by W. Ben Hunt via Epsilon Theory blog,

It is not the strongest or the most intelligent who will survive but those who can best manage change.

– Charles Darwin

We think we know that chimpanzees are higher animals and earthworms are lower, we think we've always known what that means, and we think evolution makes it even clearer. But it doesn't. It is by no means clear that it means anything at all. Or if it means anything, it means so many different things to be misleading, even pernicious.

– Richard Dawkins. "The Greatest Show on Earth: The Evidence for Evolution"

In a sense, among higher animals adaptive fitness was no longer transmitted to the next generation by DNA at all. It was now carried by teaching. … For our own species, evolution occurs mostly through our behavior. We innovate new behavior to adapt.

– Michael Crichton, "The Lost World"

Historical fact: people stopped being human in 1913. That was the year Henry Ford put his cars on rollers and made his workers adopt the speed of the assembly line. At first, workers rebelled. They quit in droves, unable to accustom their bodies to the new pace of the age. Since then, however, the adaptation has been passed down: we've all inherited it to some degree, so that we plug right into joysticks and remotes, to repetitive motions of a hundred kinds.

– Jeffrey Eugenides, "Middlesex"

That's evolution. Evolution's always hard. Hard and bleak. No such thing as happy evolution.

– Haruki Murakami, "Hard-Boiled Wonderland and the End of the World"

It was therefore inevitable that the genetic code prescribing social behavior of modern humans is a chimera. One part prescribes traits that favor success of individuals within the group. The other part prescribes the traits that favor group success in competition with other groups.

– Edward O. Wilson, "The Social Conquest of Earth"

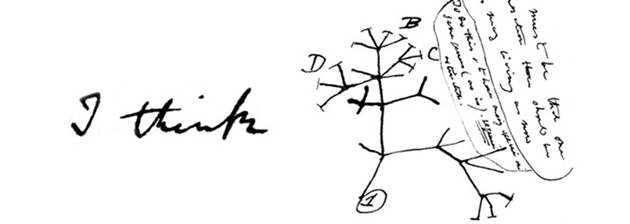

The illustration at the top of this note is taken from Charles Darwin's so-called "B" notebook, where in mid-summer 1837 on page 36 he wrote the words "I think" followed by the first depiction of an evolutionary tree. The rest, as they say, is history, first with the publication of "The Voyage of the Beagle" in 1839, which made Darwin famous, and then with "On the Origin of Species" in 1859, which made him immortal. I think it's fair to say that the theory of evolution is the most influential pillar of science since the development of Newtonian physics, topping even the theory of relativity developed by Einstein et al., and has done more to shape the modern human belief system around the Narrative of Science than anything since Galileo's introduction of the idea of empirical tests and the scientific method in the 17th century.

I want to use evolutionary theory as a perspective for understanding human behavior within capital markets for a couple of reasons. First, I think it's a more useful perspective than what economic theory has become … a cloistered, brittle theology that day after day becomes more abstract in its formation and more narrow in its application. I'm not saying that modern economic theory is wrong. I'm saying that it's a beautiful, elegant mental construct – much like the medieval Christian construct of Heaven's hierarchy with Seraphim, Cherubim, Ophanim, Thrones, etc. all in their proper sphere and convoluted yet logical relationship with each other. Both constructs are marvels of inspiration and genius, for sure, and yet they are useful to my life … how, exactly?

Gustave Doré, "Rosa Celeste, The Divine Comedy Canto XXXI"

Second, I want to use evolutionary theory because it is a Narrative with a great deal of power and meaning for anyone reading this note, enough power and meaning (I hope) to make a new vantage point on markets possible. The hardest thing in the world is to break free from the perspective imposed by an entrenched social construction while you're immersed in it, and so much of history seems ludicrous to our modern eye in this respect. What do you mean the Italian State put Galileo on trial for saying the Earth goes around the sun, all evidence to the contrary? Boy, those guys must have been really stupid. Well … no, they were just as smart as we are. But they were immersed in an entrenched Biblical Narrative that defined their reality more than any amount of empirical evidence from astronomical observations ever could. Rather than argue against a mental construct of markets derived from the entrenched Narrative of Modern Economic Science, I'd rather argue for a mental construct of markets derived from the equally entrenched Narrative of Modern Evolutionary Science. Galileo didn't have that option, as he was just getting the Narrative of Science off the ground. Fortunately, I do.1

