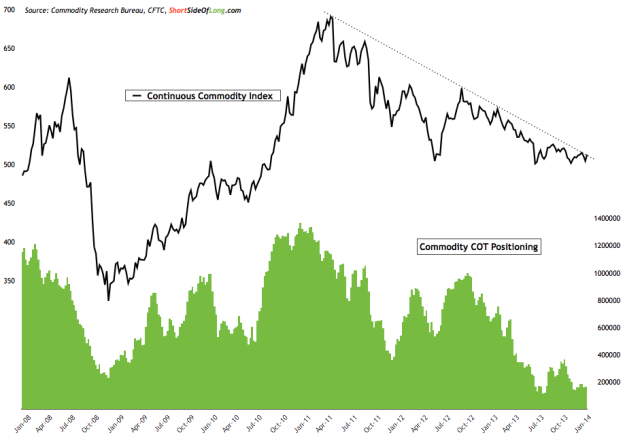

Chart 1: Funds are holding some of the lowest exposure in commodities

And while hedge funds are bearish, Wall Street has also turned very bearish on commodity price outlook as well (sourced by Bloomberg):

- Commodities revenue at the world’s 10 largest investment banks probably dropped 14 percent to $4.7 billion in 2013, London-based analytics company Coalition said in November. The biggest banks have cut commodities staff to the lowest since at least 2009, according to Coalition.

- Deutsche Bank said last month it will exit dedicated energy, agriculture, dry bulk and base metals trading and transfer its financial derivatives and precious metals desks to the fixed income and currencies division.

- JPMorgan, the biggest U.S. bank by assets, said in July it plans to get out of the business of owning and trading physical commodities ranging from metals to oil.

- Morgan Stanley cut 10 percent of its workforce in the commodity division last year and agreed to sell its global oil business to OAO Rosneft, Russia’s largest petroleum producer.

- Citigroup Inc. said last year that the “super cycle” of commodities gains has ended because supply caught up with demand.

However, there is still at least one bull left in the commodity space and he is actually one of the first to actually call the beginning of the commodity bull market in 1998. See video below: