetings in the city, January 13-17. Nevertheless, on the morning of January 10, I boarded a plane at Calgary International Airport and headed to Bangkok. But the question remained: why on earth was I going ahead with this trip?

For the reason that opportunity is born out of uncertainty.

Sometimes, when masses most noticeably perceive risk, there is less risk en masse. The world is always uncertain. The question is whether or not a market has priced-in this uncertainty. In this case, the Thai stock market was down in 2013 when other global equity markets were up 20 to 30%. Thai equities seemed to have absorbed much of the recent bad news, creating an opportunity. The Thai Baht had also depreciated somewhat, despite the country maintaining a reasonably balanced current account, compared to countries that noticeably spend more than they save, like Turkey, South Africa and India. The term “emerging markets” has also become a tarnished label of late; not exactly encouraging stock market flows into the country. Yet Thailand is a country that is full of excellent businesses. Our team has looked through over 300 companies listed in Thailand and found many with strong business models that earned high returns on their invested capital and have managed to prosper despite the occasional coup or flood.

The prospects looked bright so I was still motivated to go to Bangkok. But with the city core trapped by seven protest zones and the prospect of escalating violence, would the trip prove successful? What would I learn? Was it all worth it?

To Be Continued…

Paul Moroz