But as is often the case, the Scientific Narrative of our imagination and popular belief is somewhat at odds with the usefulness of the actual scientific toolkit. If you look again at Darwin's drawing, it doesn't look much like a tree in the botanical sense, or even what we tend to think of as an evolutionary tree, with a "primitive" species forming the trunk and "advanced" species forming the branches, such that the higher you go in the tree the more advanced the life-form must be. The truth, as Darwin wrote, is that "it is absurd to talk of one animal being higher than another", and the popular conception of evolution-as- hierarchy is just plain wrong. No, what Darwin meant by an evolutionary tree is more like a map. There's an element of time embedded in the map, with ancestors at the trunk and descendants as you move away from that trunk (hence the title of Darwin's second-most famous book, "The Descent of Man"), but descendant species are not more advanced in nature, they are simply more suited to survival in their particular environment.

This, I think, is the first and most basic lesson of an evolutionary perspective properly applied: we are well served as investors to jettison the superiority complex that comes with living in the present and looking back on what naturally seems a benighted past. The notions of liberal progress and evolution-as-hierarchy are so deeply ingrained that we assume that whatever behaviors are new or modern, including modern investment management practices or modern investment strategies (or modern monetary policy), must be part and parcel of some advancement over what existed in the past. In truth there is no up-and-to-the-right arrow associated with evolution; there is no intelligent design pushing us "forward". Modern behavioral adaptations are probably more complex than historical behaviors (adaptation tends towards specialization and complexity), but that's a far cry from being inherently superior on some absolutist scale. All you can say about a successful behavioral adaptation is that it has made its adopters more suitable for their current environment, where suitability and success are defined in terms of the prevalence of the population of behavioral adopters, not the individual achievement of whatever goal the behavior is ostensibly supposed to address.

Using concepts like "suitability" and "population" and "adaptation" and "habitat" to describe human behaviors in market settings may seem like a trivial (or weird) distinction from the dominant mental constructs we use to understand The Market (itself a mental construct of a particular sort), but I hope to make the case over the next few months that it can make all the difference in the world.

Here's a small example of what I mean. A fad diet that gains millions of converts is almost certainly a successful behavioral adaptation even if no one actually keeps off a single pound. If you want a more incendiary phrasing, replace "fad diet" with "routine mammograms" or "daily multivitamins" or, for you risk managers out there, "portfolio stress scenarios". There's a long list of modern behavioral adaptations that provide little or no direct benefit to their adopters, but are nevertheless useful in advancing the strength and numbers of the population of adopters through a dynamic based on biological or social signaling. I take a multivitamin every day, even though I think we can all agree that I am unlikely to develop a case of scurvy in its absence and that taking 30x the recommended daily allowance of thiamin is just silly. Why? Because I can say to my wife and my kids that I do. It makes them feel better about me. To them it's shorthand for "I'm taking care of myself" and they treat me as more fit and powerful than if they think that I'm "not taking care of myself." I am a slightly more successful husband and father because I take a multivitamin every day, as is every middle-aged American male who shares this behavioral trait with me. As a group, we do a little bit better in our family lives than the population of middle-aged American males who don't. So if you're a risk manager and you run a daily suite of portfolio stress scenarios, go right ahead. It is a perfectly rational thing to do even if you don't think there is any direct benefit. But you'll understand your own behavior better (and thus choose to embrace or reject that behavior with awareness) if you recognize portfolio stress scenarios for what they are … the equivalent of a bird species evolving an elaborate but functionally rather useless dance to demonstrate relative fitness to other members of the species.

Darwin's evolutionary tree encapsulates these concepts of suitability, population, adaptation, and habitat. It is a depiction of adaptive radiation, one of the core principles of evolutionary theory and the source of a valuable toolkit for understanding markets. Adaptive radiation describes the creation of new species through the opportunistic spread of an old species into new habitats. Over time, adaptations that make the species more suitable for the new habitat are naturally selected, and as those adaptations grow in number and scope the population of the original species in the new habitat becomes increasingly differentiated from the population of the original species in another new habitat or the old habitat. Ultimately the populations are unrecognizable to each other from a breeding perspective (which is the only perspective that matters in natural selection terms), and you have new species in the various new habitats … but still sharing an ancestral genetic makeup and some sort of morphology or physical instantiation of that shared ancestral DNA.

