by Kara Lily, Mawer Investment Management

I was sitting in a modest office in a quiet suburb near Amsterdam. The man in front of me wore a peculiar tweed jacket that matched his charismatic, if quirky, personality. He was the CFO of a large industrial company, but in a former life he had been the second in command at a company in which we had interest. His ex-boss was the founder of a private company whose aggressive tactics were quickly destabilizing an otherwise stable industry. I was there to figure out what made his ex-boss tick.

“So what really motivates him?” I asked, rather innocently. My companion looked at me for what seemed like five minutes, leaned back, and put his hands in pockets before saying just one word.

“Revenge.”

“Really?”

“Absolutely,” he confirmed.

The explanation that followed was intriguing to say the least. Apparently, the ex-boss felt slighted by the companies he now competed against and was out for revenge à la The Count of Monte Cristo. In fact, his entire purpose for entering the industry was to build an empire bigger than those by whom he felt wronged. This was important information. We had always questioned whether the players in this industry would behave rationally going forward, based on the observation that they had a tendency to over expand and drive down returns below the industry’s cost of capital. If what this man was saying about his ex-boss’ motivations was true, rational capital allocation would never be in the cards.

I left with my investment spidey senses tingling. And all of this information was gleaned from one seemingly innocuous question.

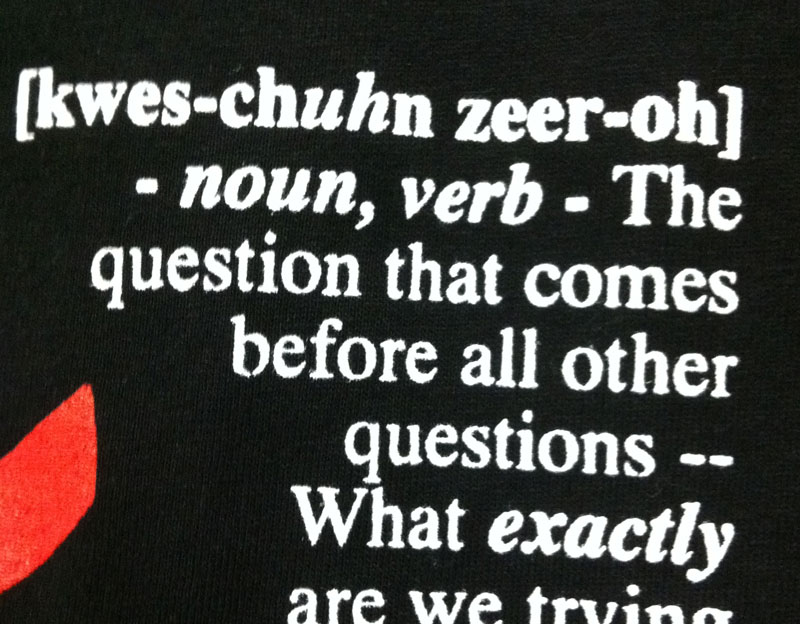

The Power of Question Zero

Mark Twain once wrote that “it’s not what you don’t know that gets you into trouble, it’s what you know for sure that ain’t so.” When faced with a problem, people tend to jump to finding a solution. But a lot of value can be uncovered by spending more time on the question itself. Harvard Business School professor, Herman Leonard, recommends that people seek to land on what he calls Question Zero. Question Zero asks: “What, exactly, are we trying to accomplish?” It is the idea that people should boil down their challenges to the most critical question at hand.

This is best achieved by starting with an open mind. An open mind enables the exploration of many different questions before settling on the right one. As Einstein said, “if I had an hour to solve a problem and my life depended on the solution, I would spend the first fifty-five minutes determining the proper question to ask, for once I knew the proper question, I could solve the problem in less than five minutes.”

As an example, it is incredibly easy to walk into a management interview with a three page list of questions and start hammering them off one by one. But an investor who immediately focuses on a very narrow line of questions can miss vital information. While my colleagues always go into meetings with a list of key questions, they often incorporate vague or open-ended questions to see where the manager will take the conversation, and then follow up with a relentless string of "whys." In the art of management interviews, this kind of open and then targeted approach can be very revealing. It was this approach that allowed me to uncover such explicit information in my interview in the Netherlands.

All of this may seem simple, but it is amazing how even subtle shifts in thinking can produce powerful results. Had I pursued a conventional approach in the Netherlands, I would have never explored the entire topic on motivation. I probably wouldn’t have even set up the meeting in the first place.

Parents always warn about making assumptions. In a world of Enrons, Worldcoms and triple-A rated subprime investments, it is best to follow this advice. Assumptions can be ruinous in investing. The Question Zero approach is a sensible process to take before proceeding down a decision-making path.

Kara Lilly

Copyright © Mawer Investment Management