The Needle and the Damage Done

by Gregory Harmon, Dragonfly Capital

Many think that the the stimulus provided by the Federal Reserve over the last 5 years is like giving drugs to a junkie. I suppose that the jury will be out on the end result of quantitative easing for some time still. I know those that think the economy is on track and it was a job well done. I also know those that think it is masking weakness and possibly a recession, like the junkie feeling a rush that Neil Young sings about that crashes and dies. Monday started a new era in monetary policy in the United States. Janet Yellen ushered in a change of command as the new head of the Federal Reserve and a major step forward as the first woman in this position of power. The stock market presented her with a loud and wet Bronx cheer as a welcome, with the S&P 500 dropping 2.25%. Thank you very much.

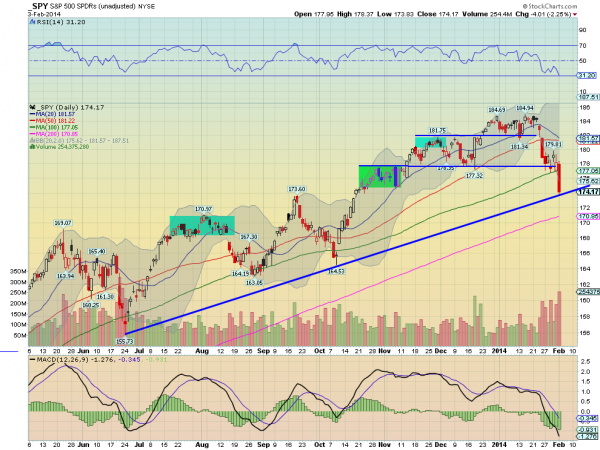

These events and descriptions will be used in other derivations across the media. But they are all noise and rhetoric to fill pages and screen time. Nonetheless Monday was a very important day. I do think it is important that the head of the Federal Reserve is a woman but my main professional interest is in the price action of the markets, the charts. And Monday was a very important day in that regard. Some major damage was done. In the big scheme of things the S&P 500 has only moved about 6% below its all-time highs, so it is not time to panic, but Monday changed things. If you look at the chart above, the S&P 500 SPDRs ETF, $SPY, made a new 3 month low. It also is a lower low, below the one from December 18th. The trend has been confirmed lower for 2 weeks now and Monday leaves the SPY at a critical juncture. The rising blue trend line as support came into play for the third time as well. The last two times it has been met with what is called a Hammer candle, a potential reversal sign. These have a long tail indicating that buyers showed up and brought the price higher to end the day. But Monday it was met nearly head on with a very bearish candle. Rubbing salt into the wound, the Relative Strength Index (RSI) is making a new 14 month low. The junkie is suffering from withdrawal and a lot of damage has been done. There may be a bounce over the next few days but without a close over 178 Friday it would be suspect. A move below this trend line however likely brings a test of the 200 day Simple Moving Average (SMA) at 170.85 below. And failure there begins the serious talk of a much deeper move longer term…….

Copyright © Dragonfly Capital