Adaptive radiation is at the core of Darwin's eureka moment on the Galapagos Islands, where he identified multiple species of finches, each inhabiting a different ecological or geographical niche.

Adaptive radiation of Galapagos finches (evolutionproject.wikispaces.com)

Darwin's insight was to recognize that each separate species must have descended from a common ancestral finch, and that natural selection over hundreds of thousands of generations would drive preferential survival for those sub-populations that developed habitat-specific adaptations and eventually "create" the separate species.

This evolutionary process of adaptive radiation occurs everywhere life and habitat change meet, from a minor island chain to a small African lake to Earth itself. Here, for example, is the adaptive radiation pattern of forelimbs in mammals around the world.

Adaptive radiation of the mammalian forelimb (Jerry Crimson Mann)

How is the concept of adaptive radiation useful to our understanding of markets? Let's start by taking seriously the notion that there are distinct populations of market participants, call them investor "species" if you like, developed over long periods of time through the adaptation of ancestral market attributes to provide improved suitability for specific market "habitats". Obviously the morphology or physical instantiation of these attributes isn't going to be a skeletal system as it was with the mammalian forelimb. It has to be something much more specific to the human animal, a creature with characteristics that throw traditional evolutionary theory for a loop.

First, we have a unique physical combination of enormous brains and non-specialized, grasping hands within an overall body size that is large enough to manipulate the environment and control fire (living on land in an oxygen-rich atmosphere helps quite a bit, too … sorry, dolphins). As a result we have the ability to create both physical constructs (inventions) and mental constructs (ideas) that accelerate our adaptation process exponentially beyond what is possible through natural biological selection alone. Homo sapiens broke out of Africa only 60,000 years ago! This is less than the blink of an eye in evolutionary terms, an almost comically short period of time for a species to not only spread globally, but to transform the entire world into a habitat of its own choosing. Science fiction authors are fond of the "terra-forming" trope, where an alien planet is made Earth-like through some application of massive, futuristic technologies. What they really mean is human-forming, and our own species history proves that it requires remarkably little time and remarkably little technology to accomplish that feat when you can take adaptation out of the realm of biological reproduction and place it into the realms of inventions and ideas.

Second, we are almost unique among mammals (it's just us and naked mole rats … funny, but true) in that we are social animals. I mean this in the sense of what's called "eusociality", where populations of a species are organized by nests or colonies in which you find cooperative brood care, overlapping generations, and a division of labor between groups of individuals. Eusociality is the common thread between the most successful insect species on earth – the ants, the bees, and the termites – which is to say it is the common thread between the most successful life forms on Earth, period. But despite its sheer potency as an adaptation, eusociality is extremely rare outside of the insect world, as it requires a tremendously lucky deal of the DNA cards in terms of genetic pre- adaptations. The human animal was dealt just such a lucky hand, a straight flush in poker terms, and by combining the adaptive robustness and potency of eusociality with our individual inventiveness we are truly a uniquely powerful life-form. Basically we are huge mammalian termites with self-awareness and fire. The rest of the world never had a chance.

It's this termite aspect of the human animal that is most at odds with our popular conception of who we are, as well as the aspect that is most relevant for an evolutionary perspective on markets. I don't want to overplay the termite angle, because most of the time our big brains give us enough self-awareness to act as individuals rather than as drones to some hive dictat … as Jon Haidt writes, "humans are 90 percent chimp and 10 percent bee." But that 10% is enough to confound modern economic theory and account for otherwise inexplicable behavior in markets.

To understand how this 10% bee-ness is relevant for markets, we need to focus on the way in which information pervades and flows through eusocial colonies. I believe that eusocial species are more successful than non-eusocial species because they are more information-rich, particularly in the information embedded within the colony hierarchy … its biologically-based collective norms and regimes. Various eusocial insect species have invented assembly lines, domesticated animals, irrigated farms, and built air-conditioned cities with millions of inhabitants. They all have complex caste systems with extraordinarily effective divisions of labor. There's an enormous amount of information in these behaviors, all carried within the individual insect DNA but only expressed within the collective insect group.

