by Ron Rimkus, CFA, CFA Institute

In a poll conducted earlier this week in the CFA Institute Financial NewsBrief, we asked readers about bitcoin’s longevity.

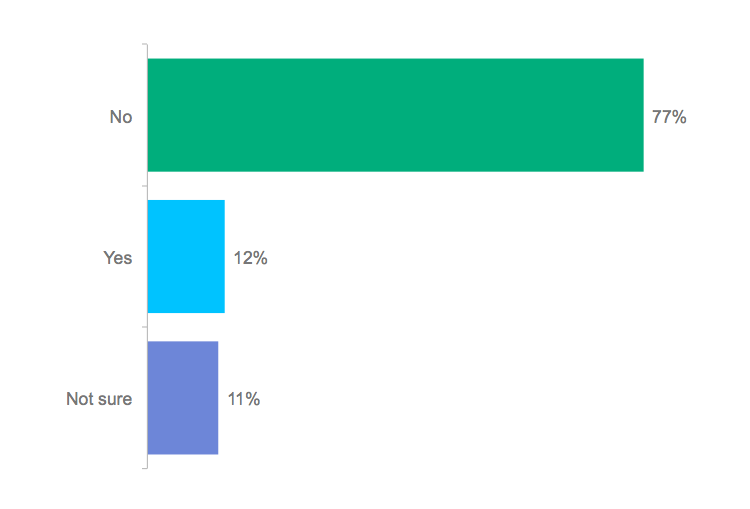

Will bitcoin be a viable alternative currency in five years?

Having risen to more than $1,100 per bitcoin in trading just a few months ago, bitcoin has subsequently experienced a good deal of turmoil and volatility. As noted in the blog post “Bitcoin: New Gold or Fool’s Gold?” bitcoin’s competition with government-sponsored currency will gain the interest or possibly the wrath of governments worldwide. China and Russia, among others, have already come down harshly on the cryptocurrency, with China prohibiting banks and payment companies from using bitcoin and Russia banning it altogether. In addition, hackers have been attacking the platform. A number of denial-of-service attacks have taken down the bitcoin exchanges Mt. Gox and Bitstamp, creating fear and uncertainty about its durability. As of this writing, the cryptocurrency is trading at about $665 per bitcoin; yet just last week, it experienced a “flash crash” down to $100 before regaining that lost ground.

Interestingly, bitcoin is not just a currency; it is also an inexpensive payment platform. Whereas credit card companies charge merchants fees ranging from 1% to 5% of purchase price, bitcoin is virtually free. Also, bitcoin competes with money wiring at banks and such money transfer services as Western Union, which charge similar fees. Given both its current popularity and substantial challenges, we asked 1,183 investors whether they thought bitcoin would be a viable alternative currency in five years’ time. They responded with a resounding no, with 77% saying bitcoin would not be viable and only about 12% saying it would.

Do you want to participate in future polls? Sign up for the CFA Institute Financial NewsBrief.

Please note that the content of this site should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute

This article was originally published at the CFA Institute's Enterprising Investor Bog.