Each individual ant or bee or termite may "know" what to do as an individual piece of the puzzle, but the only way to create the group expression of all this information is to act in a coordinated fashion, not as individuals. Acting as a coordinated group requires two things beyond the behavioral instruction book that every eusocial insect is born with – a language to transfer informational signals and a sensory/neural system that is constantly looking for and responding to these signals. Ants and bees and termites all have a complex language with a discernible grammar, and they are biologically evolved to respond to these language signals. But it's the constancy of both the communication and the behavioral response that is the hallmark of every eusocial species and sets them apart from other group-oriented but non-eusocial species like a pack of wild dogs or a troop of chimps. Ants talk to each other all the time. They live in an atmosphere that is literally swimming with pheromone molecules conveying instructions and signals from other ants, and they can't help themselves but to respond behaviorally to those signals. Sound familiar? How many human-generated or human-mediated signals hit you every day? For me it's easily 4,000 to 5,000 and it's probably a lot more than that once you start breaking down media and complex messages into their component signals. In fact, most days I don't think I am ever separated from some sort of human-mediated signal for more than a few minutes. How many times did you check your email or Twitter feed today? Do you feel uncomfortable if you don't respond to your spouse or child's text message right away, even if it's something trivial? Welcome to the world of the ant.

This is the eusocial aspect of the human animal, the 10% bee-ness that we are evolved to possess: we can no more ignore a speech by Ben Bernanke than a worker bee can ignore a pheromone from her queen. We are evolved not only to live in groups, but also to seek out and immerse ourselves in signals from other humans in our groups and, crucially, to respond to those signals in predictable, group-oriented ways. A Bernanke speech is a more complex signal than a queen bee pheromone, and our specific response to the Bernanke signal is not biologically hard-wired, but our hunger for human-mediated signals and our interpretation of those signals in the context of group dynamics IS biologically hard-wired. Language and communication are everything to the eusocial piece of the human animal, not just what is said, but who is saying it and how it is said. Thus language and communication are the human attributes we must examine to track adaptive radiation in the human context.

Iranian language family tree (Araz)

Actually, I don't think that's a terribly contentious statement, as even a cursory look at the human diaspora out of Africa and the subsequent behavioral adaptations of the human animal to their new geographies demonstrates both a classic adaptive radiation pattern and a tit-for-tat marriage with language development and evolution. Here, for example, is the Iranian language family tree, which I chose just for its obvious resemblance to Darwin's notebook doodle and its explicit linkage of geographic habitat to language adaptation.

But here's a more contentious statement: I think that there are meaningfully distinct market languages that are just as powerful in reflecting market participant populations undergoing adaptive radiation as "real" languages have been in reflecting global human populations undergoing adaptive radiation. If I'm right, the entire toolbox of linguistics and evolutionary biology opens up to us. If I'm wrong, we're left with lots of nice metaphors but not much in the way of practical applications.

What are these languages? I think the granddaddy of them all is the language of Value, together with its grammar, Reversion to the Mean. To have an institutional market you must have market makers, so I would guess that the language of Liquidity was not far behind in development, as was the language of Growth, together with its grammar, Extrapolation. These are the three great proto- languages of the market (although the language of Liquidity is rapidly becoming a non-human tongue), and all market participants think and converse predominantly in one of them.

Can you think in more than one proto-language? I don't believe so, any more than you can be both a dyed-in-the-wool Republican and Democrat at the same time. Can you speak more than one proto-language? Sure, in the same way that a lot of animals can both walk and swim. But if I had to bet on the winner of a 100-meter freestyle swim I'd put my money on the dolphin.

Aren't there really dozens of distinct market languages out there? Absolutely, but I'd characterize them as genetic offshoots of the proto-languages, as the reflection of the adaptive radiation that has occurred as these ancestral investor "species" moved into new "habitats" and took on behavioral adaptations that made them more suitable for that environment. A value-oriented stock-picker today speaks an almost entirely different investment language than a value-oriented macro investor, and if you looked at them from a distance you might be fooled by the morphology, by the equivalent physical distinction between a big black ground finch and a tiny gray warbler finch. But if you pay attention to the grammar of their language, you'd see that they both interpret the world through a reversion-to-the-mean prism. This is their ancestral genetic code, and I believe that there are useful and practical applications that stem from making this connection, by observing that the population of value-oriented macro investors has more in common (from this perspective) with a population of stock-pickers than with growth-oriented macro investors.

Essentially I'm saying that every investor has a "market DNA" … not a genetic code that you're born with, but a distinct collection of behavioral attributes that can be measured and summed up by the language you speak and think with to express your market behaviors. How did you come by this market DNA? The same way you absorb every other collection of behavioral attributes that makes you a member of whatever human tribes you belong to … your relatives' attitudes towards money and risk when you were a child, your friends, your first job in financial services, a mentor, a successful friend or colleague, the books you've read and the TV shows that you watch … there's no mystery to this, and no shortcut to creating or changing this identity, either. There's a huge body of empirical work in political science about what's called Party Identification, the way we identify with a political party at an early age and then tend to stick with that association through thick and thin for the rest of our lives. We create this stable political association out of lot fewer stimuli than we receive on money and investing. Why would the result be any different?

I included this quote by E.O. Wilson at the outset, but it's so important for the concept of Adaptive Investing that it bears repeating:

It was therefore inevitable that the genetic code prescribing social behavior of modern humans is a chimera. One part prescribes traits that favor success of individuals within the group. The other part prescribes the traits that favor group success in competition with other groups.

– Edward O. Wilson, "The Social Conquest of Earth"

As market participants we are acting as both individuals and, whether we realize it or not, as members of a distinct group with a distinct language and a distinct set of behavioral adaptations to our particular market habitat. Our group is, in a very real sense, in competition with other groups for all the good things that a market can provide. Our market interactions are almost always with fellow members of our group. They are who we talk with, they are who we listen to, they are who we transact with. That last bit means that we are indeed competing with other individuals in our groups … there's no denying that. But in meaningful ways we are also cooperating with other individuals within our investor "species". As human animals we are biologically hard-wired to live through and for our groups as well as ourselves, and our market lives are no exception.

If your view of capital markets is solely through the lens of individual decision-making, of a buyer and a seller agreeing to a transaction regarding some security based on their individual utility functions, then you are only seeing a piece of the puzzle. Unfortunately, all of modern microeconomic theory – ALL of it – is based on assumptions of individual decision-making and optimization. Until we take context and populations seriously, until we recognize that economic behaviors are not simply optimization exercises against some exogenously assumed set of environmental constraints, until we understand that individual behavioral outcomes and decisions are, in part, driven by group dynamics and individual traits that only make sense in a group context … we are looking through a glass, darkly.

Whew! Okay, Ben, that's a lot of words and imagery, but what's the pay-off?

Here are a few brief examples of what it means to bring linguistic and evolutionary biology toolboxes – where the most advanced game theory and information theory of the past 20 years has been developed – to bear on market puzzles. I'll unpack each in a future note, and there's a lot more where this came from.

One of Jim Cramer's favorite lines is "there's always a bull market somewhere," and this always used to annoy me as just another hucksterism. Now I think it's a pretty good point. If your collection of investment behavioral adaptations is no longer working so well because your investment environment has changed … and here I'm looking at you, Mr. Value Investor … you can either change your collection of behaviors or you can move to a habitat that is more conducive to your attributes. The former is absolutely impossible for any non-self aware animal, and darn near impossible for even the most self-aware investor. A tiger can't change his stripes, a seed-cracking finch can't start eating insects, and a value investor can't become a momentum day-trader. The latter – changing your habitat – is similarly impossible if you don't have the means to get from one habitat to another. If you're a snake on a tropical island and disaster wipes out your habitat … you will soon be a dead snake. If you're a bird, on the other hand, hope is on the next island over. Will it be a struggle to find your way on what is probably a crowded new island? Sure, but that's better than being a dead snake. I think that market participants often overestimate the value of their factual knowledge and personal experience within a particular market "habitat", whether that's an industry sector or asset class, when what's really of importance is the fit between personal attributes and whatever habitat you're in. A value investor can always learn new facts, but he can't "learn" how to be a growth investor. The liquidity of capital gives you wings, and it's probably a good idea to use them when you have to.

Still … it sure would be nice to know if the island you're flying to is a new Eden where your investment attributes are highly suitable or if you're flying into a new Hell, and this is where the linguistics toolbox can help. What we're interested in measuring is HOW other market participants are talking about this new habitat, not WHAT they are saying. If you're a value investor, you want to hear other value investors using value language and reversion-to-the-mean grammar in their description of the habitat, not growth investors using growth language and extrapolation grammar. It doesn't really matter what your same-species investors are saying about the habitat (in fact, if they're all saying wonderful things about the new habitat in your language, you've probably already missed the low-hanging fruit, whatever that means to your species). All you should care about is whether you've got a critical mass of fellow species members to interact with, and this is what an evolutionary perspective can reveal.

The same principle applies for single security analysis, particularly if you're thinking about going short. I say this because shorts don't work as the mirror image of longs. Longs tend to grind their way higher, as good news and story-supporting news is dribbled out more or less intentionally bit by bit. Shorts, on the other hand, work in punctuated fashion, as bad news comes out in an unanticipated rush. (Steve Strongin at Goldman Sachs wrote a tremendous article on this in April 2009, titled "Why Shorts Aren't Longs: Stockpicker's Reality Part IV"; it's a great read for anyone interested in information flow and investing.) Put simply, shorts only work when the bull story breaks. Even so, if the story is not being told in the language that fits your market DNA, you're going to have no idea whether to press the short or cover on the break. Moreover, you're far more likely to have a sense of the catalyst that actually breaks the bull story if you're in sync with the language of the prevalent conversation, which gives you a fighting chance to establish a position ahead of the break without getting killed by poor timing.

For example, let's say that you shorted Twitter right after the IPO because you're a value investor and you believe that the stock is just crazily priced on a value basis. The stock has gone against you significantly in recent weeks, but over the past few days it's declined about 15%. Okay … what now? Do you press the short because you think maybe the story is broken, or do you thank your lucky stars for the brief reprieve in the onslaught and cover? You have no insight on this whatsoever because the bull story on Twitter has nothing to do with value and the recent price decline has nothing to do with value. Everything about the stock is being spoken with the grammar of extrapolation, which you don't understand, and the dominant population around the stock is not your tribe. I know what I'd do with the position if I were you, but then I wouldn't have put it on in the first place.

One last example, something using the biology toolkit … let's say that you're an allocator trying to evaluate several different strategies. Some present themselves as alpha-generating strategies, where the goal is uncorrelated absolute returns; others are smart (i.e. inexpensive) strategies for capturing broad market returns; others are some mix of the two. You can calculate Sharpe ratios, look at volatility and drawdowns, all the usual stuff, but you can't shake the feeling that you are comparing apples and oranges here. Which of course, you are.

One new perspective on this age-old question is to look less at the external characteristics or morphology of the strategies and pay more attention to their market DNA, in particular to the grammar of the strategy language in theory and practice. This is a crucial aspect of diversification and risk management in portfolio construction that I think is often overlooked.

Or expressed in a more formal way – how suitable are the embedded utility functions in these investment strategies for the market environments they inhabit? What I mean by this is that adaptation means different things to a species at different stages in its relationship with its habitat. In the adaptive radiation stage, where the new species is just being "created", the trick is keeping the sub-population together long enough for natural selection to do its work and the adaptations to "take". There is no substitute for a high growth rate in this opportunistic phase. On the other hand, once you have a well-established species the adaptive focus shifts from high growth to maintaining its established position in the face of unknown shocks to its habitat. Suitability in this core phase of a species lifecycle is a function of adaptations that confer robustness on the population.

I believe that there are strong corollaries between an alpha-generation investment strategy and an opportunistic phase sub-population moving into a new habitat, as well as between a broad market return strategy and a core phase population maintaining its position within an existing habitat. The former lend themselves to behaviors that prioritize growth rates; the latter to behaviors that prioritize robustness. There's a large body of work on both types of behaviors in biology and economics, and I'm pretty giddy about the opportunity to synthesize this with a game theoretic toolkit. Ultimately, I think, a biological perspective holds the key for constructing an exciting new way of understanding risk and reward in portfolio construction, a perspective that avoids the one-size-fits-all utility model that pervades politics and the treat-utility-as-exogenous assumption that pervades economics. Constructing that new perspective on investment risk and reward is the ultimate goal of the Adaptive Investing project, and I'll be building this in plain sight and in real time at Epsilon Theory. Like evolution itself I'm sure there will be false starts and dead ends aplenty, but with your participation I'm confident we can come up with a set of behavioral adaptations that will make the Epsilon Theory sub-population more suitable for our unstable markets and our unstable world.

Copyright © Epsilon Theory blog